|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

加密货币市场中的鲸鱼活动通常可以作为即将发生的价格变动的晴雨表。价值 1.04 亿美元的 UNI 代币被抛售

Whale activity in the cryptocurrency markets is often closely watched as a barometer for impending price movements. Now, one massive transaction involving $104 million worth of UNI tokens has certainly caught the attention of market participants.

加密货币市场中的鲸鱼活动通常被视为即将发生的价格变动的晴雨表而受到密切关注。现在,一笔涉及价值1.04亿美元UNI代币的巨额交易无疑引起了市场参与者的关注。

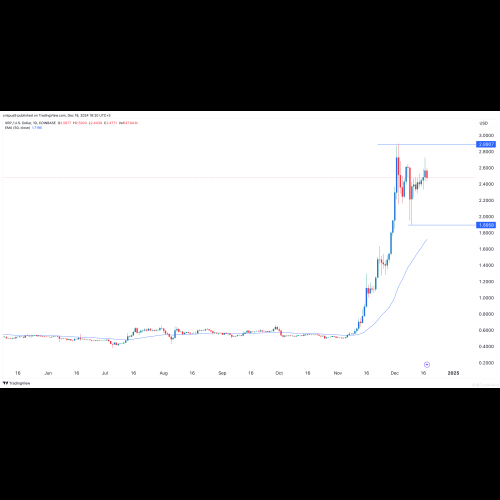

Usually, such large-scale transactions can trigger rapid price declines due to the sudden increase in supply. However, in the case of UNI, the token has managed to retain the $16 level, indicating a strong demand base or support level among retail and smaller institutional investors.

通常,如此大规模的交易会因供应突然增加而引发价格快速下跌。然而,就 UNI 而言,该代币已成功保持在 16 美元的水平,表明散户和小型机构投资者的需求基础或支持水平强劲。

The recent whale sell-off appears to be part of a broader profit-taking strategy, especially given the market uncertainty that has prevailed. Cryptocurrencies, including Bitcoin and Ethereum, have seen increased volatility recently, which could be prompting large UNI holders to liquidate their positions to hedge against potential losses.

最近的鲸鱼抛售似乎是更广泛的获利了结策略的一部分,特别是考虑到市场普遍存在的不确定性。包括比特币和以太坊在内的加密货币最近波动性加大,这可能会促使大型 UNI 持有者清算其头寸,以对冲潜在损失。

UNI's Resilience

UNI 的韧性

Despite the whale-induced selling pressure, UNI's price has shown remarkable resilience. Several factors seem to be contributing to this resilience.

尽管面临鲸鱼引发的抛售压力,UNI 的价格仍表现出显着的弹性。有几个因素似乎促成了这种弹性。

First and foremost, Uniswap maintains a dominant position as a decentralized exchange (DEX) and is also closely tied to the increasing adoption of decentralized finance (DeFi) solutions. Within the DeFi space, Uniswap is a market leader in on-chain liquidity, and this utility bodes well for the demand for the UNI token.

首先,Uniswap 保持着去中心化交易所 (DEX) 的主导地位,并且与去中心化金融 (DeFi) 解决方案的日益普及密切相关。在 DeFi 领域,Uniswap 是链上流动性的市场领导者,这种实用性预示着对 UNI 代币的需求。

On-chain metrics also paint a favorable picture. According to data from blockchain analytics firms, there has been a steady increase in the number of unique active addresses interacting with Uniswap, which indicates sustained user engagement.

链上指标也描绘了一幅有利的图景。根据区块链分析公司的数据,与 Uniswap 交互的唯一活跃地址数量稳步增加,这表明用户参与度持续上升。

Moreover, the platform's total value locked (TVL) has remained relatively stable, further highlighting the protocol's strength amid the market turbulence.

此外,该平台的总锁定价值(TVL)保持相对稳定,进一步凸显了该协议在市场动荡中的实力。

Will UNI Bounce Back?

UNI会反弹吗?

The crucial question that remains to be answered is whether UNI can now stage a recovery and resume its upward trajectory. Market analysts are divided on this point.

仍有待回答的关键问题是 UNI 现在是否可以复苏并恢复其上升轨道。市场分析师在这一点上存在分歧。

On the one hand, the continued adoption of Uniswap's platform and the growth in the DeFi sector are certainly positive indicators. These factors could provide a foundation for a rebound in the UNI token.

一方面,Uniswap 平台的持续采用和 DeFi 领域的增长无疑是积极的指标。这些因素可能为 UNI 代币的反弹提供基础。

On the other hand, macroeconomic factors, such as rising interest rates and regulatory scrutiny, still pose risks to the broader cryptocurrency market. These external conditions could limit the potential for a sustained recovery in UNI.

另一方面,利率上升和监管审查等宏观经济因素仍然对更广泛的加密货币市场构成风险。这些外部条件可能会限制 UNI 持续复苏的潜力。

For UNI to stage a recovery, it must break above key resistance levels. In this regard, $18 is emerging as a crucial psychological and technical barrier.

UNI 要实现复苏,必须突破关键阻力位。在这方面,18 美元正在成为一个重要的心理和技术障碍。

Furthermore, a sustained rally in Bitcoin and Ethereum would likely provide additional tailwinds for UNI, as positive sentiment often spills over into altcoins.

此外,比特币和以太坊的持续上涨可能会给 UNI 带来额外的推动力,因为积极的情绪往往会蔓延到山寨币中。

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- 世界币重启:山姆·奥尔特曼的加密货币驱动的在线身份企业发展速度比以往任何时候都快——但欧洲除外

- 2024-12-19 03:00:02

- 从欧洲向发展中国家的转变凸显了世界币最近的重启。

-

-

-

-

-

-

-

-

- 在美联储做出决定之前,随着加密货币行业的红海蔓延,XRP 价格回落

- 2024-12-19 02:45:02

- Ripple (XRP) 下跌超过 5%,抹去了周二 RLUSD 稳定币推出后的大部分涨幅。