|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

尽管即将到来的减半事件,全球最大的公开交易的比特币矿业公司马拉松数字控股公司(Marathon Digital Holdings)见证了机构投资者兴趣的激增。截至最新数据,机构投资者持有马拉松38.9%的大量股份,其中先锋集团、贝莱德、Jane Street、摩根士丹利和道富银行成为前五名股东,合计持有该公司超过22%的股份。

Marathon Digital Dominates Bitcoin Mining, Boasting Institutional Investor Confidence

Marathon Digital 主导比特币挖矿,赢得机构投资者信心

Marathon Digital Holdings (MARA), the world's largest publicly traded Bitcoin (BTC) mining company, has witnessed a steady influx of institutional investment despite the impending Bitcoin halving event in April.

尽管四月份即将发生比特币减半事件,全球最大的公开交易的比特币 (BTC) 矿业公司 Marathon Digital Holdings (MARA) 仍见证了机构投资的稳定涌入。

Institutional investors now hold a significant 38.9% stake in Marathon's outstanding shares, totaling 104,212,740 out of 268 million. These figures unveil the five largest institutional shareholders in the BTC mining industry:

机构投资者目前持有马拉松已发行股票 38.9% 的股份,总计 2.68 亿股中的 104,212,740 股。这些数字揭示了比特币挖矿行业的五家最大机构股东:

- Vanguard: 23.47 million shares (8.76%)

- BlackRock: 17.19 million shares (6.42%)

- Jane Street: 8.47 million shares (3.16%)

- Morgan Stanley: 6.27 million shares (2.34%)

- State Street: 5.42 million shares (2.02%)

Collectively, these five institutional investors hold 60,837,405 shares, representing 22.7% of Marathon Digital Holdings.

先锋集团:2,347万股(8.76%)贝莱德:1,719万股(6.42%)Jane Street:847万股(3.16%)摩根士丹利:627万股(2.34%)道富银行:542万股(2.02%)这五家机构投资者持有马拉松数字控股60,837,405股,占马拉松数字控股的22.7%。

As the leading player in BTC mining, Marathon boasts a market capitalization of $5.58 billion, according to CompaniesMarketCap.

根据 CompaniesMarketCap 的数据,作为 BTC 挖矿领域的领先企业,Marathon 的市值为 55.8 亿美元。

Halving Impact on BTC Miners and Institutional Investors

对比特币矿工和机构投资者的影响减半

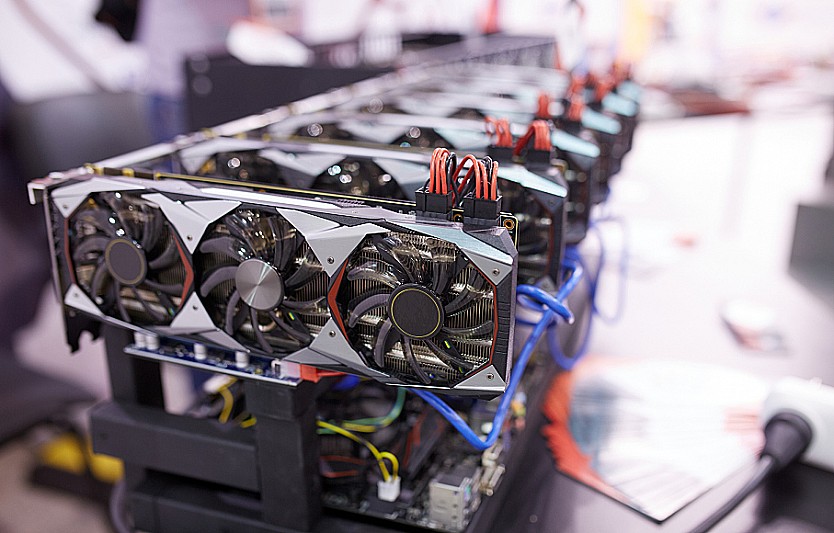

Understanding the impact of the Bitcoin halving on mining companies and institutional investors is crucial. These businesses generate revenue primarily through BTC mining and block rewards, including fees and subsidies. Miners compete to secure the next valid block using proof-of-work, measured by hashing power.

了解比特币减半对矿业公司和机构投资者的影响至关重要。这些业务主要通过比特币挖矿和区块奖励(包括费用和补贴)产生收入。矿工们利用工作量证明(通过哈希能力来衡量)竞争以确保下一个有效区块的安全。

Every four years, or after 210,000 blocks, Bitcoin's block reward is halved. Currently, over 98% of block rewards are subsidies, amounting to approximately 900 BTC daily.

每四年,或者在 210,000 个区块之后,比特币的区块奖励就会减半。目前,超过 98% 的区块奖励都是补贴,每天约为 900 BTC。

The halving could potentially halve the revenue of BTC mining companies if the price of BTC remains constant. Consequently, stocks like MARA may exhibit a correlation with the price of Bitcoin, potentially impacting earnings after the halving event.

如果比特币价格保持不变,减半可能会使比特币矿业公司的收入减半。因此,像 MARA 这样的股票可能会表现出与比特币价格的相关性,从而可能影响减半事件后的收益。

Institutional investors' increased interest in Marathon despite the halving suggests their belief in the long-term prospects of BTC mining and the company's ability to navigate this market dynamic. Marathon's strong financial position and commitment to innovation position it well to capitalize on the opportunities presented by the halving and continue to attract institutional investment.

尽管减半,机构投资者对 Marathon 的兴趣仍在增加,这表明他们对 BTC 挖矿的长期前景以及该公司驾驭这一市场动态的能力充满信心。马拉松强大的财务状况和对创新的承诺使其能够充分利用减半带来的机会并继续吸引机构投资。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

-

-

- 2024 年 11 月 1 日 GALACoin 每日组合

- 2024-11-02 00:30:02

- 通过提供正确的每日组合,您可以在 GALACoin 游戏中额外赚取 200 万积分。

-

-

- 掘金队 vs 森林狼队的预测、赔率、最佳投注和专家选择

- 2024-11-02 00:30:02

- 丹佛掘金队将在去年 NBA 西部决赛季后赛系列赛的重赛中迎战明尼苏达森林狼队

-

- 随着长期持有者(LTH)积极增持,比特币(BTC)闪现出可能反弹的迹象

- 2024-11-02 00:30:02

- 比特币(BTC)显示出可能上涨的迹象,因为其价格受益于关键指标的积极趋势,引发了投资者的乐观情绪。

-

-