|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Altcoin Market Cap Finds Relief, Bitcoin Dominance Weakness Opens Buying Window

Apr 02, 2024 at 07:00 pm

Amidst a market correction, altcoins have reached their first support level at $700 billion. Bitcoin dominance is showing signs of weakening, with a series of lower highs and potential support at 53%. This correction presents potential buying opportunities for altcoins, particularly if the $700 billion support holds. However, investors should consider the fundamentals of individual altcoins before committing, as the extent of the correction remains uncertain.

Altcoins Market Cap Finds Respite, Bitcoin Dominance Wanes: Buying Opportunity Emerges?

The cryptocurrency market has embarked on a corrective phase, leaving investors grappling with uncertainties regarding its trajectory. However, amid the market turbulence, a potential buying opportunity may be brewing for investors eyeing entry into specific altcoins.

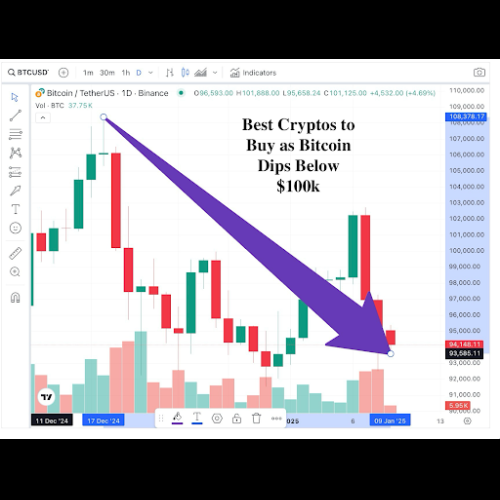

Bitcoin, the market behemoth, teeters precariously at the pivotal $66,000 support level, echoing a trend line it has adhered to since February. A further plunge, possibly extending to $61,000, remains within the realm of possibility. In contrast, altcoins have suffered a more significant downturn, raising questions about whether a tantalizing buying opportunity is on the horizon.

For long-term investors, a prudent approach dictates an assessment of the underlying fundamentals of altcoins before venturing into purchases during market downturns. The severity and duration of the correction remain uncertain, warranting a cautious consideration of risk tolerance.

Altcoins Market Cap Touches Initial Support

Delving into the Total3 chart, which aggregates the market capitalization of altcoins excluding Bitcoin and Ethereum, reveals the emergence of initial support at $700 billion. A more robust support level lies below, at $646 billion.

Assuming the $700 billion support holds, albeit acknowledging the potential for a breach, an opportune window may present itself for selective altcoin investments. A further decline to the $646 billion level could trigger an intensified "fire-sale."

Bitcoin Dominance Faces Growing Pressure

Bitcoin Dominance, a metric quantifying Bitcoin's relative market share, commands attention when trading altcoins. Scrutiny of the chart unveils a trend of lower highs in Bitcoin dominance. Alternatively, price dips have consistently gravitated around 53%, potentially forming a descending triangle, a bearish pattern.

A rejection of dominance at 54% could lead to a retracement to the triangle's lower boundary at 53%, providing a reprieve for high-performing altcoins. A breakdown of dominance below the triangle's floor could unleash a more pronounced surge in altcoin valuations.

Investment Considerations

Caution should prevail when making investment decisions amid market corrections. Thorough due diligence, including an evaluation of altcoin fundamentals and market sentiment, is paramount. Patience and a disciplined approach are essential, as market volatility may persist before a meaningful recovery materializes.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

- Nasdaq ISE Proposes Increasing Position and Exercise Limits for iShares Bitcoin Trust ETF (IBIT) Options

- Jan 09, 2025 at 05:25 pm

- The Nasdaq ISE is an options exchange owned by Nasdaq. This has filed a proposed rule change with the U.S. The Securities and Exchange Commission increased the position and exercise limits for options of the iShares Bitcoin Trust ETF (IBIT) from 25,000 contracts to 250,000.

-

-

- Forget Bitcoin (BTC) and Ethereum (ETH) – Lightchain AI Could Skyrocket Your Crypto Portfolio!

- Jan 09, 2025 at 05:25 pm

- Bitcoin and Ethereum are the heavyweights known for their widespread adoption and market influence. However, emerging projects like Lightchain AI are proving to be lucrative opportunities for investors looking beyond traditional assets.

-

- Bitcoin and Ethereum Consolidate as Altcoins Outperform with Strong Gains

- Jan 09, 2025 at 05:25 pm

- Bitcoin is holding just below $97,000, while Ethereum has dipped back under $3,400. Despite these minor pullbacks, the first week of January has been largely bullish for the cryptocurrency market, recovering from the fade seen at the end of 2024.

-

- XRP Poised to Surge 40% as Shifting Regulatory Tides in the U.S. and Favorable Price Action Set the Stage

- Jan 09, 2025 at 05:25 pm

- Since hitting highs near $2.9 in early December, payments-focused cryptocurrency XRP has lost steam to carve out what is known as a "descending triangle" pattern in technical analysis.