|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

經驗豐富的加密貨幣交易者可能會回想起比特幣(BTC)和銅表現出強烈的正相關的時期,並可能迅速得出了最近在紅色金屬中的集會中得出的看漲結論。

Copper prices are nearing record highs again, a development that seasoned crypto traders may quickly draw bullish conclusions from, especially considering periods when bitcoin (BTC) and copper exhibited a strong positive correlation.

銅價再次接近創紀錄的高點,經驗豐富的加密貨幣交易者可能會迅速得出看漲的結論,尤其是考慮到比特幣(BTC)和銅表現出強烈的正相關的時期。

To be precise, copper's year-to-date increase of 12% to $5.10 per pound on COMEX has been driven by President Donald Trump's trade tariffs, which pose risks to both the U.S. and global economies. These aggressive policy moves likely led the Federal Reserve to lower growth forecasts while raising inflation projections this week.

確切地說,COMEX的銅從少年提高到每磅5.10美元的增長是由唐納德·特朗普總統的貿易關稅驅動的,唐納德·特朗普的貿易關稅對美國和全球經濟體構成了風險。這些積極的政策舉動可能導緻美聯儲在本週提高通貨膨脹預測的同時,降低了增長預測。

"Copper is up around 12% so far this year, driven mostly by uncertainty over Trump's trade policies. Tariff news is likely to continue to dictate price direction in the months ahead," analysts at ING said in a note to clients on March 18.

Ing分析師在3月18日向客戶的一份報告中說:“今年迄今為止,銅的上升幅度約為12%,這主要是由於特朗普的貿易政策不確定性。關稅新聞可能會在未來幾個月內繼續決定價格方向。”

However, the latest copper rally is being fueled by factors other than positive cues from global economy, warranting caution while viewing it as a bullish indicator for risk assets, including BTC.

但是,最新的銅集會是由全球經濟的積極線索以外的其他因素所推動的,在將其視為包括BTC在內的風險資產的看漲指標時,請謹慎行事。

Moreover, BTC's best years have been characterized by a rally in the copper-gold ratio, which is beginning to rise again after a period of decline.

此外,BTC最好的年份的特徵是銅金比的集會,在一段時間後,銅金的比率又開始上升。

The Aussie dollar-U.S. dollar exchange rate has been moving sideways and down, which is another factor that suggests the ongoing copper rally is not bullish for risk assets.

Aussie Dollar-US美元的匯率一直在側面和下降,這是另一個因素表明,正在進行的銅集會並不對風險資產看漲。

Australia is the world's 7th largest producer of copper and the 3rd largest exporter of copper. As such, the AUD and copper prices have historically boasted a correlation coefficient of over 0.80. But it's not working this time, probably due to the tariffs-led surge in copper.

澳大利亞是世界第七大銅生產國,也是銅的第三大出口商。因此,AUD和銅價歷史上的相關係數超過0.80。但這這次可能無法正常工作,這可能是由於銅的關稅領導的激增。

Another factor that could be supportive of bitcoin and risk-taking in general is the recent China stimulus. The world's factory is also the largest importer of commodities.

總體而言,可能支持比特幣和冒險的另一個因素是最近的中國刺激。全球工廠也是商品的最大進口商。

Earlier this week, Beijing announced its most potent plan in decades to boost domestic consumption as it battles external uncertainties posed by Trump's tariffs. The plan noted a direct link between consumption, affordable childcare and the country’s long-running property crisis.

本週早些時候,北京宣布了數十年來最有力的計劃,以促進國內消費,因為它與特朗普的關稅構成的外部不確定性作鬥爭。該計劃指出,消費,負擔得起的育兒和該國長期運行的財產危機之間的直接聯繫。

"The policy package includes efforts to increase household income, spur spending, and support population growth. Fresh data was also released for the first two months of the year showing Chinese consumption, investment and industrial production exceeding estimates," ING analysts said.

ING分析師說:“政策方案包括提高家庭收入,刺激支出和支持人口增長的努力。一年中的頭兩個月還發布了新的數據,顯示了中國的消費,投資和工業生產超過估計。”

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- SUI(SUI)定於重大供應活動,計劃於4月1日釋放6419萬SUI令牌。

- 2025-03-31 15:25:13

- SUI將舉行重大供應活動,計劃於4月1日發布6419萬SUI令牌,價值約1.482億美元

-

-

- 隨著交易量的增加,XRP顯示出有趣的價格變動

- 2025-03-31 15:20:12

- XLM在過去24小時內顯示了一些有趣的價格變動,而交易活動的增加引起了交易者的注意。

-

-

- 3個廉價的數字硬幣,具有巨大的潛力

- 2025-03-31 15:15:12

- 如今,三個數字硬幣引起了人們的關注,這是一個很大的原因:它們現在便宜,但具有巨大的潛力。

-

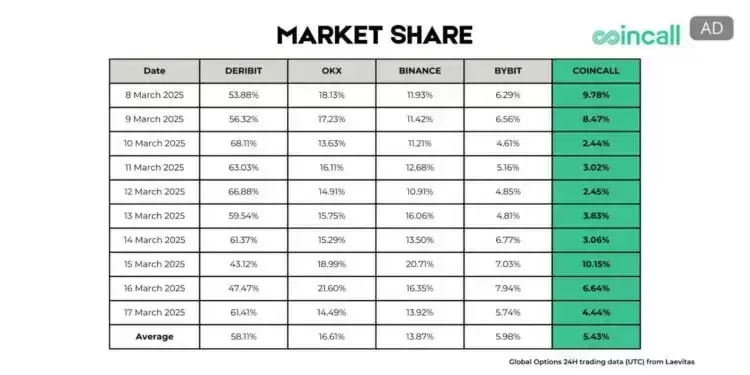

- CONCALL正式進入全球5號加密貨幣選項交流

- 2025-03-31 15:15:12

- 加密貨幣交易所Concincall已正式進入世界上五大加密貨幣期權交易所的行列,在建立後僅18個月就達到了這一里程碑。

-

- 比特幣(BTC)在亞洲早晨的交易額超過80,00美元

- 2025-03-31 15:10:12

- 星期一,在亞洲早上的時間裡,比特幣(BTC)的交易剛剛超過80,00美元

-

- 上週加密貨幣市場大幅縮小

- 2025-03-31 15:10:12

- 由於宏觀經濟環境不確定,上週的加密貨幣市場縮小了大量,儘管一些鮮為人知的硬幣贏得了大量回報。

-