|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin’s recent price retreat has created a strategic entry point

Mar 28, 2025 at 08:10 pm

Despite macroeconomic headwinds, the firm highlights a confluence of technical and fundamental indicators pointing to a golden opportunity for long-term investors.

Bitcoin’s recent price retreat has created a strategic entry point, according to Tide Capital, as the firm highlighted several technical and fundamental indicators that signal a potential market bottom. Despite macroeconomic headwinds and pessimism, the firm believes that current market dynamics and institutional activity are setting the stage for a substantial recovery rally in the latter half of 2025.

Specifically, U.S. economic turbulence has intensified in early 2025, resulting in sharp corrections across major asset classes. The Nasdaq Index has tumbled -15% from recent highs, while Bitcoin has fallen over -25% as traders engage in frantic flight-to-safety flows.

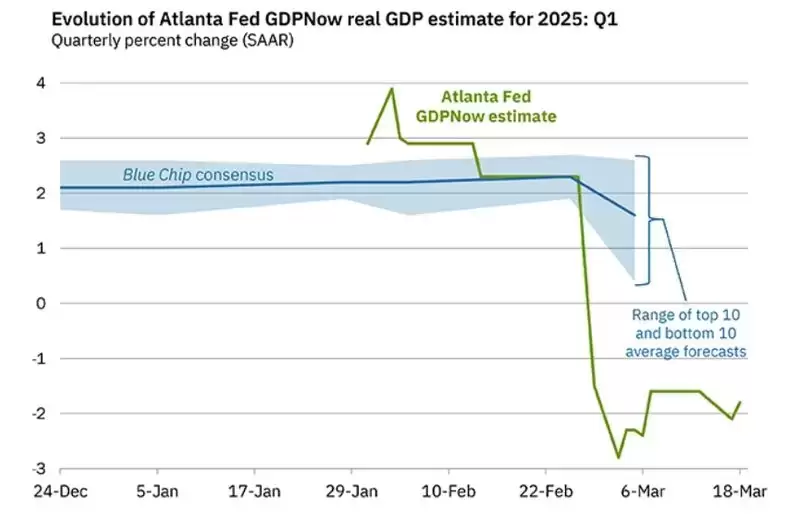

Data from the Atlanta Fed's GDPNow model showcases a significant revision in Q1 2025 U.S. real GDP growth projections, dropping sharply from 3.2% to -1.8%. This signals weak short-term economic performance and has raised concerns about a potential recession.

The risk of recession has escalated amidst these growth concerns. Polymarket data cited by Tide Capital reveals that the market-implied probability of a U.S. recession in 2025 has risen to 35%. This marks an increase of 13 percentage points since the beginning of the year, highlighting intensifying fears of a recession and increased defensive positioning among investors.

In response to this economic weakness, Tide Capital observes a surge in demand for safe-haven assets. Goldman Sachs has recently raised its gold price target to $3,300, reflecting heightened economic uncertainty and a booming demand for risk hedges.

However, despite experiencing sharp corrections of over -50% from recent highs, markets appear to have fully integrated negative expectations, according to Tide Capital. The firm points out that U.S. equity CTA short positions have reached a two-year extreme, exceeding $30 billion, as reported by Goldman Sachs. This signals peak bearish sentiment and suggests reduced downside risks moving forward.

The unexpected decision by the Federal Reserve during its March FOMC meeting to slow the pace of quantitative tightening—by reducing monthly Treasury roll-off caps from 25 billion to 5 billion—has significantly bolstered market confidence. This shift has contributed to a rebound in risk assets, noted Tide Capital.

While acknowledging the persistence of near-term challenges, Tide Capital emphasizes that current economic data does not indicate an inevitable crisis. With extreme pessimism already reflected in asset prices, any minor economic improvements could swiftly overturn prevailing recession narratives and ignite a robust recovery rally.

According to data from CoinGlass, Bitcoin spot ETFs have seen five consecutive weeks of outflow since February 10, totaling $5.5 billion.

This sustained outflow period is noteworthy as it usually coincides with market bottoms and presents significant long-term entry opportunities for investors, according to Tide Capital.

Moreover, Tide Capital highlights that BTC perpetual funding rates on Binance have dropped below 5% (7-day average), levels not seen since September 2024, as reported by The Block. This decline in funding rates is indicative of weak bullish momentum and peak bearish sentiment—classic signs of a market bottom forming.

This aligns with the observations of prominent figures in the crypto sphere, such as Galaxy's Mike Novogratz, who has also pointed to a potential market bottom in the first quarter of 2025.

Despite BTC's current price being off its highs, stablecoin supplies continue to break records, surpassing 230 billion—a 30 billion increase since the start of 2025. As the backbone of liquidity within the crypto markets, the expansion of stablecoin reserves signals institutional readiness to capitalize on the next upcycle, providing fuel for future growth.

Tide Capital concludes that BTC’s current environment—marked by depressed funding rates, crowded shorts, and stablecoin accumulation—creates a rare buying opportunity. “Any macro improvement or policy catalyst could trigger simultaneous short squeezes and capital inflows, propelling prices into a new upward cycle,” the firm emphasized.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

- The settlement of the years-old legal dispute between the US Securities and Exchange Commission and Ripple, a prominent cryptocurrency company, has significantly increased market confidence that a XRP ETF will be approved by the regulator in 2025.

- Apr 08, 2025 at 09:25 am

- Polymarket bettors suggest that there is a 84% probability of a XRP ETF approval in 2025. Here is everything you should know about the development. Read on!

-

-

-

-

-