|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

昨天结算价:68.75,下跌-0.49 [-0.71%] WTI 原油期货在欧洲时段再次创下早盘高点后,昨天收低。

WTI Crude Oil Futures (January)

WTI 原油期货(一月)

Yesterday’s Settlement: 68.75, down -0.49 [-0.71%]

昨日结算价:68.75,下跌-0.49 [-0.71%]

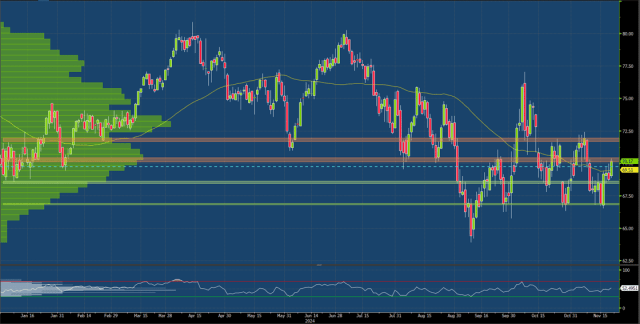

WTI Crude Oil futures closed lower yesterday after making early morning highs once again in the European session. U.S. traders sold crude aggressively into the U.S. open. European buying into aggressive American selling on the open has been a rinse-and-repeat pattern in crude this week.

WTI 原油期货在欧洲时段再次创出早盘高点后,昨天收低。美国交易商在美国开盘时大举抛售原油。欧洲人在公开市场上买入美国的激进抛售,这是本周原油市场的反复模式。

This morning, WTI futures are showing promising strength through the European session once again. January futures are higher by +1.00 to 70.27 [+0.46%] at the time of writing. Catalysts for the rally are Russian – Ukraine fears. Early this morning Ukrainian authorities reported the use of an intercontinental ballistic missile for the first time in the war. ICB’s and their use have been a sore spot for Nato & the U.S for years and the strike will likely elicit a response out of the rest.

今天上午,WTI 期货在欧洲时段再次展现出强劲的势头。截至撰写本文时,一月期货上涨 +1.00 至 70.27 [+0.46%]。此次涨势的催化剂是对俄罗斯和乌克兰的担忧。今天凌晨,乌克兰当局报告称战争中首次使用了洲际弹道导弹。多年来,洲际弹道导弹及其使用一直是北约和美国的痛处,这次袭击可能会引起其他国家的回应。

The macro environment is mixed to risk-on today with Gold higher by +0.40%, S&P’s +0.24%, Copper -0.44%, 10Yr’s lower by -1.37bps at 4.396%, and the DXY lower by -0.08%. The commodity complex desperately needs this dollar strength to ease.

今天的宏观环境喜忧参半,其中黄金上涨+0.40%,标准普尔指数上涨+0.24%,铜上涨-0.44%,10年期指数下跌-1.37个基点至4.396%,美元指数下跌-0.08%。大宗商品市场迫切需要美元走强来缓解。

Yesterday’s EIA report showed a reversal of the hot product demand trend while Crude Oil demand ramped on increased exports. U.S. stockpiles remain at record lows. Figures are as follows [thousand bbls]:

昨天的环境影响评估报告显示,产品需求热点趋势出现逆转,而原油需求因出口增加而猛增。美国库存仍处于历史低位。数字如下[千桶]:

WTI Crude Oil futures are running into major three-star resistance at 70.11-70.42. Although it has so far slowed down the overnight rally, we see a landscape in which prices fundamentally and technically can continue higher into the weekend. To hold a most constructive path, we would not like to see the bottom end of yesterday’s EIA release whipsaw (68.97) to be surrendered. Furthermore, we envision the bulls decisively in the driver’s seat as long as price action holds our Pivot and point of balance at…

WTI 原油期货正遭遇主要三星级阻力位 70.11-70.42。尽管到目前为止已经减缓了隔夜的涨势,但我们看到价格在基本面和技术上都可以继续走高到周末。为了保持最具建设性的路径,我们不希望看到昨天 EIA 发布的洗盘(68.97)的底部被放弃。此外,我们预计,只要价格走势将我们的枢轴和平衡点保持在……,多头就会果断地占据主导地位。

Want to stay informed about energy markets?

想了解能源市场的最新情况吗?

Subscribe to our daily Energy Update for essential insights into Crude Oil and more. Get expert technical analysis, proprietary trading levels, and actionable market biases delivered straight to your inbox. Sign up now for free futures market research from Blue Line Futures!

订阅我们的每日能源更新,了解有关原油等的重要见解。将专家技术分析、专有交易水平和可操作的市场偏差直接发送到您的收件箱。立即注册,获取 Blue Line Futures 的免费期货市场研究!

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 亚马逊目前体育和健身器材的终极销售

- 2024-11-22 08:40:01

- 想要强身健体吗?以下是亚马逊家庭健身房和健身器材的惊人销售,可提供最佳的家庭锻炼。

-

- 在特朗普重返白宫之前,比特币飙升至 99,000 美元以上

- 2024-11-22 08:40:01

- 比特币的生态系统随着创新的第 2 层应用程序而扩展。比特币的极端主义是否阻碍了区块链的潜力?

-

- 比特币(BTC)在其最大的年度反弹之一中逐步接近 10 万美元的里程碑

- 2024-11-22 08:35:02

- 这一次,很多散户错过了牛市。

-

-

- 中国法院称比特币是一种商品,但警告其相关用途是非法的

- 2024-11-22 08:35:02

- 上海松江区人民法院商事法官孙杰表示,加密货币在中国被视为商品,并未受到法律明确禁止。

-

-

- 投资者瞄准 10 万美元里程碑,比特币金库创历史新高

- 2024-11-22 08:30:02

- 自前总统唐纳德·特朗普连任以来,世界上最受欢迎的加密货币的价值已飙升 31%

-

- 随着散户投资者逢高抛售,比特币鲸鱼囤积比特币

- 2024-11-22 08:30:02

- 过去 30 天,“虾米”净卖出了约 70 亿美元的比特币。另一方面,交易所中的比特币数量略低于 300 万,创两年来新低。

-

- 英国承诺加密货币监管框架草案将于明年初准备就绪

- 2024-11-22 08:30:02

- 财政部经济部长 Tulip Siddiq 表示,这些法规将涵盖稳定币和质押服务,以及加密货币本身。