|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

FTX Ex-CEO Sam Bankman-Fried Slapped with 25-Year Prison Slammer for Billionaire Fraud

Mar 29, 2024 at 03:16 am

Cryptocurrency entrepreneur Sam Bankman-Fried was sentenced to 25 years in prison for massive fraud that resulted in billions of dollars in losses for customers and investors. The sentence came despite prosecutors' request for 40-50 years and a probation officer's recommendation of 105 years. Judge Lewis A. Kaplan criticized Bankman-Fried's "arrogant" and "greedy" behavior, stating that the sentence was intended to prevent him from committing further harm.

Former FTX CEO Sam Bankman-Fried Sentenced to 25 Years in Prison for Multi-Billion Dollar Fraud

New York - In a landmark ruling, United States District Judge Lewis A. Kaplan on Thursday sentenced Sam Bankman-Fried, the former CEO of bankrupt cryptocurrency exchange FTX, to 25 years in prison. This stringent punishment follows Bankman-Fried's conviction in November on eight counts of fraud and conspiracy, stemming from a massive scheme that defrauded hundreds of thousands of customers and caused billions of dollars in losses.

Judge Kaplan's sentencing decision, while less than the 40 to 50 years sought by prosecutors, reflected the severity of Bankman-Fried's crimes. The court found that the 32-year-old California entrepreneur had knowingly looted customer accounts, made illegal political donations, and engaged in reckless investments, ultimately causing devastating financial harm to victims worldwide.

The sentence carries significant consequences for Bankman-Fried, who once stood as a prominent figure in the cryptocurrency industry. As the co-founder and CEO of FTX, he had amassed billions of dollars in wealth and enjoyed widespread acclaim for his innovative ideas. Now, his legacy is irrevocably tarnished by his criminal actions.

In a blistering analysis of Bankman-Fried's conduct, Judge Kaplan described him as "extremely smart" but also "completely irresponsible" and "arrogant." He emphasized the defendant's repeated perjury on the witness stand, highlighting his lack of remorse and his persistent attempts to evade accountability.

"There is absolutely no doubt that Mr. Bankman-Fried's name right now is pretty much mud around the world," Kaplan remarked, referencing the widespread public outrage over the FTX collapse.

The judge also emphasized the risk that Bankman-Fried posed to society, stating that he believed the defendant was capable of committing future crimes. This concern influenced the court's decision to impose a substantial prison term, intended to prevent Bankman-Fried from causing further harm.

During the sentencing hearing, Assistant U.S. Attorney Nicolas Roos argued for a lengthy prison sentence, emphasizing the need to deter Bankman-Fried and others from engaging in similar fraudulent schemes. Roos pointed out that tens of thousands of individuals and companies had lost billions of dollars as a result of Bankman-Fried's actions.

Prosecutors also disputed Bankman-Fried's claim that he intended to repay customers, noting that they had lost approximately $8 billion. The court ordered Bankman-Fried to forfeit this vast sum, which will be distributed to victims through the bankruptcy proceedings.

In a brief but emotional statement, Bankman-Fried apologized for his actions, acknowledging that he had "let down" many people. However, he expressed regret that his "useful life" was over and blamed others for his downfall.

Bankman-Fried's defense attorney, Marc Mukasey, argued that his client should receive leniency due to his lack of malicious intent and his willingness to assist with the bankruptcy proceedings. Mukasey emphasized Bankman-Fried's "mathematical" approach to decision-making, suggesting that he lacked the calculated greed of a traditional fraudster.

However, Judge Kaplan dismissed these arguments, stating that Bankman-Fried's actions were motivated by a reckless pursuit of profit. He pointed out that Bankman-Fried had gambled with customer funds, betting on risky investments and ignoring the consequences of his actions.

Despite pleas from Bankman-Fried's family, friends, and attorneys for a lighter sentence, the court remained unmoved. The judge determined that the severity of the crimes and the need to protect the public from future harm outweighed any mitigating circumstances.

Bankman-Fried will serve his prison sentence at a medium-security facility near San Francisco, where he will likely face additional challenges due to his notoriety and vulnerability. The Federal Bureau of Prisons will determine the specific facility where he will be incarcerated.

The sentencing of Sam Bankman-Fried to 25 years in prison sends a clear message that white-collar crime will not be tolerated. It serves as a warning to those who seek to exploit investors and engage in financial misconduct.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

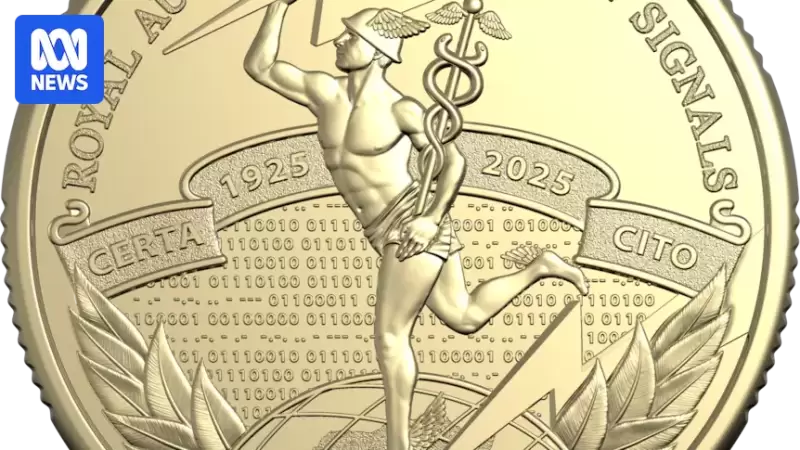

- New coin released by the Royal Australian Mint celebrates the Centenary of the Royal Australian Corps of Signals — but not all is as it seems.

- Apr 03, 2025 at 12:25 pm

- Beneath its golden facade, the $1 commemorative coin features a hidden message in code, just waiting to be cracked. By Tenzing Johnson.

-

-

-

-

- Coincodex's machine learning algorithm predicts Dogecoin (DOGE) price surge to $0.57

- Apr 03, 2025 at 12:15 pm

- The machine learning algorithm predicted that the Dogecoin price could surge $0.57 by April 28, later this month, representing a 229.55% gain for the foremost meme coin. This bullish prediction comes despite DOGE's decline, thanks to the broader crypto market crash, led by Bitcoin, which is attempting to test new lows.

-