|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Bitcoin Dominance Nears Cycle Highs, Signaling a Potential Shift Toward Altcoin Season

Nov 07, 2024 at 07:30 am

Bitcoin's dominance (BTC.D) has been steadily climbing, and as it approaches its previous cycle highs, traders and analysts are wondering if we're on the verge of a shift toward altcoin season.

Bitcoin’s (CRYPTO: BTC) dominance has been a hot topic among traders and analysts, especially as it approaches critical levels. Historically, when Bitcoin’s dominance peaks, it signals a potential turning point in the market. This could open the door for altcoin season, a period when altcoins tend to outpace Bitcoin and take center stage.

Bitcoin Dominance and Market Dynamics

Bitcoin dominance is a metric that measures Bitcoin’s share of the total cryptocurrency market. A high Bitcoin dominance means Bitcoin is outperforming the rest of the market, drawing in most of the capital. Conversely, a declining dominance signals that other cryptocurrencies, known as altcoins, are gaining traction and outperforming Bitcoin.

Bitcoin’s rally over the past few months has pushed its dominance to new highs. After months of trading in a narrow range, Bitcoin surged through September and October, with its price briefly retesting its all-time high in late October, nearing $73,600. As Bitcoin’s price climbed, so too did its dominance, drawing more capital to the top cryptocurrency and leaving altcoins trailing behind.

But this dominance is approaching a key resistance level—one that has historically marked the peak of Bitcoin’s market share before the altcoin market takes off. As Bitcoin’s dominance approaches this critical threshold, many are asking whether the shift toward altcoins could happen soon.

A History of Bitcoin Dominance and Altcoin Cycles

If history is any guide, we may be approaching a turning point. During the previous crypto cycles, Bitcoin’s dominance reached around 82% before a significant decline, which was followed by a sharp rally in altcoins. In 2020 and 2023, we saw Bitcoin dominance peak at similar levels before a downward reversal triggered the beginning of altcoin season. In those cycles, Bitcoin’s dominance eventually fell, and funds began rotating into altcoins, propelling the smaller cryptocurrencies to impressive gains.

Right now, Bitcoin’s dominance sits at about 80.5%, just shy of its previous highs. If it begins to reverse from this level, we could be on the cusp of a major market shift. However, this reversal won’t happen overnight, and some analysts suggest that the true altcoin season may still be months away.

The Road to Altcoin Season

Benjamin Cowen, a well-known crypto analyst and founder of Into The Cryptoverse, has suggested that the market won’t fully enter altcoin season until sometime in 2025. He notes that while Bitcoin dominance remains high, the shift toward altcoins typically doesn’t occur until BTC.D begins to decline significantly. Cowen’s analysis is based on past cycles where Bitcoin and Ethereum’s dominance was high before the market rotated toward altcoins.

This shift is important for altcoin investors. When Bitcoin dominance begins to decline, capital usually flows from Bitcoin into altcoins, often leading to substantial gains for smaller cryptocurrencies. However, this doesn’t happen automatically. For the shift to take place, we need to see Bitcoin’s dominance either plateau or begin to drop, accompanied by a rise in altcoin market interest.

The Altcoin Season Index: How to Gauge the Shift

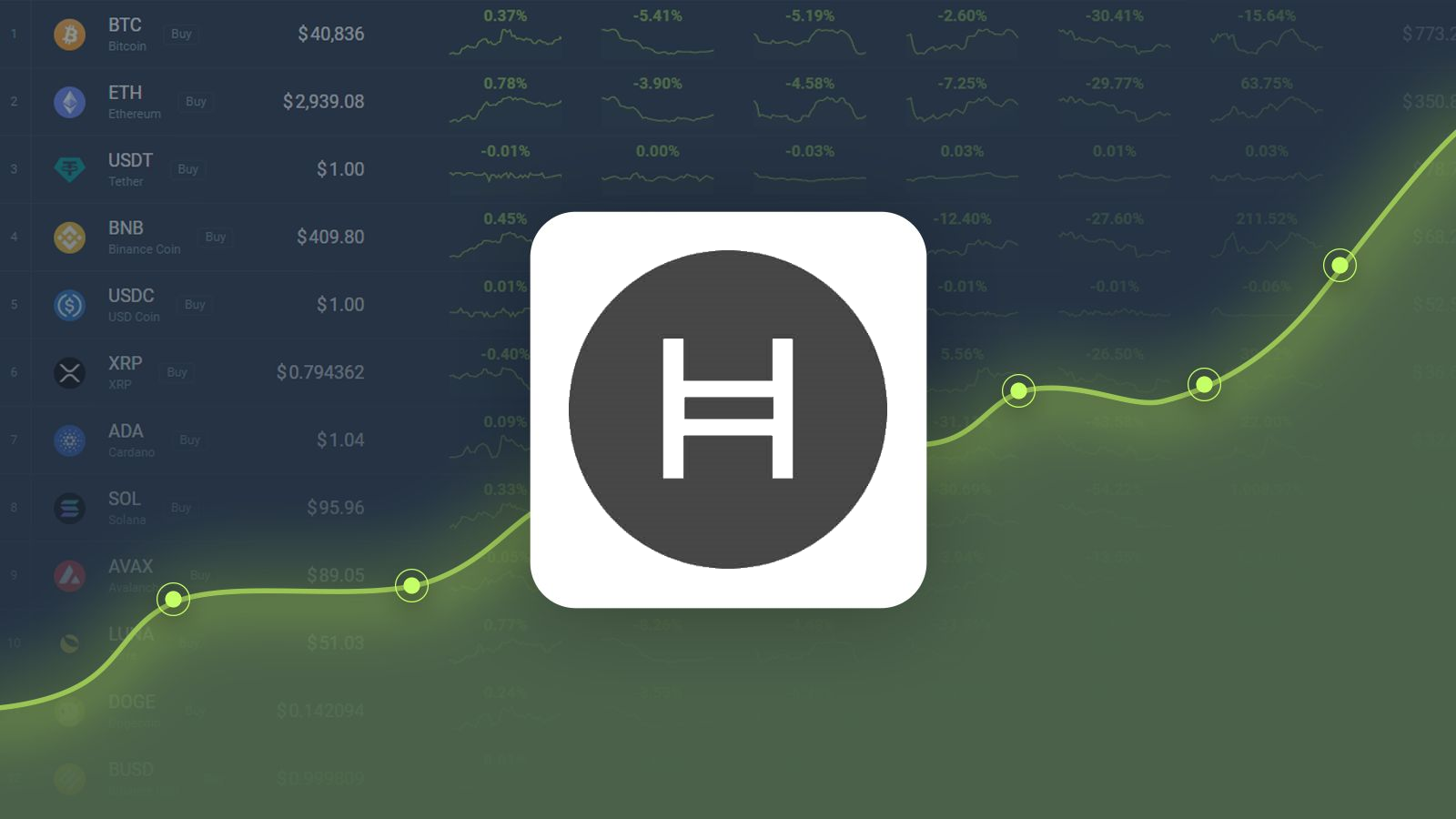

One tool that helps track whether an altcoin season is approaching is the Altcoin Season Index. This index measures how well altcoins are performing relative to Bitcoin. When the index reads 100, it indicates that altcoins are outpacing Bitcoin in terms of price growth. If the index is below 50, as it currently is, it suggests that altcoins are still struggling to keep up with Bitcoin’s performance.

At present, the Altcoin Season Index stands at 27. This suggests that Bitcoin remains dominant, and altcoins are underperforming. Historically, altcoin season tends to begin when the index reaches around 50, and the real action starts when it approaches 70-80. So, while we are not yet in altcoin season territory, the market is showing signs of potential change.

Bitcoin’s Dominance Chart: A Critical Moment

Bitcoin dominance is currently testing key levels that could signal a major shift in market dynamics. The BTC.D chart is showing an upward trajectory toward the 72% mark, which was the peak of the last cycle. However, Bitcoin’s dominance doesn’t necessarily need to hit 72% for the altcoin season to begin. If dominance begins to reverse before hitting this point, it could trigger a swift rotation of funds into altcoins, leading to a surge in altcoin prices.

In technical terms, a break in Bitcoin’s dominance could be the first sign that the market is shifting. If Bitcoin’s dominance starts to decline and altcoins begin to gain, we could see a dramatic rise in the value of smaller cryptocurrencies. The higher Bitcoin dominance goes before this shift happens, the more significant the subsequent gains for altcoins may be.

The

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

-

- A rare US dime, an unstamped dime, has been auctioned for $506250, nearly 30 times the price it sold for 46 years ago.

- Nov 07, 2024 at 10:20 am

- GreatCollections, which auctioned the 1975 Ten without an S, said the coin was purchased by an Ohio collector and his mother for $18200 in 1978 and remained in the family for nearly 50 years.

-

-

- Rollblock ($RBLK): The Web3 Casino Bringing Blockchain Benefits to the Enormous Casino Market

- Nov 07, 2024 at 10:15 am

- With a bullish Q4 upon us, now is the time for utility-based projects to shine and rise to the top of the crypto pile. Read on to find out why the Web3 casino Rollblock ($RBLK) has attracted nearly $5 million of investment from Fantom and Toncoin holders and what the future holds for this potential 100x gaming gem.