|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

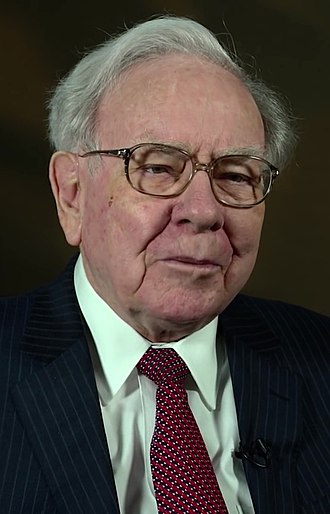

儘管華倫巴菲特一再批評比特幣和加密貨幣,波克夏海瑟威對加密貨幣友善巴西新銀行 Nubank 的投資還是帶來了大量未實現利潤。伯克希爾哈撒韋公司在 Nubank 的股份在過去兩年中增加了超過 10 億美元,這表明了對加密貨幣的信心,並向社區發出了看漲信號。

Berkshire Hathaway's Contradictory Crypto Stance: Profits Galore from Nubank Investment Despite Buffett's Bitcoin Skepticism

伯克希爾哈撒韋公司矛盾的加密貨幣立場:儘管巴菲特對比特幣持懷疑態度,但 Nubank 投資仍獲利豐厚

Amidst Warren Buffett's unwavering disdain for Bitcoin and cryptocurrencies, his investment conglomerate, Berkshire Hathaway, has quietly amassed significant profits from its investment in Nubank, a cryptocurrency-friendly Brazilian neobank. This paradoxical situation has raised eyebrows and sparked questions about Buffett's true stance on digital assets.

在華倫·巴菲特對比特幣和加密貨幣堅定不移的蔑視中,他的投資集團伯克希爾·哈撒韋公司卻悄悄地從對加密貨幣友好的巴西新銀行Nubank 的投資中積累了巨額利潤。這種矛盾的情況引起了人們的關注,並引發了人們對巴菲特對數位資產的真實立場的質疑。

Nubank's Stellar Performance and Berkshire Hathaway's Investment

Nubank 的出色表現和波克夏海瑟威的投資

Despite Buffett's well-publicized criticism of Bitcoin, Berkshire Hathaway committed $500 million to Nubank in 2021, followed by an additional $250 million. This investment, representing approximately 0.1015% of Berkshire Hathaway's market capitalization at the time, has proven to be highly lucrative.

儘管巴菲特對比特幣的批評廣為人知,伯克希爾·哈撒韋公司仍承諾在 2021 年向 Nubank 提供 5 億美元,隨後又追加了 2.5 億美元。這項投資約佔波克夏海瑟威當時市值的 0.1015%,已被證明利潤豐厚。

In 2022 alone, Nubank's shares surged by an impressive 106%, propelling Berkshire Hathaway's stake in the company to a value exceeding $1 billion. The Nebraska-based conglomerate's unrealized profits from this investment soared to around $250 million.

光是 2022 年,Nubank 的股價就飆升了 106%,令波克夏海瑟威持有的該公司股份價值超過 10 億美元。這家總部位於內布拉斯加州的企業集團從這項投資中獲得的未實現利潤飆升至約 2.5 億美元。

By 2023, Nubank's stock valuation had further increased by nearly 100%. This year, it has continued to climb, albeit at a more modest rate of 50%. Remarkably, Berkshire Hathaway has maintained its stake in Nubank, signaling confidence in the investment and sending a cautiously optimistic message to the cryptocurrency community.

到了2023年,Nubank的股票估值進一步上漲近100%。今年,這一數字繼續攀升,儘管增幅較為溫和,為 50%。值得注意的是,伯克希爾哈撒韋保留了 Nubank 的股份,這表明了對這項投資的信心,並向加密貨幣社區發出了謹慎樂觀的信息。

Buffett's Unwavering Anti-Bitcoin Stance

巴菲特堅定不移的反比特幣立場

Despite Berkshire Hathaway's profitable investment in Nubank, Buffett remains steadfast in his belief that Bitcoin and other cryptocurrencies lack intrinsic value. He has famously referred to Bitcoin as "rat poison squared," a sentiment echoed by his late business partner, Charlie Munger, who labeled it "rat poison."

儘管波克夏海瑟威對 Nubank 的投資有利可圖,但巴菲特仍然堅信比特幣和其他加密貨幣缺乏內在價值。他曾經將比特幣稱為“老鼠藥的平方”,這一觀點得到了他已故商業夥伴查理·芒格的呼應,後者將其稱為“老鼠藥”。

Amid Nubank's remarkable growth in 2022, Buffett reiterated his view that BTC has no value because it does not produce anything. As a result, he pledged never to own or purchase any cryptocurrency.

在 Nubank 2022 年的顯著成長中,巴菲特重申了他的觀點,即 BTC 沒有價值,因為它不生產任何東西。因此,他承諾永遠不會擁有或購買任何加密貨幣。

Contradictory Signals and Implications

矛盾的信號和意義

The stark contrast between Berkshire Hathaway's actions and Buffett's public statements has raised questions about the true nature of his stance on cryptocurrencies. Some observers suggest that Buffett's comments may be an attempt to preserve the dominance of traditional finance, while others believe that they simply reflect the skepticism of an older generation toward novel technologies.

波克夏海瑟威的行動與巴菲特的公開聲明之間的鮮明對比引發了人們對他對加密貨幣立場的真實性質的質疑。一些觀察家認為,巴菲特的言論可能是為了維護傳統金融的主導地位,而有些人則認為,這只是反映了老一輩對新科技的懷疑態度。

The situation serves as a reminder of the criticism leveled by PayPal co-founder Peter Thiel two years ago, who accused Buffett and JPMorgan CEO Jamie Dimon of engaging in a "finance gerontocracy" that dismisses the merits of Bitcoin and hinders its progress.

這種情況讓人想起兩年前PayPal 聯合創始人彼得·泰爾(Peter Thiel) 提出的批評,他指責巴菲特和摩根大通首席執行官傑米·戴蒙(Jamie Dimon) 參與了“金融老人統治” ,忽視了比特幣的優點並阻礙了其進步。

Conclusion

結論

The paradoxical situation surrounding Berkshire Hathaway's investment in Nubank and Buffett's anti-crypto stance highlights the complex and evolving nature of the cryptocurrency landscape. While some see it as a sign of Buffett's willingness to adapt to changing times, others view it as a glaring disconnect between his words and actions.

As the cryptocurrency market continues to mature and gain mainstream acceptance, it remains to be seen whether Buffett's skepticism will ultimately hinder or hasten the adoption of digital assets.

隨著加密貨幣市場不斷成熟並獲得主流接受,巴菲特的懷疑最終是否會阻礙或加速數位資產的採用還有待觀察。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 貝克梅菲爾德可能需要改變拋硬幣策略

- 2024-11-08 02:35:27

- 在今年首場比賽中,海盜隊加時賽輸給獵鷹隊,梅菲爾德錯誤地判定為正面,之後他決定改變對陣酋長隊的方式。

-

- 門羅幣注重隱私的區塊鏈現在擁有自己的專用頂級域名

- 2024-11-08 02:35:01

- 門羅幣注重隱私的區塊鏈現在擁有自己的專用頂級域名,具有與以太坊 .eth 相同的交易簡單性,同時保持完全匿名。

-

-

- 趙長鵬(CZ)回歸,但不再擔任幣安首席執行官

- 2024-11-08 02:35:01

- 幣安前執行長趙長鵬(又稱 CZ)最近出獄後公開亮相。

-

-

-

-

-