|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在市場調整中,山寨幣已達到 7,000 億美元的第一個支撐位。比特幣的主導地位正顯示出減弱的跡象,其高點不斷走低,潛在支撐位為 53%。這種調整為山寨幣提供了潛在的買入機會,特別是如果 7000 億美元的支撐位保持不變的話。然而,投資者在做出決定之前應考慮個別山寨幣的基本面,因為調整的程度仍不確定。

Altcoins Market Cap Finds Respite, Bitcoin Dominance Wanes: Buying Opportunity Emerges?

山寨幣市值得到喘息,比特幣主導地位減弱:買入機會出現?

The cryptocurrency market has embarked on a corrective phase, leaving investors grappling with uncertainties regarding its trajectory. However, amid the market turbulence, a potential buying opportunity may be brewing for investors eyeing entry into specific altcoins.

加密貨幣市場已進入調整階段,使投資者面臨其發展軌跡的不確定性。然而,在市場動盪之際,對於有意進入特定山寨幣的投資者來說,潛在的買入機會可能正在醞釀中。

Bitcoin, the market behemoth, teeters precariously at the pivotal $66,000 support level, echoing a trend line it has adhered to since February. A further plunge, possibly extending to $61,000, remains within the realm of possibility. In contrast, altcoins have suffered a more significant downturn, raising questions about whether a tantalizing buying opportunity is on the horizon.

市場巨頭比特幣在 66,000 美元的關鍵支撐位搖搖欲墜,與 2 月以來一直堅持的趨勢線相呼應。進一步下跌,可能延伸至 61,000 美元,仍然是可能的。相比之下,山寨幣遭受了更嚴重的下滑,引發了人們對誘人的購買機會是否即將到來的疑問。

For long-term investors, a prudent approach dictates an assessment of the underlying fundamentals of altcoins before venturing into purchases during market downturns. The severity and duration of the correction remain uncertain, warranting a cautious consideration of risk tolerance.

對於長期投資者來說,謹慎的做法要求在市場低迷期間冒險購買山寨幣之前對山寨幣的基本面進行評估。調整的嚴重程度和持續時間仍不確定,需要謹慎考慮風險承受能力。

Altcoins Market Cap Touches Initial Support

山寨幣市值觸及初步支撐位

Delving into the Total3 chart, which aggregates the market capitalization of altcoins excluding Bitcoin and Ethereum, reveals the emergence of initial support at $700 billion. A more robust support level lies below, at $646 billion.

深入研究 Total3 圖表,該圖表匯總了不包括比特幣和以太坊的山寨幣市值,揭示了 7000 億美元的初步支撐位。下面是更強勁的支撐位,即 6,460 億美元。

Assuming the $700 billion support holds, albeit acknowledging the potential for a breach, an opportune window may present itself for selective altcoin investments. A further decline to the $646 billion level could trigger an intensified "fire-sale."

假設 7000 億美元的支撐得以維持,儘管承認存在違約的可能性,但選擇性山寨幣投資可能會出現一個合適的窗口。如果進一步跌至 6,460 億美元的水平,可能會引發更激烈的「拋售」。

Bitcoin Dominance Faces Growing Pressure

比特幣的主導地位面臨越來越大的壓力

Bitcoin Dominance, a metric quantifying Bitcoin's relative market share, commands attention when trading altcoins. Scrutiny of the chart unveils a trend of lower highs in Bitcoin dominance. Alternatively, price dips have consistently gravitated around 53%, potentially forming a descending triangle, a bearish pattern.

比特幣主導地位是一種量化比特幣相對市場份額的指標,在交易山寨幣時引起了人們的關注。對圖表的仔細觀察揭示了比特幣主導地位的高點下降的趨勢。另外,價格下跌一直在 53% 左右,可能形成下降三角形,也就是看跌模式。

A rejection of dominance at 54% could lead to a retracement to the triangle's lower boundary at 53%, providing a reprieve for high-performing altcoins. A breakdown of dominance below the triangle's floor could unleash a more pronounced surge in altcoin valuations.

拒絕 54% 的主導地位可能會導致回調至三角形下限 53%,從而為高性能山寨幣提供喘息機會。三角形底部以下主導地位的崩盤可能會引發山寨幣估值更明顯的飆升。

Investment Considerations

投資注意事項

Caution should prevail when making investment decisions amid market corrections. Thorough due diligence, including an evaluation of altcoin fundamentals and market sentiment, is paramount. Patience and a disciplined approach are essential, as market volatility may persist before a meaningful recovery materializes.

在市場調整中做出投資決策時應保持謹慎。徹底的盡職調查,包括對山寨幣基本面和市場情緒的評估,至關重要。耐心和嚴格的方法至關重要,因為在有意義的復甦實現之前,市場波動可能會持續存在。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

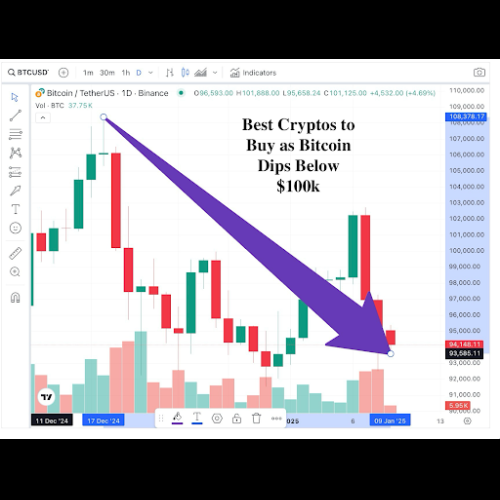

- 10 萬美元以下最適合用比特幣購買的 5 種加密貨幣

- 2025-01-09 17:25:24

- 比特幣跌破 10 萬美元大關令大多數人感到意外,因為就在加密貨幣重新奪回黃金價值幾天后

-

-

-