|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Hong Kong Debuts Crypto ETFs, Aiming for Digital Asset Hub Status

Apr 24, 2024 at 05:05 am

Hong Kong is set to launch a range of cryptocurrency exchange-traded funds (ETFs) in a move that mirrors the US market and aims to position the city as a digital asset hub. The upcoming ETFs, including spot-Bitcoin and Ether products, are expected to begin trading by the end of April, and their demand will indicate the progress Hong Kong has made in developing its virtual asset industry.

Hong Kong Unveils Cryptocurrency Exchange-Traded Funds, Signaling Ambitions as Digital Asset Hub

Hong Kong, striving to establish itself as a leading hub for digital assets, is poised to follow in the footsteps of the United States by introducing a series of cryptocurrency exchange-traded funds (ETFs). The upcoming launches are set to test the appetite for such products in the region and provide insights into the city's progress towards becoming a global center for virtual assets.

Several of China's prominent asset management firms are nearing completion of preparations for the introduction of spot-Bitcoin and Ether ETFs, which are expected to commence trading by the end of April. These launches will inevitably draw comparisons to the surge of three-month-old US Bitcoin ETFs, which have amassed an impressive $56 billion in assets to date.

Hong Kong has been actively competing with the likes of Singapore and Dubai for over a year to create a well-regulated environment for the burgeoning virtual asset industry. This move is part of a broader strategy to revitalize the city's reputation as a modern financial center, especially after a crackdown on dissent that has diminished its appeal.

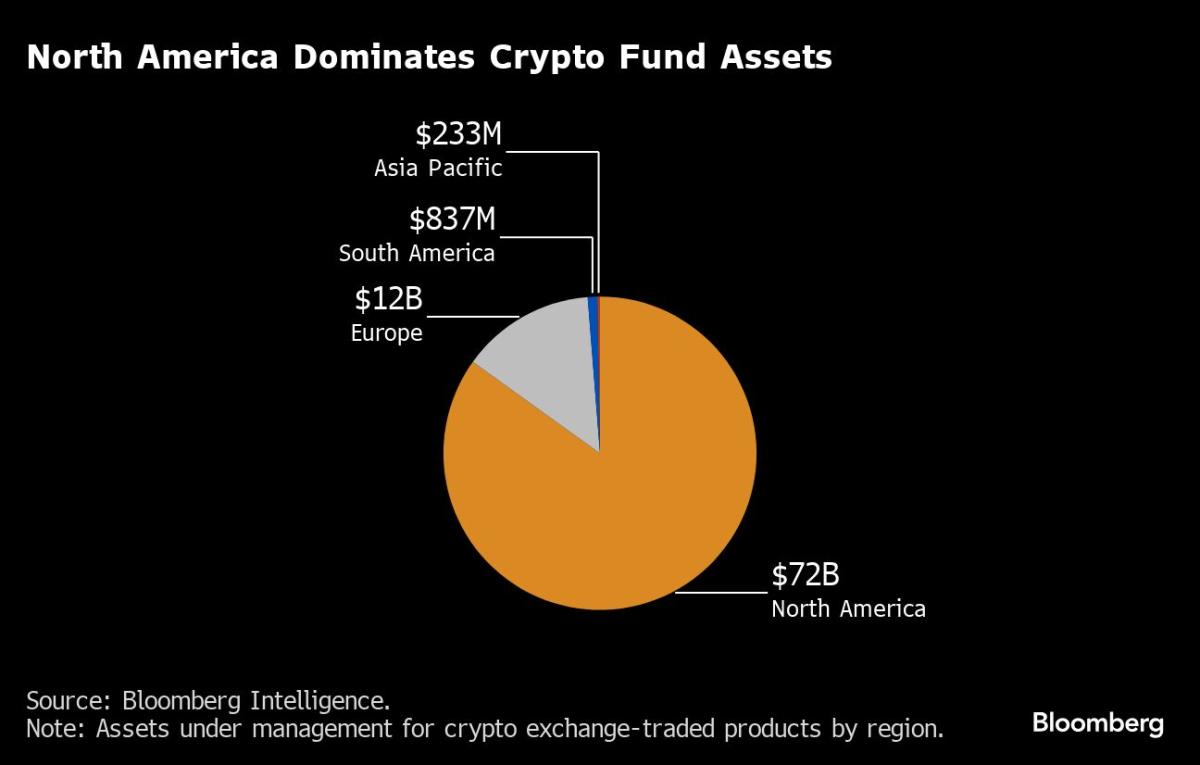

The level of demand for the forthcoming ETFs will provide valuable clues regarding Hong Kong's progress in this endeavor. Local wealth parked in the city represents a potential source of demand, as do crypto exchanges and market makers operating in the Asia-Pacific region. Bloomberg Intelligence ETF Analyst Rebecca Sin estimates that the funds could accumulate up to $1 billion in assets under management over a two-year period.

Shadow of US Funds

However, the US-based Bitcoin funds launched by industry giants such as BlackRock Inc. and Fidelity Investments have already captured substantial global interest and investment. The prospective Hong Kong issuers, including Harvest Global Investments Ltd., the local unit of China Asset Management, and a partnership between HashKey Capital Ltd. and Bosera Asset Management (International) Co., lack comparable name recognition.

"Hong Kong does not possess the 'BlackRock' effect to rely upon," remarked Roger Li, co-founder of One Satoshi, a chain of stores in Hong Kong offering over-the-counter conversions between cash and crypto. He emphasized the need to moderate expectations for ETF demand in line with the city's relatively smaller financial sector.

In January, the US Securities & Exchange Commission (SEC) reluctantly approved ETFs investing directly in Bitcoin, the largest digital asset. The agency remains skeptical of cryptocurrencies following a market downturn in 2022, coupled with bankruptcies and high-profile fraud cases. As a result, ETFs for Ether, the second-largest cryptocurrency, face an uphill battle for approval.

In contrast, Hong Kong has given the initial green light for spot-Bitcoin and Ether funds, according to issuers. Another distinction is that HashKey Capital and Bosera have indicated that the Hong Kong spot-ETFs will feature an in-kind subscription and redemption mechanism, allowing underlying assets to be exchanged for ETF units and vice versa. In contrast, US funds operate on a cash redemption model.

Arbitrage Opportunities

The in-kind approach "holds particular appeal for crypto enthusiasts, market makers, and digital asset exchanges" because it enhances efficiency and creates arbitrage opportunities, explained Evgeny Gaevoy, co-founder of crypto liquidity provider Wintermute Trading Ltd.

A HashKey spokesperson announced on Wednesday that the Bosera-HashKey Capital spot products will commence trading on April 30th.

Hong Kong has already permitted crypto-futures based ETFs, three of which have listed so far: CSOP Bitcoin Futures, CSOP Ether Futures, and Samsung Bitcoin Futures. These funds have accumulated approximately $175 million in total assets, a fraction of US offerings such as the $2.5 billion ProShares Bitcoin Strategy ETF, which is based on derivatives.

"It is crucial to set realistic expectations for the Hong Kong ETF market, especially considering the relatively modest size of the region's existing futures ETFs," Gaevoy cautioned.

Beyond approving spot ETFs, officials are reviewing approximately two dozen applications to expand Hong Kong's current roster of two licensed digital asset exchanges. The city is also developing a framework for stablecoins, a type of token pegged 1-1 to fiat currency and typically backed by reserves of cash and bonds.

Rally Tailwind

Whether Hong Kong will succeed in establishing itself as a crypto hub remains an open question. The ETF launches undoubtedly benefit from the tailwind of Bitcoin's fourfold increase since the start of last year, including a record high of $73,798 reached last month, fueled in part by inflows into US Bitcoin products.

"I am receiving numerous inquiries from Bitcoin holders" regarding Hong Kong ETFs, said Marco Lim, managing director of crypto hedge fund MaiCapital based in Hong Kong. He expressed surprise at the speed of approvals for the products.

Digital assets continue to be in high demand in China, despite a mixed outlook for stocks and a weak real estate sector. However, crypto trading remains prohibited on the mainland, driving activity underground. The upcoming fund launches will likely remain beyond the scope of a program that grants Chinese investors access to certain Hong Kong ETFs.

"It will take time for virtual asset ETF infrastructure to develop," said BI's Sin. "As the ETF ecosystem matures, more players will enter the market, resulting in increased liquidity, improved pricing, tighter spreads, and reduced fees."

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- dly becoming a religionoutput: title: Despite soaring to a new all-time high of $108,288 on December 17th, Bitcoin has retraced 15% in just a few days, which is a stark reminder that whilst Bitcoin remains the digital gold standard, its sheer size and dom

- Dec 26, 2024 at 08:45 pm

- So, where does real millionaire-making potential lie and what’s the best new crypto to buy right now? The answer is clear: the real fortune-building opportunities lie in emerging cryptos with explosive narratives, unshakable communities, and the kind of untapped potential that can rewrite financial destinies.

-

-

-

-

-

- Russian Companies Are Using Bitcoin to Circumvent Western Sanctions, Finance Minister Confirms

- Dec 26, 2024 at 08:36 pm

- Russian companies are circumventing Western sanctions by using Bitcoin and other cryptocurrencies to settle international trade, the country's Finance Minister, Anton Siluanov, confirmed yesterday (Wednesday).

-