|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin Shrimps Emerge as the New ‘Smart Money’ as Whales Offload Their Stash: Van Straten

Nov 12, 2024 at 09:07 pm

Bitcoin has surged by $20,000 in the past week as we examine the cohort breakdown of this rally.

Bitcoin (BTC) price action has surged by over $20,000 in the past week alone. Now, a closer examination of the different types of market participants reveals a surprising trend.

While common wisdom might suggest that large bitcoin holders, often referred to as "whales," are driving the buying, on-chain data indicates otherwise. Instead, it appears that smaller bitcoin addresses are the ones accumulating the cryptocurrency as prices rise.

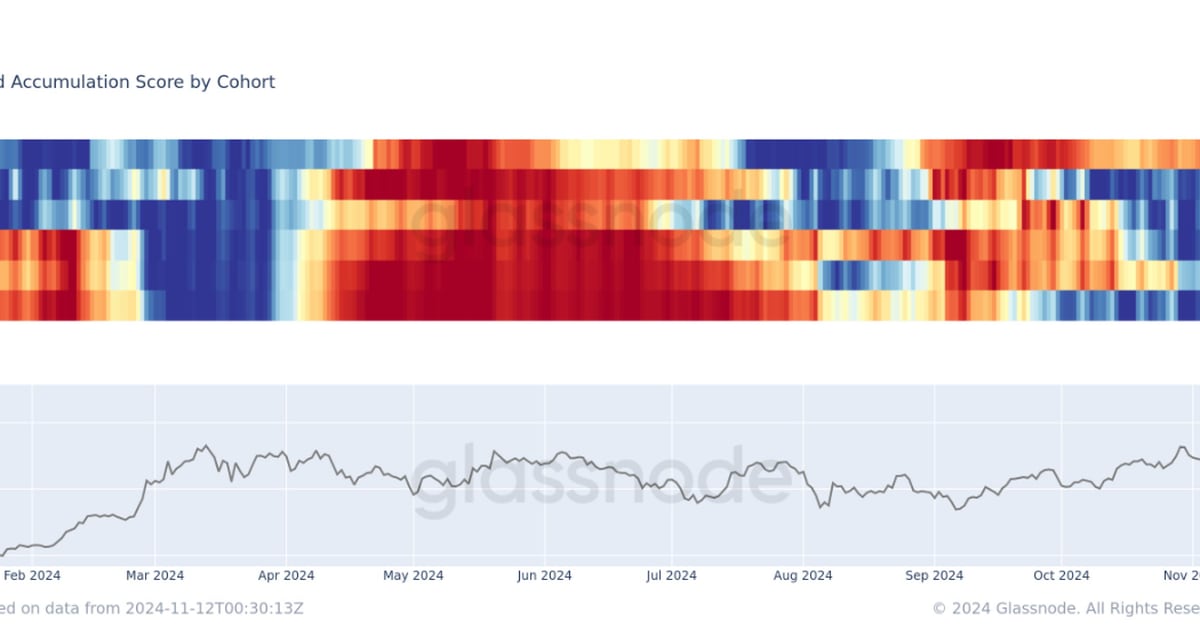

According to data from on-chain analytics firm Glassnode, all cohorts other than humpback whales, which are defined as bitcoin addresses holding over 10,000 BTC, have shown net accumulation over the past two months. This period coincides with bitcoin's upward price trajectory, which saw the primary cryptocurrency climb from around $55,000 in September to just shy of $90,000 in November.

The analysis groups market participants into cohorts based on the amount of bitcoin they hold, ranging from less than one BTC, known as "shrimps," to over 10,000 BTC, denoted as "humpback whales." A value closer to one on the chart indicates that the respective cohort is accumulating tokens, whereas a value close to zero represents distribution.

The chart shows that shrimps, small bitcoin addresses holding less than one BTC, have been accumulating throughout the past two months, indicating a trend of buying bitcoin on the way up. In contrast, humpback whales, depicted by the blue line, have been distributing their bitcoin holdings over the past two months. This behavior suggests that whales are selling their bitcoin as prices rise, a strategy commonly known as "sell on rise."

This data challenges the narrative that whales are the "smart money" of the bitcoin ecosystem, a notion that has been propagated in the past. The feature image, which shows that whales have been selling into price strength, while retail has been buying the rally, further highlights this trend.

However, it’s important to note that while smaller bitcoin addresses are showing net accumulation, overall demand has been outpacing supply and issuance. When aggregating the data from all cohorts, including miners, exchanges and retail investors, over the past 30 days, it shows that all groups combined have net bitcoin holdings, which total over 26,000 BTC. But again, this demand has been consistent for the past three months, outstripping supply and issuance.

This sustained demand has contributed to bitcoin’s price rally, pushing the cryptocurrency to new all-time highs in recent weeks. However, the narrative of smaller bitcoin addresses driving the buying is an interesting observation, especially given the common perception that "smart money" is typically associated with large bitcoin holders.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- Shiba Inu (SHIB) Meme Rallies To Break The Top Ten

- Nov 14, 2024 at 10:25 pm

- Shiba Inu is up an astonishing 29% in the last 7 days to hit $0.0000259. This brings the Shiba Inu market cap above $15.3 billion and secures it a place in the coveted coin market cap top 10 crypto index. This could be the beginning of an insane run for Shiba Inu, which has a history of surprising to the upside with the strength of its bullish impulses.

-

-

-

- TRON and Avalanche Prices Significantly Decline, Prompting Investors to Reconsider Their Investment Options

- Nov 14, 2024 at 10:15 pm

- While most coins are bullish following a favorable turn of externalities, TRX and AVAX have been the direct opposite. AVAX and Tron's prices have significantly declined in the past few weeks, prompting investors to reconsider their investment options.

-

-

-

-

- Dogecoin's Hidden Impact: Revolutionizing Industries and Community Dynamics

- Nov 14, 2024 at 10:15 pm

- Dogecoin, once dismissed as a mere internet meme, has now cemented its status as a formidable player in the cryptocurrency arena. While its rise has been largely discussed, some aspects haven't received the attention they deserve. In this article, we delve into unexplored facets of Dogecoin that could significantly influence lives globally.