|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

Marathon Digital Dominates Bitcoin Mining, Secures Institutional Investor Confidence

Mar 25, 2024 at 09:00 pm

Marathon Digital Holdings, the world's largest publicly traded Bitcoin mining company, has witnessed a surge in institutional investor interest despite the upcoming halving event. As of the latest data, institutional investors hold a substantial 38.9% stake in Marathon, with Vanguard, BlackRock, Jane Street, Morgan Stanley, and State Street emerging as the top five shareholders, collectively owning over 22% of the company's shares.

Marathon Digital Dominates Bitcoin Mining, Boasting Institutional Investor Confidence

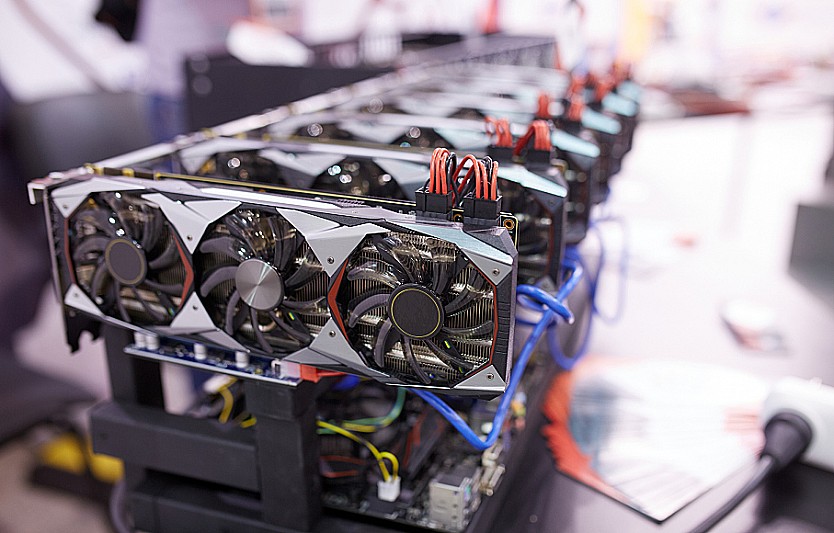

Marathon Digital Holdings (MARA), the world's largest publicly traded Bitcoin (BTC) mining company, has witnessed a steady influx of institutional investment despite the impending Bitcoin halving event in April.

Institutional investors now hold a significant 38.9% stake in Marathon's outstanding shares, totaling 104,212,740 out of 268 million. These figures unveil the five largest institutional shareholders in the BTC mining industry:

- Vanguard: 23.47 million shares (8.76%)

- BlackRock: 17.19 million shares (6.42%)

- Jane Street: 8.47 million shares (3.16%)

- Morgan Stanley: 6.27 million shares (2.34%)

- State Street: 5.42 million shares (2.02%)

Collectively, these five institutional investors hold 60,837,405 shares, representing 22.7% of Marathon Digital Holdings.

As the leading player in BTC mining, Marathon boasts a market capitalization of $5.58 billion, according to CompaniesMarketCap.

Halving Impact on BTC Miners and Institutional Investors

Understanding the impact of the Bitcoin halving on mining companies and institutional investors is crucial. These businesses generate revenue primarily through BTC mining and block rewards, including fees and subsidies. Miners compete to secure the next valid block using proof-of-work, measured by hashing power.

Every four years, or after 210,000 blocks, Bitcoin's block reward is halved. Currently, over 98% of block rewards are subsidies, amounting to approximately 900 BTC daily.

The halving could potentially halve the revenue of BTC mining companies if the price of BTC remains constant. Consequently, stocks like MARA may exhibit a correlation with the price of Bitcoin, potentially impacting earnings after the halving event.

Institutional investors' increased interest in Marathon despite the halving suggests their belief in the long-term prospects of BTC mining and the company's ability to navigate this market dynamic. Marathon's strong financial position and commitment to innovation position it well to capitalize on the opportunities presented by the halving and continue to attract institutional investment.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- PropiChain (PCHAIN): A Rising Project Focused on Real World Assets (RWAs), Specifically Real Estate

- Nov 02, 2024 at 12:30 am

- PropiChain (PCHAIN) is a rising project focused on Real World Assets (RWAs), specifically real estate. It aims to transform the real estate industry by solving these issues and attracting more investors to participate in property investments.

-

- Bitcoin's Price Drop May Be Linked to Former President Donald Trump's Decreased Chances of Winning the Upcoming Presidential Election

- Nov 02, 2024 at 12:30 am

- Bitcoin was priced around $70,400 early Friday, according to CoinDesk, down from $72,723.76 on Tuesday when it looked to be heading towards surpassing its record high of $73,084.

-

- ZenCoin: A “Tap-to-Earn†Telegram Game Inspired by Zen Buddhism

- Nov 02, 2024 at 12:30 am

- ZenCoin is a "tap-to-earn" Telegram game that's very similar to other popular Telegram games in terms of gameplay. As the name implies, the visuals and sounds of the game are inspired by Zen Buddhism and the calming effects of meditation and other Zen practices.

-

-

-

-

-

-