|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

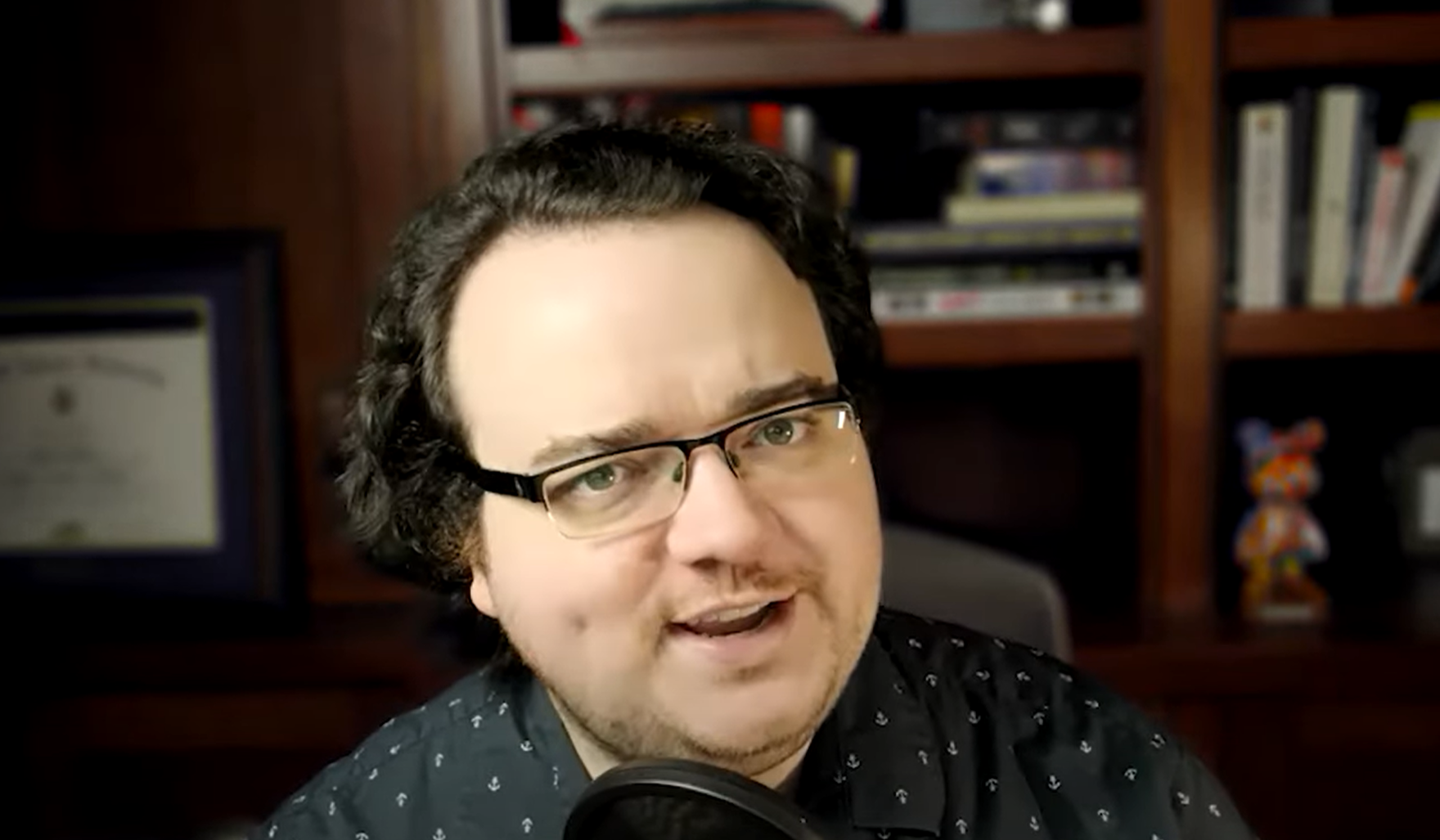

激进风险投资公司 Cinneamhain Ventures (CEHV) 的合伙人 Adam Cochran 在 YouTube 上最新的视频分析中描述了 Ripple 新推出的稳定币

Adam Cochran, partner at Cinneamhain Ventures (CEHV), an activist venture capital firm, described Ripple’s newly launched stablecoin, RLUSD, as a “Trojan Horse” poised to transform both decentralized finance (DeFi) and traditional banking sectors.

激进风险投资公司 Cinneamhain Ventures (CEHV) 的合伙人 Adam Cochran 将 Ripple 新推出的稳定币 RLUSD 描述为“特洛伊木马”,准备改变去中心化金融 (DeFi) 和传统银行业。

In his latest video analysis on YouTube, Cochran highlighted the strategic significance of RLUSD, stating, “It’s something that no one’s really talking about but it could dramatically revolutionize the position of Ripple in the marketplace.” He elaborated that while the crypto community remains largely focused on XRP’s price movements and its upcoming programmability upgrades, RLUSD marks a fundamental shift within the XRP Ledger (XRPL) ecosystem.

在 YouTube 上最新的视频分析中,Cochran 强调了 RLUSD 的战略意义,并表示:“虽然没有人真正谈论它,但它可能会极大地改变 Ripple 在市场中的地位。”他阐述说,虽然加密社区仍然主要关注 XRP 的价格走势及其即将推出的可编程性升级,但 RLUSD 标志着 XRP Ledger (XRPL) 生态系统内的根本性转变。

Crucially, RLUSD differentiates itself from other stablecoins by adhering to stringent regulatory standards. As Cochran noted, “RLUSD isn’t just another USDC clone; this is getting more into the original Paxos stablecoin that’s NYDFS regulated, custodian issued, backed by secure cash assets.”

至关重要的是,RLUSD 通过遵守严格的监管标准来区别于其他稳定币。正如 Cochran 所指出的,“RLUSD 不仅仅是 USDC 的另一个克隆;这将更多地涉及由 NYDFS 监管、由托管人发行、由安全现金资产支持的原始 Paxos 稳定币。”

The stablecoin is exclusively backed by real US cash equivalents, which are held in US banks that are registered with regulators and subject to regular audits. This regulatory compliance ensures that RLUSD meets stringent monetary transfer licenses, including a Virtual Asset Service Provider (VASP) license, which would enable its use by EU exchanges and banks.

该稳定币完全由真实的美国现金等价物支持,这些现金等价物存放在已向监管机构注册并接受定期审计的美国银行中。这种监管合规性确保 RLUSD 满足严格的货币转移许可证,包括虚拟资产服务提供商 (VASP) 许可证,这将使其能够被欧盟交易所和银行使用。

Furthermore, unlike other stablecoins such as Tether (USDT), RLUSD is set to be issued on both the XRP Ledger and the Ethereum blockchain. In Cochran’s words, “Something that stood out to me is that while it’s being issued on the XRPL, Ripple is making sure they themselves capture it and can provide more value into the ecosystem.”

此外,与 Tether (USDT) 等其他稳定币不同,RLUSD 将在 XRP Ledger 和以太坊区块链上发行。用 Cochran 的话说,“令我印象深刻的是,虽然它是在 XRPL 上发行的,但 Ripple 正在确保他们自己捕获它并能为生态系统提供更多价值。”

According to Cochran, RLUSD is integral to unlocking the vast multi-trillion dollar Forex markets on the blockchain without the need for advanced technological upgrades. “This stablecoin is going to open up the ability for real-world asset (RWA) issuers, Forex issuers, currency issuers, and other programs to be able to price on a native AMM their assets in the US dollar,” he remarked.

根据 Cochran 的说法,RLUSD 是在区块链上解锁庞大的数万亿美元外汇市场不可或缺的一部分,而无需进行先进的技术升级。他表示:“这种稳定币将为现实世界资产 (RWA) 发行人、外汇发行人、货币发行人和其他项目提供能力,使其能够在本地 AMM 上以美元对其资产进行定价。”

With the introduction of RLUSD, assets can be priced in US dollars directly on the XRPL’s Automated Market Maker (AMM), which is expected to attract institutional trading and Forex settlement activities. As Cochran elaborated, “This opens up the possibility for a yield to come back into the XRP ecosystem, which Ripple can begin to benefit from and put that back into the ecosystem.”

随着RLUSD的推出,资产可以直接在XRPL的自动做市商(AMM)上以美元定价,这有望吸引机构交易和外汇结算活动。正如 Cochran 所阐述的那样,“这为 XRP 生态系统带来了收益的可能性,Ripple 可以开始从中受益,并将其放回到生态系统中。”

He suggests that the stablecoin could ultimately enhance liquidity on-chain, which is currently limited to opaque exchange balances:

他认为稳定币最终可以增强链上的流动性,目前仅限于不透明的交易余额:

“What we’ve seen is that sophisticated participants don’t want to have an AMM that trades against XRPA as the underlying currency. They want to be able to price their assets in the US dollar and until the launch of RLUSD that was something that wasn’t possible. But now, this stablecoin is going to open up the ability for RWA assets, Forex issuers, currency issuers and other programs […] to allow Ripple to bring a lot of their overall liquidity on-chain.”

“我们看到的是,经验丰富的参与者不希望 AMM 与 XRPA 作为基础货币进行交易。他们希望能够以美元对资产进行定价,但在 RLUSD 推出之前这是不可能的。但现在,这种稳定币将为 RWA 资产、外汇发行商、货币发行商和其他项目开放能力 [...],使 Ripple 能够将大量整体流动性带入链上。”

It is worth noting that Ripple has consistently targeted institutional clients, including banks, financial institutions and Forex traders, in its strategic initiatives. Cochran highlighted the importance of regulatory compliance in this regard, stating, “If Ripple can get their MA compliance approved and be offered in the EU and bring this stablecoin to diverse markets, they have a great opportunity to get these providers to integrate Ripple’s Network by offering them on-chain yield and sharing of that yield.”

值得注意的是,Ripple 的战略举措始终以机构客户为目标,包括银行、金融机构和外汇交易商。 Cochran 强调了监管合规性在这方面的重要性,他表示:“如果 Ripple 能够获得 MA 合规性批准并在欧盟提供服务,并将这种稳定币推向不同的市场,那么他们就有很好的机会让这些提供商通过以下方式整合 Ripple 的网络:为他们提供链上收益并分享该收益。”

Moreover, the company’s focus on programmability through upcoming features like Hooks and an Ethereum Virtual Machine (EVM) sidechain is expected to further enhance RLUSD’s utility. “Ripple still really needs hooks and their EVM sidechain to perform well, get the programmability in place to be able to offer more sophisticated DeFi products,” Cochran noted.

此外,该公司通过即将推出的 Hooks 和以太坊虚拟机 (EVM) 侧链等功能来关注可编程性,预计将进一步增强 RLUSD 的实用性。 Cochran 指出:“Ripple 仍然确实需要 hooks 及其 EVM 侧链才能表现良好,获得适当的可编程性,以便能够提供更复杂的 DeFi 产品。”

In conclusion, Cochran’s analysis underscores the significant opportunity presented by RLUSD within the global stablecoin market, which is currently dominated by Tether (USDT) and USD Coin (USDC), particularly in the EU with its stringent regulatory frameworks. As Cochran estimated, “If Ripple was to issue the same amount of stablecoins as Tether does nowadays, they’d be looking at something like $5 billion a year potentially in yield gains.”

总之,Cochran 的分析强调了 RLUSD 在全球稳定币市场中带来的重大机遇,目前该市场由 Tether (USDT) 和 USD Coin (USDC) 主导,特别是在监管框架严格的欧盟。正如 Cochran 估计的那样,“如果 Ripple 发行与 Tether 目前相同数量的稳定币,他们每年可能会获得 50 亿美元的收益收益。”

Crucially, Cochran also highlighted the competitive edge that RLUSD could provide to Ripple, stating, “These are the type of asset issuers that care about RWA issuance, Forex settlement and interchange […] something that no

至关重要的是,Cochran 还强调了 RLUSD 可以为 Ripple 提供的竞争优势,他表示:“这些资产发行人关心 RWA 发行、外汇结算和交换 [...]

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

- 比特币(BTC)价格预测:多头会重组并将比特币推至历史新高吗?

- 2024-12-19 07:25:02

- 尽管美联储在最新的 FOMC 会议上宣布降息 0.25%,但加密货币市场周三仍走低。

-

-

-