|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

链上指标表明,由于市值与实现价值 (MVRV) 比率较低,为 -14.75%,Polygon (MATIC) 正处于吸筹阶段,表明存在损失和潜在的上涨空间。 MATIC 已跌破 1 美元,但仍高于支撑位和 100 日均线,创造了潜在的反弹机会。

Polygon's MATIC: Accumulation Opportunity Amidst Bullish Indicators

Polygon 的 MATIC:看涨指标中的吸筹机会

Amidst the recent market volatility, the native cryptocurrency of the Polygon blockchain network, MATIC, has exhibited promising on-chain data indicators, suggesting a potential accumulation phase for investors.

在最近的市场波动中,Polygon 区块链网络的原生加密货币 MATIC 表现出了有希望的链上数据指标,表明投资者可能进入积累阶段。

MVRV Ratio Indicates Undervaluation

MVRV 比率表明估值被低估

The Market Value Relative to Realized Value (MVRV) ratio is a key metric that gauges investor sentiment and potential market trends. Currently, Polygon's 30-day MVRV stands at -14.75%, indicating that investors are experiencing losses. Historically, when MATIC's MVRV falls within the range of -5% to -15%, it often precedes rallies, making this zone an opportunity area for accumulation.

市场价值相对于已实现价值 (MVRV) 比率是衡量投资者情绪和潜在市场趋势的关键指标。目前,Polygon 的 30 天 MVRV 为-14.75%,表明投资者正在遭受损失。从历史上看,当 MATIC 的 MVRV 落在 -5% 至 -15% 的范围内时,通常会先于反弹,使该区域成为吸筹的机会区域。

Minimal Selling Pressure

最小的销售压力

Furthermore, the likelihood of investors selling MATIC is currently low due to minimal profits. Based on historical break-even metrics, approximately 53% of investors are experiencing losses, leaving less than 42% in profit. With the current price decline, the majority of investors are unlikely to sell their holdings below the Polygon's value, presenting an opportunity for accumulation and potential upside movement in Polygon's price.

此外,由于利润微薄,投资者目前出售 MATIC 的可能性较低。根据历史盈亏平衡指标,大约 53% 的投资者正在遭受损失,剩下不到 42% 的利润。随着当前价格下跌,大多数投资者不太可能以低于 Polygon 价值的价格出售其持有的股票,这为 Polygon 价格提供了积累和潜在上涨的机会。

Defi Challenges and Recent Upgrades

Defi 挑战和近期升级

While Polygon continues to face some challenges in the decentralized finance (DeFi) space, with the total value locked (TVL) lagging behind other DeFi protocols, the Polygon blockchain is actively implementing upgrades to enhance its capabilities.

虽然 Polygon 在去中心化金融(DeFi)领域继续面临一些挑战,总锁定价值(TVL)落后于其他 DeFi 协议,但 Polygon 区块链正在积极实施升级以增强其功能。

The forthcoming "Napoli upgrade" will integrate enhancements to parallel execution and new operational codes for the Ethereum Virtual Machine (EVM). This upgrade is expected to improve the efficiency and scalability of the Polygon network.

即将到来的“Napoli 升级”将集成并行执行的增强功能和以太坊虚拟机(EVM)的新操作代码。此次升级预计将提高Polygon网络的效率和可扩展性。

Support and Resistance Levels

支撑位和阻力位

Currently, MATIC is trading above the $0.88 support level, which coincides with the 100-day Exponential Moving Average (EMA). This level has acted as a support on numerous occasions, providing significant momentum for the Polygon token to surpass the $1.0 price threshold.

目前,MATIC 的交易价格高于 0.88 美元的支撑位,该支撑位与 100 日指数移动平均线 (EMA) 一致。这一水平在很多情况下都起到了支撑作用,为 Polygon 代币突破 1.0 美元的价格门槛提供了巨大的动力。

If the MATIC price remains above $0.88, there is potential for a rebound to retest the $0.92 resistance. However, a break below $0.88 could lead to further declines towards the $0.81 and $0.80 levels.

如果 MATIC 价格保持在 0.88 美元之上,则有可能反弹以重新测试 0.92 美元的阻力位。然而,跌破 0.88 美元可能会导致进一步跌向 0.81 美元和 0.80 美元的水平。

Strategic Outlook for MATIC

MATIC 的战略展望

Polygon's recent on-chain data indicators, coupled with the upcoming Napoli upgrade, suggest a positive outlook for MATIC. The accumulation phase at current levels presents an opportunity for investors to acquire MATIC at a potentially undervalued price.

Polygon 最近的链上数据指标,加上即将到来的那不勒斯升级,表明 MATIC 的前景乐观。当前水平的积累阶段为投资者提供了以可能被低估的价格收购 MATIC 的机会。

While the price action remains volatile, the bullish indicators and Polygon's ongoing development efforts provide a strong foundation for a potential uptrend. Investors should carefully monitor the price action and consider the support and resistance levels to make informed trading decisions.

尽管价格走势仍然波动,但看涨指标和 Polygon 持续的开发努力为潜在的上涨趋势提供了坚实的基础。投资者应仔细监控价格走势,并考虑支撑位和阻力位,以做出明智的交易决策。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 皮特·赫格斯:从军官到福克斯新闻主持人,再到特朗普挑选的国防部长

- 2024-11-15 04:20:01

- 44 岁的赫格斯拥有多元化的背景,涵盖服兵役、退伍军人宣传和媒体影响力。

-

-

- 比特币的坚定增长:重塑全球经济和生活方式的变革力量

- 2024-11-15 04:20:01

- 比特币价格的剧烈波动继续吸引全球投资者的关注。比特币被称为原始加密货币,保持着最受欢迎的数字资产的地位

-

-

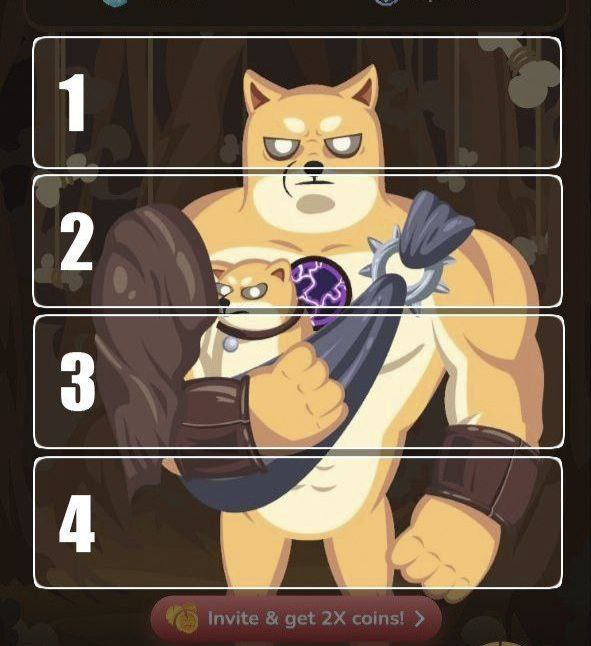

- 标题:利用我们 11 月 14 日最新的 MemeFi 每日组合和视频代码列表,最大限度地提高您在 MemeFi 上的收入潜力

- 2024-11-15 04:15:02

- MemeFi 每日组合 11 月 14 日的 MemeFi 每日组合为 1-3-3-2-4:头部 - 一击 腹部 - 一击 腹部 - 一击 颈部 - 一击 腿部 - 一击 在 MemeFi 币中,如果正确执行,玩家可以获得丰厚奖励每日组合。与敌人战斗时,屏幕分为4个区域,分别代表敌人的头部、颈部、腹部和腿部。执行正确的点击顺序将为玩家带来大量金币。如果您喜欢 Telegram 游戏,我们相信您一定会喜欢 CoinGram,CoinCodex 的官方迷你应用程序!通过在应用程序中赚取金币,您将有资格获得每月赠送的真实奖励。您获得的金币越多,赢得奖品的机会就越大。 立即玩 CoinGramMemeFi 视频代码 在 MemeFi 硬币中赚取巨额奖励的另一种方法是输入在视频中找到的密码。视频代码将尽快更新!以下是2024年11月14日的MemeFi视频代码:Telegram Mobile Play赚取加密游戏代码:42666将您的足球知识转化为利润:Sorare体验|第 5 部分(共 5 部分)| MemeFi 代码:72941 套利和 DCA:最安全的加密货币交易策略解释 |第 4 部分(共 7 部分)| MemeFi 代码:99944 创办数十亿美元公司的秘密公式 | MemeGirls 代码:42437如何开始您的小型企业 代码:42111将新闻转化为利润 代码:53320转到秘密任务 代码:空投假钱包骗局 代码:23790加密戏剧展开!代码:46467如何从零开始自己的生意| MemeGirls 代码:41211我如何做出最贵的。代码:11586不要丢失您的加密货币:锁定您的钱包的 9 个简单步骤 |第 5 部分(共 5 部分)| MemeFi 代码:32397 关于地毯拉动和假 ICO 的真相:加密货币最大骗局 |第 2 部分(共 5 部分)代码:98236不要丢失您的加密货币:锁定您的钱包的 9 个简单步骤 |第 5 部分(共 5 部分) 代码:32397黑客如何窃取 4.5 亿美元 代码:23525如何通过文本赚钱 代码:05432通过 DAPPS 赚钱:如何入门 代码:65673 拉高和转储计划 代码:20234如何在线赚钱 代码:52811充分利用公牛市场代码:35688如何制作每月 10,000 美元 代码:23700牛市危险 代码:63956比特币最伟大的牛市:历史上最大的价格飙升 |第 3 部分(共 6 部分)| MemeFi 代码:57823 在投资加密货币之前,请留意这些致命的骗局 |第 1 部分(共 5 部分)| MemeFi 代码:346692024 年加密货币淘金热?下一个牛市的迹象就在这里! |第 4 部分(共 6 部分)| MemeFi 代码:48675如何赚 10,000 美元| Memegirls 代码:45688 加密货币中的被动收入 代码:95146 为什么您在加密货币中不断亏损 - 立即修复! |第 1 部分(共 7 部分) 代码:115295 开始您的第一个业务的步骤 代码:98213 现金游戏:dApp 如何将您的技能转化为加密货币 |第 3 部分(共 5 部分) 代码:31954 成功企业家的最佳秘密 代码:99335 最佳初学者交易策略解释 – 不要错过! |第 2 部分(共 7 部分) 代码:855542025 年 Telegram 应用程序中最赚钱的点击赚钱游戏 代码:42622如何白手起家 | MemeGirls 代码:41323如何自动化加密货币利润:Yearn Finance 与 Alchemix |第 4 部分(共 5 部分)| MemeFi 代码:14287 数字化拥有财产 代码:75612如何使用 Telegram 每月赚取 5,000 美元 代码:42681Can

-

-

-

-