|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

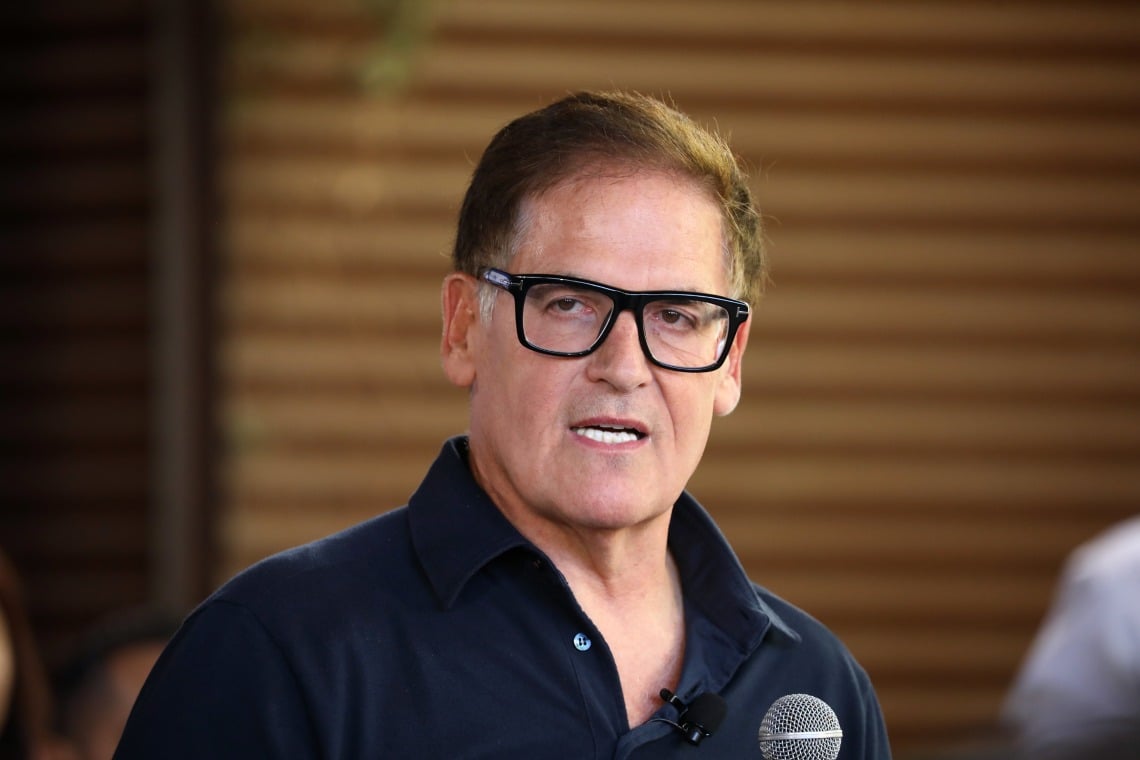

Mark Cuban, the billionaire entrepreneur and owner of the Dallas Mavericks, recently stated in an interview that he would rather own Bitcoin than gold in the event of an economic downturn, as he believes it has “more value.”

Cuban, who is known for his appearances on ABC's Shark Tank and his ownership of 2929 Entertainment, has been following Bitcoin since at least 2017, when he expressed skepticism towards the cryptocurrency. However, his stance gradually shifted over the years, and by 2022, he was advising people to invest in Bitcoin during the bear market, when the price of BTC fell below $16,000.

In the past, Cuban has likened cryptocurrencies to the dot-com bubble of the early 2000s and has fallen victim to two separate hacking incidents involving cryptocurrencies, both of which resulted in thefts.

During the 2024 NBA season, Cuban's interest in Bitcoin became increasingly evident, culminating in the interview where he stated that he would choose Bitcoin over gold as a hedge against economic troubles.

According to Cuban, the value of gold is largely derived from its status in financial markets as a safe haven asset during periods of economic crisis or downturn, despite the fact that jewelry demand and supply has little impact on its price. He believes that many people who own Bitcoin view it in a similar light, as a store of value.

In the event of a severe economic crisis, Cuban suggests that Bitcoin could have an advantage over gold due to being perceived as a superior asset.

While gold tends to maintain its purchasing power over the long term, unlike fiat currencies such as the dollar, its use as a medium of exchange is limited. It is rarely used for this purpose today, and even in the past, other metals like silver were used more frequently because gold coins were too valuable and scarce.

Gold is also relatively easy to steal and impractical for everyday use. Its presence in financial markets is purely financial, and even then, it is mostly used through financial derivatives like ETFs.

On the one hand, this makes gold advantageous as a risk-off asset, but on the other hand, it inevitably limits its potential for return.

In contrast, Bitcoin is designed to be simple and quick to use. It can be used by anyone and cannot be counterfeited, Cuban points out.

In addition to serving as a store of value, Bitcoin's ease of use and divisibility also makes it a currency of exchange that can be transferred both domestically and internationally.

For these technical advantages, Cuban believes that Bitcoin has “more value” than gold.

While it's true that the number of people using Bitcoin as a payment method globally is negligible, its transferability is what matters here, especially to and from exchanges.

Additionally, being a risk-on asset differentiates Bitcoin from gold, potentially ensuring higher returns at least in theory.

Ultimately, however, Bitcoin is not an alternative to gold but a separate asset with overlapping purposes. From a purely technical perspective, though, the advantages are evident.

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

- 加密市场是在追逐噪音,还是最终准备好奖励物质?

- 2025-04-26 12:05:13

- 最近,SUI价格上涨每天的飞跃11%,由Memecoin溢出驱动比核心公用事业更多。

-

-

- 乐观(OP)价格预测2025-2031:OP可以达到$ 10吗?

- 2025-04-26 12:00:26

- 乐观对创新的承诺得到了对3层解决方案的支持。这些解决方案可以开发分散应用程序(DAPP)

-

- 堆栈(STX)价格提高了16%,但潜在的市场情绪表明可以进行更正

- 2025-04-26 11:55:13

- 在过去的24小时内,Stacks(STX)一直是加密货币市场的出色表现,其价格上涨了16%。

-

- 圈子坚定否认有谣言,建议它计划申请美国银行许可证

- 2025-04-26 11:55:13

- “我们敦促国会现在通过两党付款稳定立法来倡导美国的创新,稳定和消费者安全。”

-

-

-

- 使用这些顶级流行的加密货币探索蓬勃发展的仲裁网络

- 2025-04-26 11:45:12

- 想象一个空间,Defi平台摆脱特定于链的限制,区块链消息流而无需摩擦