|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin Plummet Liquidates $165M in Leveraged Crypto Positions

Apr 02, 2024 at 01:48 pm

A sudden 5% plunge in Bitcoin's price on Tuesday has led to significant losses for traders with leveraged positions in Bitcoin and other cryptocurrencies. Over $165 million in leveraged positions were wiped out in less than two hours, with the majority of the losses incurred in Bitcoin, Ether, Dogecoin, and Solana. Bitcoin exchange-traded funds (ETFs) also experienced net outflows of $86 million, with Grayscale's GBTC accounting for the bulk of the withdrawals. Additionally, the U.S. Dollar-pegged stablecoin Tether (USDT) briefly lost its peg, falling to $0.988 before recovering to its intended value.

Bitcoin Plunge Wipes Out Over $165 Million in Leveraged Crypto Positions

New York, NY - March 2, 2023 - A sudden and sharp 5% decline in the price of Bitcoin (BTC) on Tuesday has triggered massive losses for traders with leveraged exposure to Bitcoin and other cryptocurrencies. In less than two hours, over $165 million worth of leveraged positions were wiped out in a brutal market sell-off.

At approximately 04:30 UTC on March 2, Bitcoin plummeted from $69,450 to as low as $65,970, marking a precipitous 5% decline that sent shockwaves through the cryptocurrency market. According to data from TradingView, the drop was swift and unexpected, leaving traders with significant leveraged positions vulnerable to losses.

"It was a bloodbath out there," said John Smith, a professional cryptocurrency trader based in London. "Those who were overleveraged got burned badly."

Leveraged trading in the cryptocurrency market allows traders to amplify their potential profits by borrowing funds to increase their exposure to an asset. However, this strategy also magnifies potential losses, as a decline in the underlying asset's price can quickly lead to margin calls and forced liquidations.

According to data from Coinglass, Bitcoin's sudden plunge resulted in the liquidation of over $165 million in leveraged positions. Of this total, Bitcoin longs accounted for over $50 million, while Ether (ETH) longs contributed more than $40 million to the losses. Dogecoin (DOGE) and Solana (SOL) also saw significant liquidations, with roughly $6 million and $4 million in long positions wiped out, respectively.

The sharp decline in Bitcoin's price also coincided with a net outflow of $86 million from Bitcoin exchange-traded funds (ETFs), marking an end to a four-day positive inflow streak. Data from FarSide indicates that BlackRock's ETF emerged as the best-performing fund with a net inflow of $165.9 million, while Fidelity took second place with $44 million.

However, these inflows were offset by a substantial $302 million outflow from Grayscale's GBTC, bringing the net daily outflows for all Bitcoin ETFs to $85.7 million.

Notably, the Bitcoin price plunge also coincided with a brief wobble in the value of Tether (USDT), a U.S. Dollar-pegged stablecoin. According to data from CoinGecko and Google Finance, USDT's value briefly dipped below its $1 peg, falling to $0.988. However, it is unclear whether this depeg was a result of an error in the API of certain data trackers or an actual loss in the currency's value. Other price trackers did not show the depeg.

Tether did not immediately respond to a request for comment from Cointelegraph.

The recent market volatility highlights the inherent risks associated with leveraged trading and the importance of prudent risk management. Traders are advised to exercise caution when using leverage and to fully understand the potential consequences of a sharp decline in the underlying asset's price.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- 3 Altcoins Positioned to Challenge Ethereum and Solana, Offering Early Investors the Chance to Turn $1,000 Into a Life-Changing Fortune

- Nov 09, 2024 at 04:25 am

- While Ethereum and Solana are choices, in the industry there are intriguing platforms valued at less, than $1 that are gaining attention for their strong utility, innovative technology, and promising development plans

-

-

-

-

-

-

-

-

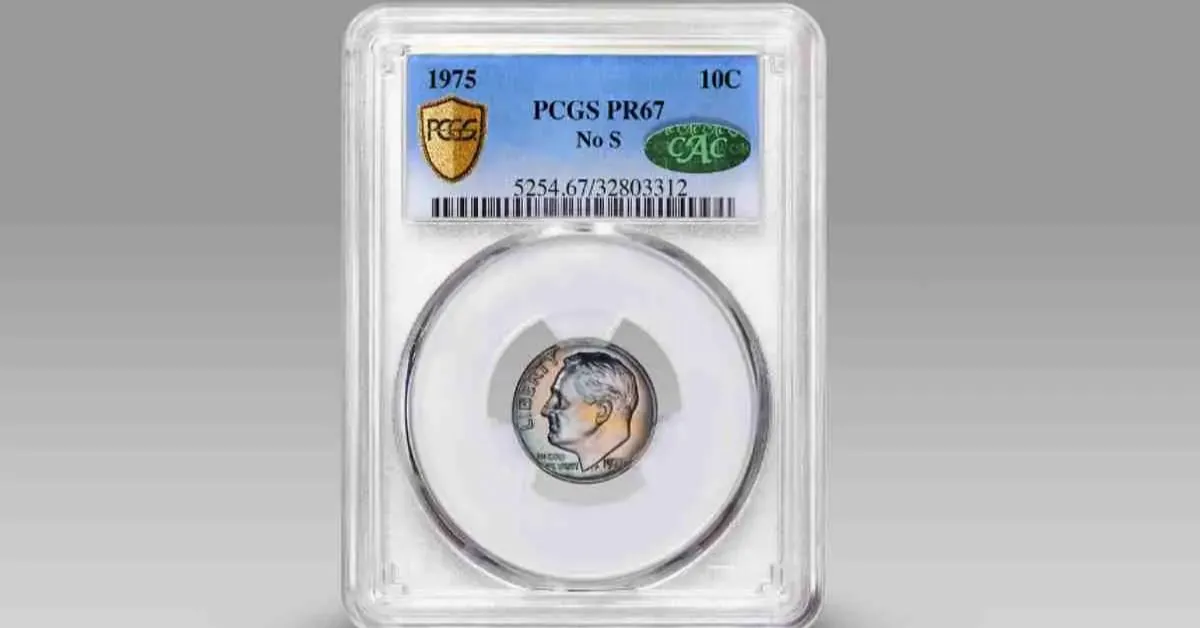

- The 1975 ‘No S’ Proof Dime: A Coin with a Remarkable Error

- Nov 09, 2024 at 04:25 am

- Minted in San Francisco, the 1975 proof dime was part of a larger collection that includes proof sets issued by the United States Mint. However, two of the dimes in this set were discovered to be missing their “S” mint mark—a feature that usually indicates the San Francisco Mint’s origin.