|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Could Warren Buffett One Day Want to Invest in a Money Transfer Fintech Like XRP (CRYPTO: XRP)?

Feb 24, 2025 at 03:01 pm

There's a lot for traditional value investors to like hereLet's quickly recap the investment thesis for XRP to show why it might appeal to Buffett.

Warren Buffett is renowned for his value investing philosophy, which has led him to acquire shares in companies ranging from American Express to Apple. But could he ever be tempted to invest in a money transfer fintech like XRP (CRYPTO: XRP), despite his strong aversion to cryptocurrencies?

It's impossible to say for sure whether the Oracle of Omaha would actually want to buy this coin. But there are a few things about it that he might appreciate, if he were willing to entertain the idea at all. So, let's examine how XRP might align with the principles behind some of his greatest investments.

A lot to like for traditional value investors

Here's a quick recap of the investment thesis for XRP to show why it might appeal to Buffett.

In essence, XRP is a coin that aims to facilitate low-cost, high-speed, and highly reliable money transfers across international borders. The target user base comprises financial institutions such as banks and currency exchange clearing houses, both of which typically handle a large volume of these transfers. However, with the legacy technology currently in use, users can end up paying as much as $50 or more per transfer, and their transactions can take up to five business days to settle and be subject to currency exchange fees. In contrast, XRP transactions settle within a couple of minutes and cost just fractions of a penny on average; the network uses those fees to pay for tech upgrades and marketing.

Buffett certainly likes to invest in financial technology companies and payment processors, as long as he can acquire them at the right price. In addition to American Express, he also has large positions in Visa and Mastercard, all of which were early innovators in the payments processing industry.

The business models of these companies reflect Buffett's preferred approach. Rather than selling a product directly to consumers, the card companies facilitate payments from consumers to businesses to streamline the process for both ends of the transaction, capturing a small portion of each payment.

The idea is not to generate a lot of revenue upfront but to gradually expand the payment networks by onboarding more businesses and cardholders, capturing more payments and a steady stream of increasing fees. Those fees easily fall to the bottom line because processing each additional payment costs very little after the massive cost of building the network has been absorbed. Once these players reached a certain size, they effectively had an economic moat that protected their margins, as new entrants to the market would have to struggle to get established by rolling out new hardware and offering new cards to users who were already accustomed to using competing products.

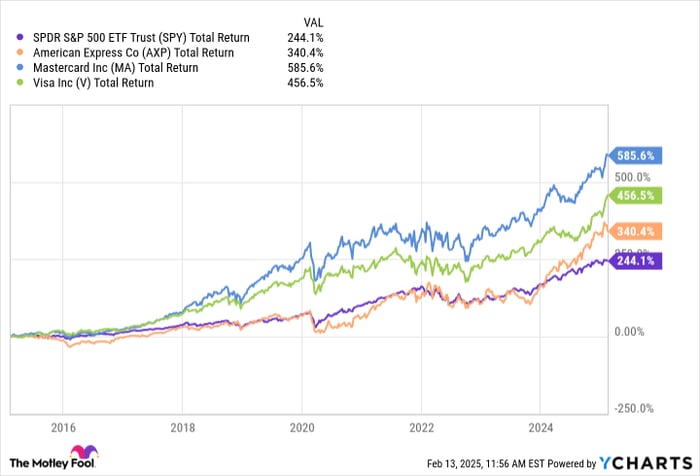

Just look at how well that process has played out in Buffett's favor over the past 10 years alone:

^SPX Total Return Level data by YCharts

Now, consider XRP's position today.

It offers a service that is cheaper, faster, and more convenient than the existing methods for making international money transfers. Processing each transaction is not a major expense, but it can reliably reap fees from any given user for years and years. XRP's price has increased by more than 800% over the past five years alone. It is nowhere near onboarding all of the potential users globally that could benefit from using the coin instead of older systems, so it likely has many years of growth ahead.

In other words, XRP looks a lot like a Buffett stock even though he doesn't own it.

Think for yourself

Don't hold your breath waiting for Buffett to buy XRP. It's unlikely that he would even consider it to be a real investment opportunity because it's a cryptocurrency rather than a traditional company with a stock he could size up with a valuation calculation.

But XRP is a popular cryptocurrency for a reason. There are many arguments for why buying it today will mean having more money in the future, when its core value-generation process will have had even more time to generate fees, and many more users turn to it for processing cross-border transactions. And unlike the credit card businesses Buffett bought, XRP's biggest competition right now is stuck with obsolete technology, so it isn't much of a threat.

That is no guarantee that the coin will go up in the near term. Still, if you're willing to hold onto your XRP for a Buffett-esque period of time -- many years -- the odds of reaping big profits are in your favor.

Should you invest $1,000 in XRP right now?

Before you buy stock in XRP, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and XRP wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $854,317!*

Stock Advisor provides investors with an easy-to-follow blueprint for

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- FXGuys: The Ultimate Alternative for ETH and TRX Holders?

- Feb 24, 2025 at 07:45 pm

- The crypto market is getting more attention from investors, and FXGuys ($FXG) is at the center of it all. With a booming presale, a Trade2Earn model, and a massive 100x profit potential, FXGuys is positioning itself as a top choice for traders and investors.

-

-

-

-

-

-

-

-