|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Trump's Tariffs Reignite a Trade War, Spooking Crypto Markets

Feb 03, 2025 at 08:02 pm

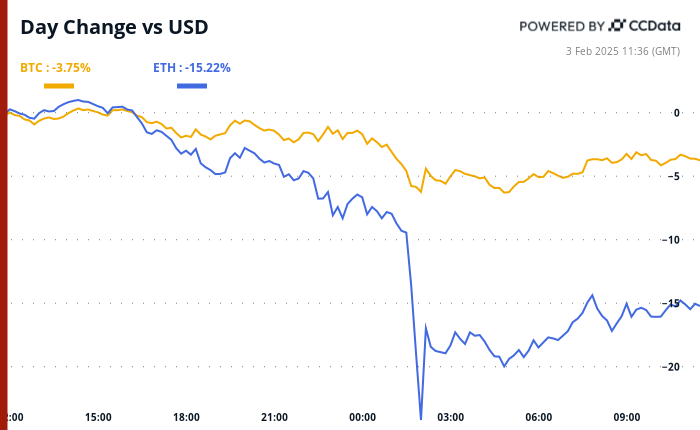

Crypto markets are a sea of red alongside a growing risk aversion in traditional markets, and Trump's tariffs are to blame.

output: A tariff-induced sell-off in the crypto market is underway, with bitcoin (BTC) and other major cryptocurrencies clocking double-digit losses.

The slide comes after U.S. President Donald Trump imposed a 25% tariff on imports from Canada and Mexico and a 10% levy on imports from China late Friday. The tariffs, which are set to take effect on Monday, follow months of stalled trade talks and are expected to be met with retaliatory measures.

The tariffs are part of Trump's effort to pressure trading partners to address the trade deficit and other concerns, and they mark a significant escalation in the trade war that began in 2018.

The tariffs on Canada and Mexico are being imposed under Section 232 of the Trade Expansion Act, which allows the president to restrict imports that threaten national security. The tariffs on China are being imposed under Section 301 of the Trade Act of 1974, which allows the president to impose tariffs on imports that are found to be unfair or unreasonable.

The tariffs are expected to have a broad impact on the U.S. economy, and they are likely to lead to higher prices for consumers and businesses. The tariffs are also expected to slow economic growth and could lead to job losses.

The crypto market has been largely spared from the trade war so far, but the latest tariffs are likely to hit the markets hard. The tariffs are set to cover a wide range of goods, including electronics, clothing and food, and they are expected to drive up inflation and slow economic growth.

This, in turn, could lead to a sell-off in the stock market and other risk-on assets, which would put pressure on crypto prices.

Moreover, Trump has threatened to increase the tariffs if trading partners retaliate, which could further hurt the crypto market.

Some analysts are downplaying the impact of the tariffs on the crypto market, arguing that they are a negotiating tactic and will be lifted quickly. However, others believe the tariffs could remain in place for several months and may even increase, posing a sustained challenge for crypto prices.

Geo Chen, a macro trader and author of the popular Substack-based newsletter Fidenza Macro, told subscribers in an email on Friday that his view is that the tariffs "will remain in place for several months with the risk of increasing."

“These responses could escalate the situation. The best we can hope for is a partial rollback of tariffs once negotiations conclude,” Chen added.

According to Chen, markets may take several days or weeks to fully digest this news, which could lead to continued volatility in the coming period.

"This latest round of tariffs is on $1.3 trillion of imports from the three nations, seven times bigger in value than the first shot fired in 2018,” Chen said, regarding the tariffs on Canada, Mexico and China.

“This makes the latest episode appear more destabilizing than back then, when the S&P 500 initially dropped 9% from its peak in March from a height that never returned before quickly rebounding. In other words, the potential pain may be greater this time around."

A crypto trader, who preferred to remain anonymous, told Forkast.News on Monday that, "Despite the talk of deals, this move doesn't feel temporary."

"The tariffs are being imposed slowly, starting with 5% on Mexican goods on Monday and increasing by 5% each subsequent month if no agreement is reached, up to a maximum of 25%,” the trader added.

“This gives the markets time to adjust, but it also seems to be designed to keep the pressure on trading partners to make a deal quickly."

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- U.S. Lawmakers Aim to Regulate the Rapidly Growing Stablecoin Market. The Proposed STABLE and GENIUS Acts Set Strict Compliance Rules, With Major Implications for Companies Like Tether.

- Feb 09, 2025 at 03:11 am

- The STABLE Act outlines provisions to authorize the Office of the Comptroller of the Currency (OCC) to oversee federal qualified nonbank stablecoin issuers.

-

-

-

- Sol Strategies Doubles Down on Solana (SOL) with a Massive 190,000 Coin Purchase, Pushing Its Total Asset to Nearly $40 Million

- Feb 09, 2025 at 03:11 am

- Big moves are happening across the crypto space, and some names are making waves for different reasons. Sol strategies are doubling down on Solana with a massive 190,000 coin purchase, pushing its total asset to nearly $40 million.

-

-

- Dogecoin (DOGE) Millionaire Potential by 2030: Rexas Finance (RXS) and OfficialTrump (TRUMP) Are Better Substitutes

- Feb 09, 2025 at 03:11 am

- Dogecoin has become rather popular due to its distinctive appeal, vibrant community, and celebrity sponsorships; analysts estimate its value to be $400 in 2030.

-

- The Power of Referrals: BlockDAG's 5% USDT Rewards Fuel Presale Towards $200M; Insights on Mantle Price Prediction & SUI's Future

- Feb 09, 2025 at 03:11 am

- The digital asset market presents a complex picture, with some projects showing promise while others face significant challenges. BlockDAG, however, has defied market trends with its remarkable growth, fueled in part by its innovative affiliate program that rewards participants with 5% cashback on successful referrals.

-

-

![🚨IS CARDANO (ADA) A DEAD COIN ?? [GET READY FOR THIS MOVE] 🚨IS CARDANO (ADA) A DEAD COIN ?? [GET READY FOR THIS MOVE]](/uploads/2025/02/08/cryptocurrencies-news/videos/cardano-ada-dead-coin-ready-move/image-1.jpg)