|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

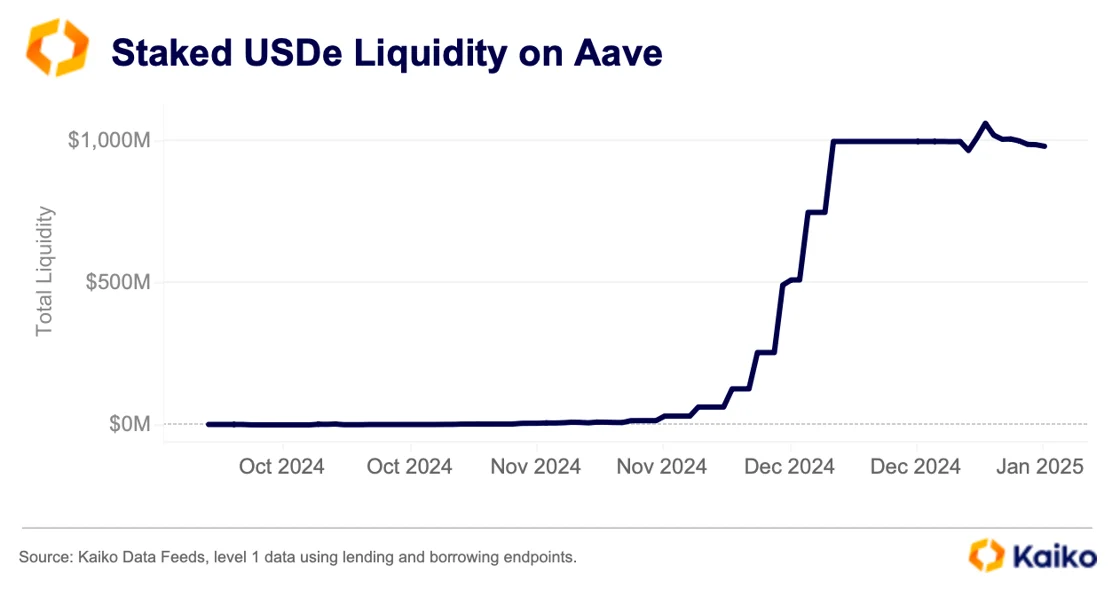

Amidst rising interest in ethena following the launch of staked USDe on Aave, a deeper analysis of the inflows reveals that a majority of the funds were deposited by a small group of users.

As sUSDe began trading on Aave in Q4, it quickly attracted over $1 billion in inflows within the first few weeks of its launch. This integration marked a significant step in boosting the adoption of Ethena's stablecoin.

However, a closer examination of the inflows using our lending and borrowing events data solution shows that most of the funds wereارية deposited by a few users.

To illustrate, the five addresses highlighted below collectively contributed over half a billion dollars to the total inflows. These addresses employed varying strategies when depositing funds.

For instance, 0xb99 (light blue) made two separate deposits, with the first installment amounting to $67 million, followed by an additional $30 million. In contrast, 0x9e (orange) made over 133 smaller deposits between November and December.

This behavior is not entirely uncommon on Aave. For example, one address deposited $13 billion USDC across 200 transactions between November and December. Another split a $200 million deposit over five transactions.

As the sUSDe inflows soared and crypto prices rose across the board, the price of Ethena's governance token, ENA, also climbed high. ENA approached its near-airdrop levels for the first time last month as BTC traded above $100k.

More recently, the Ethena team also launched the USDtb stablecoin, which complements its USDe product.

Before delving into the dynamics of USDtb, it's essential to recap the mechanics of USDe, which differ from conventional stablecoins.

The token maintains its peg by carrying out delta-neutral hedging strategies. This approach aims to keep the price relatively stable and aligned with its dollar peg.

In contrast, USDtb offers a more conventional option for investors. The stablecoin is essentially backed by US government bonds through Ethena's investment in BlackRock's BUI.

The ability, and willingness, to innovate is one of the key drivers behind Ethena’s success in 2024. While the soaring inflows on Aave look great, they largely come from just a few holders and sUSDe is still some way off challenging USDC and USDT in reality.

However, the protocol can innovate more quickly than its older rivals and has chosen to do so. While Circle and Tether leadership grapple with MiCA compliance, Ethena’s on-chain first approach with integrations to some large centralized platforms, has contributed to its success so far. Furthermore, Maker’s decision to rebrand its platform which fragmented liquidity between DAI and the newly launched USDS benefited Ethena in claiming the third spot by market cap.

Going forward to regulatory outlook is set to change, which could further shake up the space and add renewed competition for the budding protocol in 2025.

부인 성명:info@kdj.com

제공된 정보는 거래 조언이 아닙니다. kdj.com은 이 기사에 제공된 정보를 기반으로 이루어진 투자에 대해 어떠한 책임도 지지 않습니다. 암호화폐는 변동성이 매우 높으므로 철저한 조사 후 신중하게 투자하는 것이 좋습니다!

본 웹사이트에 사용된 내용이 귀하의 저작권을 침해한다고 판단되는 경우, 즉시 당사(info@kdj.com)로 연락주시면 즉시 삭제하도록 하겠습니다.

-

-

- 트럼프 동전 : 트럼프 가족을 상당히 부유하게 만들 수있는 암호 화폐 벤처

- 2025-05-09 18:25:13

- 취임 전날 트럼프 대통령은 자신의 암호 화폐 인 트럼프 코인을 발표했다.

-

-

-

-

-

-

-