|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Cryptocurrency Market: Solana, Ripple, and Uniswap Present Risks for Trading

Apr 12, 2024 at 08:36 pm

Amidst the volatility inherent in cryptocurrency markets, investors should be aware of potential risks associated with specific projects. Coinphony has identified three notable cryptocurrencies to avoid trading next week: Solana (SOL), XRP, and Uniswap (UNI). SOL has been experiencing persistent network congestion, XRP's unusually delayed monthly token release raises concerns, and UNI faces legal scrutiny from the SEC. These factors create uncertainty and warrant caution for traders seeking to mitigate risks in the cryptocurrency space.

The Precarious State of Cryptocurrency: Solana's Network Woes, Ripple's Unusual Activity, and Uniswap's Legal Setback

The cryptocurrency market, heavily influenced by news, technological advancements, and economic factors, can occasionally present uncertainty for projects. Notably, Coinphony has identified three prominent cryptocurrencies that are best avoided for trading next week, given their atypical risks.

Solana: Network Congestion and Transaction Failures Abound

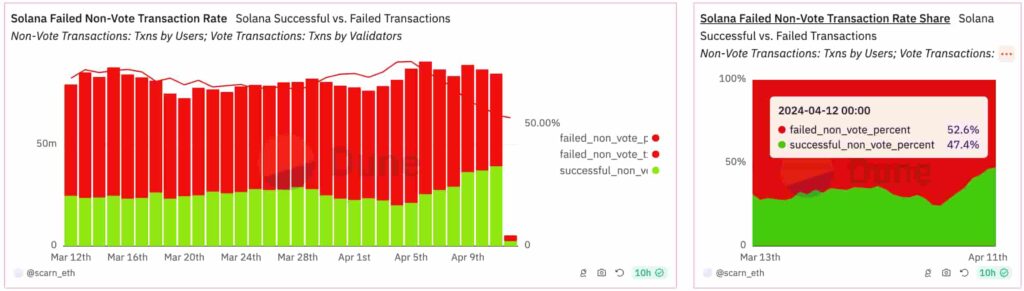

Solana (SOL), the reputedly high-performance Layer 1 blockchain and a popular Ethereum (ETH) rival, finds itself in a state of network congestion, with a rising rate of failed transactions. Notably, over half of the transactions received by Solana's validators fail to reach consensus and are thus not finalized.

At the time of writing, on April 12, the transaction failure rate stood at 52.6%, according to a Dune Analytics dashboard by scar_eth. This level has persisted for over a month and has previously exceeded 75%.

Despite this, SOL remains the fifth-largest cryptocurrency by market capitalization, trading at $173, which correlates with the cryptocurrency market cap index on TradingView. This suggests that Solana traders have yet to price in the network's poor conditions, introducing uncertainty into the asset's future price action.

XRP: Ripple's Unusual Inactivity Raises Concerns

Traders would also be well-advised to avoid trading the XRP token next week, given Ripple's atypical delay in its monthly April token sale.

As reported by Coinphony, Ripple unlocked 1 billion XRP on April 1. The company then moved 200 million tokens, worth $120 million, to its Escrow account, preparing for the month's sale.

However, the 'Ripple (1)' address has not executed any payments as of press time. This is unusual for a company that has consistently sold its initial token offering within the first 11 days of each month.

Historically, these sales have preceded notable price drops for XRP, as illustrated by the year-to-date daily chart. The token currently trades at $0.608, seemingly poised for a significant price move.

Uniswap: SEC Legal Pressure Weighs Heavily

Finally, Uniswap (UNI), the largest decentralized exchange protocol by trading volume, faces potential legal pressure from the United States Securities and Exchange Commission (SEC).

In a notable development, Uniswap creator Hayden Adams stated that the company is willing to take on the SEC.

"Today @Uniswap Labs received a Wells notice from the SEC.

I'm not surprised. Just annoyed, disappointed, and ready to fight.

I believe the products we've built are lawful and in the best interest of history. But it has been clear for a while that instead of...

— hayden.eth 🦄 (@haydenzadams) April 10, 2024"

As a result, UNI has experienced a sell-off this week. The Uniswap governance token has plunged from around $11.5 to $9.0, a 20% loss in four days.

Cautious Trading Amid Network Issues, Regulatory News, and Market Volatility

In summary, cryptocurrency traders must remain aware of network issues, regulatory developments, and economic news to successfully navigate this market. Cryptocurrencies are inherently volatile, but external factors can introduce additional risks that warrant avoiding certain assets for trading purposes.

Disclaimer: The information provided in this article is not intended as investment advice. Investing involves risk. Cryptocurrency investments are highly speculative and volatile, and there is a significant risk of loss associated with them.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

-

-

-

- Top 4 Indicators Predicting the Altseason of 2025

- Nov 24, 2024 at 04:10 pm

- One of the most discussed topics in the cryptocurrency space has always been "Altseason." This is because this brief period often sees crazy returns. Altseason is considered a major source of attraction for crypto tourists as it helps bring newcomers into the crypto space. Today, we will explore the top four indicators predicting the upcoming Altseason in 2025.