|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Crypto Market Correction: Reasons to Stay Bullish Amid Market Volatility

Apr 17, 2024 at 01:49 am

Despite a recent market correction, analysts remain bullish on digital assets, citing several reasons. The Bitcoin halving may provide support, as it has historically preceded price rallies. Spot exchange-traded funds (ETFs) could introduce bitcoin to a wider audience, potentially fueling demand. While macro turbulence may temporarily affect crypto assets, other narratives and growing adoption should provide support. Leverage wipe-outs have reduced excessive leverage, creating a healthier market. The current drawdown is within the range of typical bull market pullbacks, suggesting that the market is not overextended. Consistent demand for long-term BTC and ETH calls indicates that market participants anticipate future price appreciation.

Crypto Correction: Reasons to Stay Bullish Despite Market Turmoil

The recent cryptocurrency market correction has sent investor sentiment plummeting, but analysts maintain that there are compelling reasons to remain optimistic about digital assets.

Bitcoin Halving and Spot ETFs

One significant event on the horizon is the upcoming Bitcoin halving, a recurring occurrence approximately every four years that reduces the supply of newly issued tokens by half. While historical price movements around halvings have been mixed, it often precedes periods of substantial growth.

Joel Kruger, a market strategist at LMAX Group, believes that the halving will not result in immediate upward momentum but acknowledges the potential for a rally due to the broader adoption of Bitcoin spot exchange-traded funds (ETFs).

With traditional finance giants like BlackRock and Fidelity ramping up their sales efforts to introduce Bitcoin to a wider investor base, Kruger anticipates increased excitement and demand for the asset. Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, recently observed BlackRock advertising its Bitcoin fund on Bloomberg's homepage.

Macroeconomic Volatility and Crypto Resilience

The market correction was primarily triggered by macroeconomic events, including geopolitical tensions between Israel and Iran, rising bond yields, and a stronger U.S. dollar. These factors have weighed on traditional markets and raised concerns about the trajectory of the stock market.

Noelle Acheson, a macro analyst and author of the "Crypto Is Macro Now" newsletter, warns that the earnings yield on the S&P 500 has fallen below that of both 3-month and 10-year U.S. Treasuries, indicating potential downside for U.S. equities. While this could temporarily affect crypto assets, Acheson believes that long-term narratives such as store of value, currency hedge, and growing adoption will encourage accumulation at lower levels.

Leverage Wipe-Out and Market Cleansing

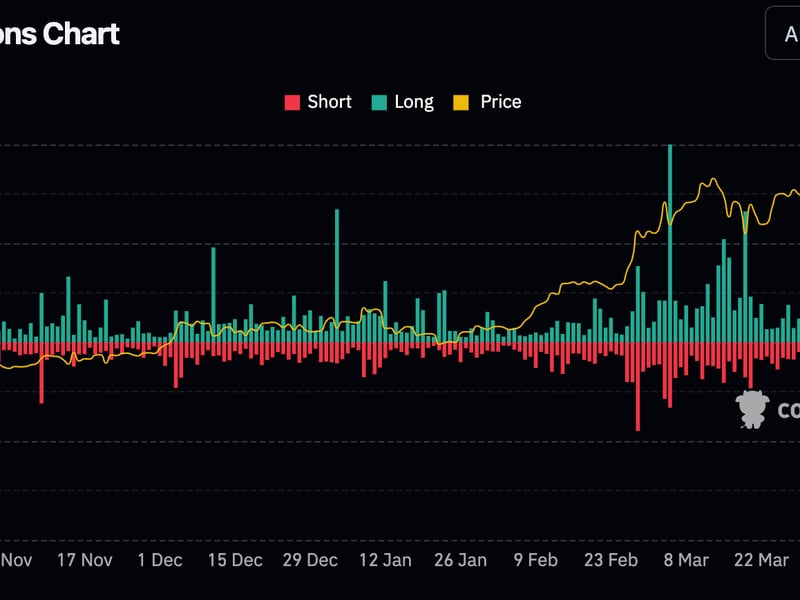

Massive liquidation events on derivatives markets, where over $1.5 billion of bullish bets were liquidated last weekend, often mark the bottom for asset prices. Vetle Lunde, a senior market analyst at K33 Research, views this as a cleansing process that reduces excessive leverage and sets the stage for a healthier market.

Combined with Bitcoin's resilience above $60,000, Lunde believes these events resemble the market action of August 2021, when BTC fell sharply but later rebounded to much higher prices.

Historical Pullbacks and Market Maturity

Bitcoin's current pullback of 16% from its recent all-time high is within the range of typical drawdowns observed in previous bull markets. The 2016-2017 and 2020-2021 cycles both featured multiple 20%-30% pullbacks before continuing their upward trajectories.

Crypto analysts emphasize that such corrections are normal in bull markets and should not discourage long-term investors.

Hedge Fund Demand and Market Sentiment

Despite the recent market volatility, hedge fund QCP Capital continues to report consistent demand for Bitcoin and Ethereum calls with longer-term expiries extending to March 2025. This indicates that market participants anticipate higher prices in the future, underscoring the ongoing bullish sentiment.

In conclusion, while the crypto market correction has certainly tested investor sentiment, there are several factors that support the argument for remaining optimistic about digital assets. The Bitcoin halving, spot ETFs, macroeconomic resilience, leverage wipe-out, historical pullbacks, and hedge fund demand all point to reasons to believe that the current correction may be a temporary setback in a long-term uptrend.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- The Hyperliquid (HYPE) future continues to shine as the decentralized exchange breaks past $1 trillion in trading volume

- Apr 11, 2025 at 10:25 am

- The Hyperliquid (HYPE) future continues to shine as the decentralized exchange breaks past $1 trillion in trading volume, offering unmatched speed and full anonymity

-

-

- Rexas Finance (RXS) is at a crossroads, with investors wondering if the price will rise above $0.50 or fall under $0.05.

- Apr 11, 2025 at 10:20 am

- DOGE is now trading at $0.17, near key support levels. Analysts are paying great attention to price fluctuations, as the Falling Wedge pattern and Stochastic RSI crossing provide conflicting signals.

-

-

-

- BlockDAG (BDAG) picks up speed, launching $30m grants program and partnering with SpaceDev to shape the next era of blockchain.

- Apr 11, 2025 at 10:10 am

- Learn what's shifting in Ethereum analysis, what's behind PI coin's fall, and how BlockDAG's SpaceDev deal and $30m grants shape the next era of blockchain.

-

-

![🐢Super Mario World Koopa Troopa 100% 96⭐️ + Coin [Ao Vivo] 🐢Super Mario World Koopa Troopa 100% 96⭐️ + Coin [Ao Vivo]](/uploads/2025/04/10/cryptocurrencies-news/videos/super-mario-koopa-troopa-coin-ao-vivo/image-1.webp)