|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

一个新创建的鲸鱼钱包在两天内撤回了461,874个UNISWAP [UNI](456万美元)和1580万美元,从而引发了人们对可能的市场转变的猜测。

A whale wallet made two large withdrawals from Binance within two days, removing 461,874 Uniswap [UNI] ($4.56M) and 15.8M USDT.

一条鲸鱼钱包在两天内从二元中进行了两次大型撤离,删除了461,874个uniswap [uni](456万美元)和1580万美元。

This activity sparked speculation among investors about an impending market shift, with large withdrawals often indicating upcoming price movements.

这项活动引发了投资者对即将发生的市场转变的猜测,大量提款通常表明即将发生的价格变动。

The withdrawal could signal confidence in Uniswap’s future or a change in liquidity strategies.

撤回可能表明对Unistwap的未来或流动性策略的变化信心。

However, broader market trends indicate that Uniswap faces challenges that could impact its short-term outlook.

但是,更广泛的市场趋势表明,UNISWAP面临可能影响其短期前景的挑战。

UNI’s market share slips despite strong volumes

尽管很大,但Uni的市场份额滑倒

At press time, UNI was trading at $9.02, down 2.33% in the last 24 hours. But a bigger concern was its declining decentralized exchange (DEX) market share.

发稿时,Uni的交易价格为9.02美元,在过去24小时内下跌2.33%。但是,更大的担忧是其分散交易所(DEX)市场份额下降。

Raydium overtook Uniswap in January, capturing 27% of DEX volume, while Uniswap’s share dropped from 34.5% in December to 22%.

Raydium在一月份超过了Uniswap,占DEX量的27%,而Uniswap的份额从12月的34.5%下降到22%。

This shift was largely driven by Solana’s rising memecoin trading activity, which attracted significant liquidity.

这种转变在很大程度上是由Solana的Memecoin交易活动不断增加的,这引起了大量流动性。

Moreover, growing dissatisfaction within the Ethereum community over Uniswap’s direction further pressured its position.

此外,以太坊社区对Unistwap的方向的不满进一步迫使其立场。

Exchange netflow signals growing uncertainty

交换NetFlow信号越来越不确定性

Uniswap’s exchange netflow showed a decline of 3.22%, indicating that more UNI left exchanges than entered. Typically, large withdrawals signaled that investors were planning to hold for the long term, which could be bullish.

UNISWAP的Exchange Netflow显示下降了3.22%,表明Uni左交易所的交换比输入的更多。通常,大型提款表明投资者计划长期持有,这可能是看好的。

However, sustained outflows also signaled that traders lacked confidence in short-term price appreciation. Additionally, concerns over UNI’s weakening position in the DEX market might have prompted some investors to pull back.

但是,持续的流出也表明,交易者对短期价格欣赏缺乏信心。此外,对Uni在DEX市场中的弱势地位的担忧可能促使一些投资者退缩。

High NVT ratio raises concerns about network activity

高NVT比率引起了人们对网络活动的担忧

Finally, UNI’s Network Value to Transactions (NVT) Ratio was 199.84, suggesting that the token’s valuation was high relative to its transaction volume. Historically, elevated NVT ratios indicated that a market might be overvalued.

最后,UNI与交易(NVT)比率的网络价值为199.84,这表明令牌的估值相对于其交易量很高。从历史上看,NVT升高的比率表明市场可能被高估。

So, despite the recent whale accumulation, on-chain activity did not fully support UNI’s current price. A high NVT ratio often preceded price corrections, as it indicated that an asset was trading at a premium without sufficient transaction demand.

因此,尽管最近积累了鲸鱼,但链活动并未完全支持Uni当前的价格。高NVT比率通常先于价格更正,因为它表明资产以溢价交易而没有足够的交易需求。

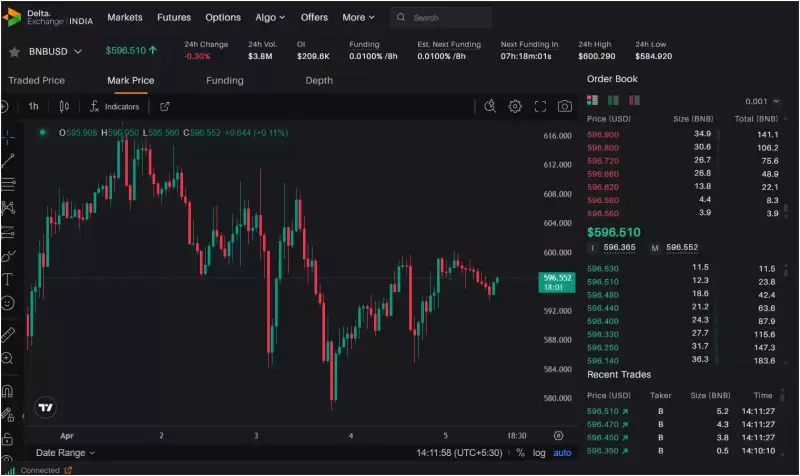

Uniswap was priced within a descending wedge at press time, a pattern that usually preceded a breakout. The key resistance levels to watch were $12.71 and $15, while $8.17 remained strong support.

uniswap在发稿时在下降的楔子中定价,这种模式通常是突破性的。要观看的关键阻力水平为$ 12.71和15美元,而8.17美元的支持仍然有很大的支持。

If UNI breached above the wedge, it could signal a bullish reversal. However, failure to hold above support could lead to further downside pressure.

如果Uni在楔形上方违反,则可能表明看涨逆转。但是,无法保持支持可能会导致进一步的下行压力。

Therefore, the next few trading sessions were critical in determining Uniswap’s near-term price direction.

因此,接下来的几个交易会议对于确定Uniswap的近期价格方向至关重要。

Weakening trader confidence

削弱交易者的信心

Open Interest in Uniswap Futures dropped by 8.85%, reaching $235.12M, suggesting that traders were closing positions due to market uncertainty.

UNISWAP期货的开放兴趣下降了8.85%,达到2.3512亿美元,这表明由于市场不确定性,交易者正在关闭头寸。

Moreover, long liquidations ($237K) surpassed short liquidations ($22.7K) by a large margin, indicating that buyers were being liquidated as prices fell.

此外,漫长的清算(23.7万美元)超过了短暂的清算($ 22.7k),这表明随着价格下跌,买家正在清算。

Thisرافیک indicated a bearish market sentiment, with traders reducing leverage and exiting positions. If open interest continued to fall, UNI might struggle to gain momentum.

这表明贸易商降低了杠杆作用和退出职位。如果开放兴趣继续下降,Uni可能会努力获得动力。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- 狗狗(Doge)降低了3%,而比特币(BTC)和Ether(Eth)保持平坦

- 2025-04-15 15:40:14

- 著名的财务数字已经开始警告美国即将陷入衰退

-

- Shiba INU(SHIB)燃烧率飙升2000%,为20M令牌燃烧

- 2025-04-15 15:35:13

- Shiba INU燃烧率再次引起了惊人的2000%

-

- 特朗普关税公告后,比特币(BTC)飙升至85,800美元

- 2025-04-15 15:35:13

- 比特币(BTC)最近在2025年4月14日达到85,800美元,在稳定为84,600美元之前,成为头条新闻!

-

- 另一个黑客故事震惊了投资者对Defi的信仰

- 2025-04-15 15:30:14

- 在新推出的永久交易平台Kiloex之后,Defi World再次成为人们关注的焦点

-

- 市场情绪在高币损失中谨慎

- 2025-04-15 15:30:14

- 本周,加密货币市场经历了下滑,著名的Altcoins超流动性(HYPE)和UNISWAP(UNI)面临巨大的损失。

-

- 我们探索了许多没有纳税人美元的增加比特币储备的方法

- 2025-04-15 15:30:12

- 美国正在探索多种方法来增加其没有纳税人美元的比特币储备,包括通过关税收入和重估政府的金证书。

-

-