|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

What's the Deal with Crypto Stock Short Sellers?

加密货币股票卖空者的情况如何?

Contrary to the rallying crypto-linked stocks fueled by Bitcoin's surge, short sellers are doubling down on their multi-billion-dollar bets against them, seeing an inevitable end to the rally.

与比特币飙升推动的加密货币相关股票的上涨相反,卖空者正在加倍押注数十亿美元的空头赌注,认为涨势不可避免地会结束。

Total short interest, an indicator of contrarian traders' bets against crypto stocks, has soared to nearly $11 billion this year, according to S3 Partners. MicroStrategy and Coinbase account for over 80% of the sector's short interest.

S3 Partners 的数据显示,作为反向交易者做空加密货币股票押注的指标,空头总额今年已飙升至近 110 亿美元。 MicroStrategy 和 Coinbase 占该行业空头头寸的 80% 以上。

Burning Paper Billions

烧纸数十亿

Despite paper losses mounting to nearly $6 billion as Bitcoin's year-to-date ascent lifts the sector, short sellers remain steadfast. "They're either anticipating a Bitcoin rally pullback or hedging against their actual Bitcoin holdings," explains S3's Ihor Dusaniwsky.

尽管随着比特币年初至今的上涨提振了该行业,账面损失已达到近 60 亿美元,但卖空者仍然坚定不移。 S3 的 Ihor Dusaniwsky 解释说:“他们要么预期比特币反弹回调,要么对冲其实际持有的比特币。”

MicroStrategy in the Hot Seat

MicroStrategy 陷入困境

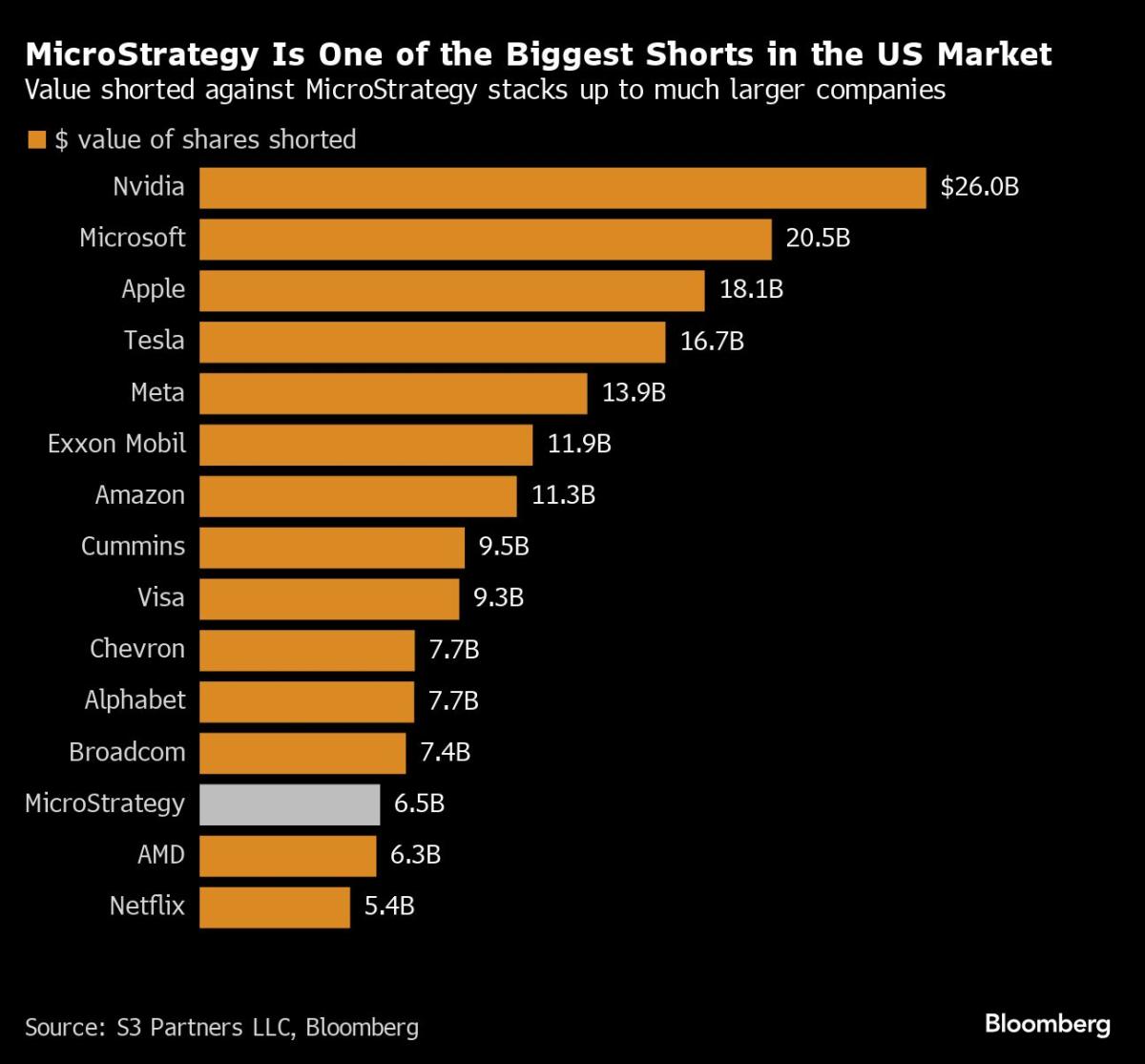

Traders betting against crypto stocks have piled into MicroStrategy, increasing their short positions by $974 million in the past 30 days, despite its soaring share price. This surge pushes MicroStrategy's total short interest above 20% of its float, making it one of the most-shorted stocks in the US, rivaling behemoths like Apple and Microsoft.

尽管股价飙升,但做空加密货币股票的交易员却纷纷涌入 MicroStrategy,在过去 30 天内将其空头头寸增加了 9.74 亿美元。这一激增使 MicroStrategy 的总空头利息超过其流通量的 20%,使其成为美国被做空最多的股票之一,可与苹果和微软等巨头相媲美。

Short Squeeze Risk

轧空风险

However, short sellers could face significant losses if their bets prove incorrect. MicroStrategy, Coinbase, and Cleanspark are all poised for short squeezes, where forced buybacks by losing short sellers drive prices higher, pressuring others to follow suit.

然而,如果卖空者的押注被证明是错误的,他们可能会面临重大损失。 MicroStrategy、Coinbase 和 Cleanspark 都做好了轧空的准备,卖空者的损失导致价格被迫回购,从而推高价格,迫使其他公司效仿。

Are They Digging Their Own Graves?

他们是在自掘坟墓吗?

Given their rally and limited availability of shortable shares, MicroStrategy, Coinbase, and Cleanspark are vulnerable to squeezes. With MicroStrategy already up nearly 200% and Coinbase and Cleanspark up over 60% and 115%, respectively, short sellers might be in for a painful reckoning.

鉴于 MicroStrategy、Coinbase 和 Cleanspark 的反弹和可卖空股票的供应有限,它们很容易受到挤压。随着 MicroStrategy 已经上涨近 200%,Coinbase 和 Cleanspark 分别上涨超过 60% 和 115%,卖空者可能会面临痛苦的清算。

Moral of the Story

故事的道德启示

While short sellers remain skeptical, the crypto stock rally continues unabated. Shorting crypto stocks in an upward market can be a risky proposition, exposing traders to the potential for massive losses if their bets go awry.

尽管卖空者仍然持怀疑态度,但加密货币股票的涨势仍然有增无减。在上涨的市场中做空加密货币股票可能是一个冒险的提议,如果交易者的押注出现问题,交易者可能会面临巨大损失。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- 以太坊白皮书 11 周年,标志着智能合约和 DeFi 周年

- 2024-11-05 00:45:01

- 以太坊基础技术文档的第一次迭代——白皮书,已经 11 岁了。

-

-

- Lunex 网络成为狗狗币和 Tron 的有力竞争者,具有 100 倍升值潜力

- 2024-11-05 00:45:01

- 狗狗币和波场币令人兴奋不已,这两种排名前十的加密货币在过去几个月中价格增长迅猛。

-

-

- OSL集团战略收购CoinBest,进军日本蓬勃发展的数字资产市场

- 2024-11-05 00:40:02

- OSL 收购 CoinBest 81.38% 的股份标志着日本向不断增长的数字资产经济迈出了重要一步。

-

-

-