|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

ETH Burn vs Staking: How Ethereum's Economic Model Is Struggling to Find Balance

Apr 14, 2025 at 07:35 pm

A total of 4.5 million Ethereum tokens worth $15.3 billion were destroyed through Ethereum Improvement Proposal (EIP) 1559 implemented during August 2021.

A total of 4.5 million Ethereum (CRYPTO: ETH) tokens were burned through Ethereum Improvement Proposal (EIP) 1559 in August 2021. The eventual objective was to make Ethereum a "deflationary token" by decreasing the total number of tokens.

However, the supply of Ethereum (CRYPTO: ETH) continues to grow despite an “Ethereum deflation dilemma” which occurred due to the business.

ETH Burn Vs Staking: How Ethereum’s Economic Model Is Struggling to Find Balance

With EIP-1559 a part of transaction fees are burnt as burn payments which helps in reducing the ETH supply. The designers of Ethereum wanted the burn mechanism to cancel out its existing inflationary feature while promoting scarcity of ETH which potentially enhances its market price over time.But the ongoing ETH burn vs staking issue highlights the challenges that Ethereum faces in balancing its token supply with increasing staking rewards.

The system worked exactly as the designers had planned when there were a large number of transactions. After the initial implementation of this approach decreased Ethereum’s supply increase to a point where some individuals began believing the system was deflationary. But the real scenario turned out to be drastically different from the original setup.

Ethereum Deflation Problem: Can EIP-1559 and Staking Rewards Coexist?

Proof-of-Stake replaced proof-of-work as Ethereum’s consensus algorithm when the platform transitioned in September 2022. The network transition to proof-of-stake decreased energy consumption significantly but it led to an increased issuance of new ETH because validators received ETH rewards through staking. The ongoing expansion of Ethereum’s supply is due to a steady growth despite the operation of its burning mechanism.The Ethereum deflation problem is getting worse as staking rewards continue to outpace the burning mechanism, which raises concerns about the long-term value.

A Deeper Look into Ethereum’s Inflationary Trend

The Ethereum network went into an inflationary state for the first time after EIP-1559 implementation during Q2 2024. The staking rewards distributed 228,543 ETH to validators but they destroyed only 107,725 ETH in this period. The number of ETH in circulation increased by about 120,818 from the shifts in supply and demand at that time. This shift happened mainly because the staking reward issuance rates exceeded the total amount burned.

Ethereum continues to increase its supply as the program issues rewards for staking even though it has successfully destroyed millions of ETH tokens. To maintain its deflationary structure, Ethereum needs adjustments because rewards from staking exceed burning activities which creates an imbalance in the economic model. Future protocol enhancements or modifications to the staking rewards might be required to achieve this desired economic model.

How the Ethereum Deflation Dilemma Could Impact Ethereum Price in the Long RunThe price of Ethereum remains highly sensitive to these deflationary and inflationary dynamics, and the market trends reflect the uncertainty surrounding the network’s future.Recent momentum changes from the Relative Strength Index (RSI) indicator corresponded with key price movements at the $1,630 mark. Price momentum became bullish whenever the currency plunged into over sold levels and these events supported the bullish crossover of the MACD signs (Golden Crosses) throughout upward price action. Despite the RSI showing a decreased overbought reading, we can still see that the preferred momentum is bullish due to the recent MACD crossover. Ethereum shows a strong resilience to bear trends but a strong breakout of the $1,630 threshold would lower the risk to either the $1,600 or $1,585 levels.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- Ripple Eyes a Landmark SEC Settlement Paid in XRP as CEO Brad Garlinghouse Boldly Forecasts Bitcoin Hitting $200,000

- Apr 16, 2025 at 01:25 pm

- Ripple Chief Executive Brad Garlinghouse said the company’s settlement with the U.S. Securities and Exchange Commission (SEC) could potentially involve payment in XRP. He also offered a bullish outlook on bitcoin’s future price during an April 10 interview with Fox Business.

-

-

-

- Fresh From Convincing GameStop to Buy Bitcoin, Strive Asset Management CEO Matt Cole Now Wants Intuit to Do the Same

- Apr 16, 2025 at 01:20 pm

- input: Fresh from successfully convincing game retailer GameStop to add Bitcoin to its balance sheet, Strive Asset Management CEO Matt Cole has now set his sights on fintech firm Intuit to do the same.

-

-

- Bitcoin (BTC) Faces a Critical Test as Global Markets Remain Volatile and Macroeconomic Tensions Escalate

- Apr 16, 2025 at 01:15 pm

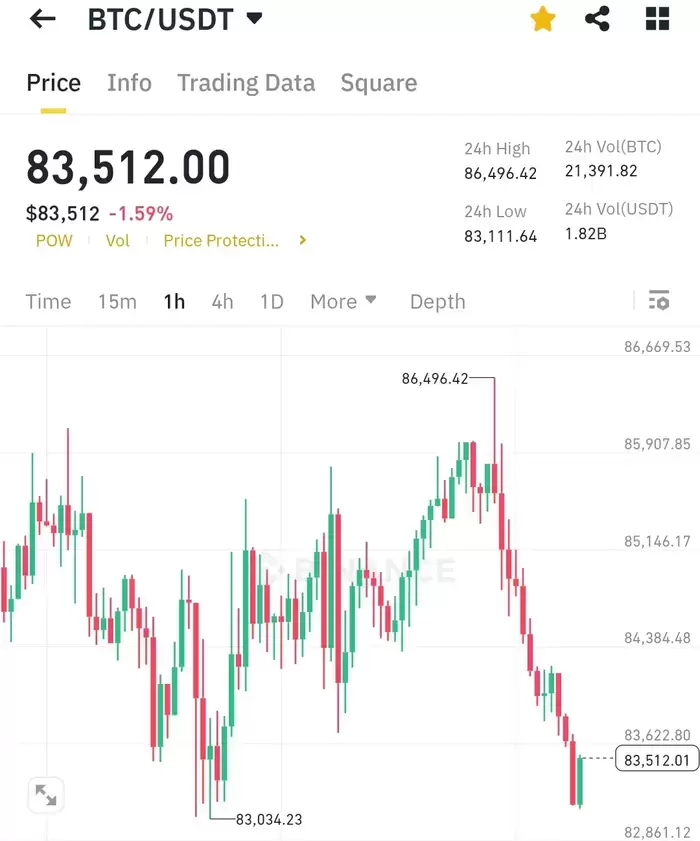

- Bitcoin is facing a critical test as global markets remain volatile and macroeconomic tensions escalate. After weeks of price swings and uncertainty, BTC is trading above the $85,000 level — a psychological and technical threshold that bulls have managed to defend.

-

- Bitcoin (BTC) has been moving between $80,00 and $85,00 for the fourth day as the uncertain market for the U.S.-China trade dispute continues.

- Apr 16, 2025 at 01:10 pm

- In the meantime, most of the world's transactions are from de facto kimchi coins from Korean exchanges. All of the top coins in the upbit growth rate over the past week were also taken up by coins with a high share of Korean transactions.