|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

四月到来,狗狗币(DOGE)在 INDODAX 的看涨趋势中保持主导地位,莱特币(LTC)和比特币现金(BCH)紧随其后。 INDODAX 市场信号的这一更新揭示了目前正在经历看涨势头的五种加密资产,以及五种面临看跌趋势的加密资产,为市场当前动态提供了见解,以做出明智的交易决策。

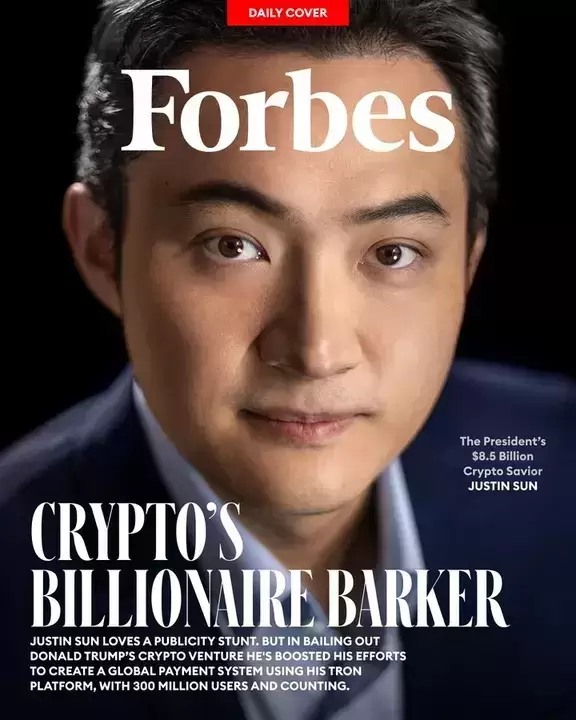

INDODAX Market Signal: Dogecoin Dominates Bullish Crypto Assets in April

INDODAX 市场信号:狗狗币在 4 月份主导看涨加密资产

Jakarta, April 1, 2023 – As the month of April commences, INDODAX unveils its comprehensive Market Signal update, providing insights into the prevailing market trends and identifying crypto assets exhibiting bullish and bearish momentum.

雅加达,2023 年 4 月 1 日 – 随着 4 月份的开始,INDODAX 推出了全面的市场信号更新,提供对当前市场趋势的见解并识别表现出看涨和看跌势头的加密资产。

Bullish Crypto Assets

看涨加密资产

- Dogecoin (DOGE): Dogecoin has surged dramatically, breaking past the 1,300-1,650 resistance barrier with a remarkable 50% gain. Analysts predict further bullish dominance if prices can stabilize within the 3,600-4,000 range, potentially reaching its highest value since December 2021.

- Origin Protocol (OGN): Origin Protocol has maintained its bullish stance since October 31, 2023, operating above the WMA/85. Market indicators suggest a potential breakout from the 4,500-5,500 resistance zone, aiming for a dominant 6,000-7,500 range.

- Litecoin (LTC): Litecoin is poised to strengthen its uptrend, aiming to surpass the 1,700,000-1,800,000 level. Positive confirmation of this breakout would pave the way for a potential rally towards the 2,400,000-2,700,000 range. The MACD indicator reinforces Litecoin's positive momentum.

- SushiSwap (SUSHI): SushiSwap is undergoing a period of consolidation, requiring additional time to determine its price direction. The support level at 20,000-22,000 is crucial, as a potential breakout could dampen its bullish momentum.

- Bitcoin Cash (BCH): Bitcoin Cash has regained strength after a corrective pullback, successfully breaking the 7,300,000-8,000,000 resistance level. The upcoming test for BCH lies within the 10,000,000-12,000,000 range, presenting a significant market opportunity.

Bearish Crypto Assets

狗狗币 (DOGE):狗狗币大幅飙升,突破 1,300-1,650 阻力位,涨幅高达 50%。分析师预测,如果价格能够稳定在 3,600-4,000 区间内,则看涨占据主导地位,有可能达到 2021 年 12 月以来的最高值。 Origin Protocol (OGN):Origin Protocol 自 2023 年 10 月 31 日以来一直保持看涨立场,运行于 WMA/85 上方。市场指标显示,其可能突破 4,500-5,500 阻力区,目标是 6,000-7,500 的主导区间。 莱特币 (LTC):莱特币准备加强其上升趋势,目标是突破 1,700,000-1,800,000 水平。对该突破的积极确认将为潜在反弹至 2,400,000-2,700,000 区间铺平道路。 MACD 指标强化了莱特币的积极势头。 SushiSwap (SUSHI):SushiSwap 正在经历一段整合期,需要更多时间来确定其价格方向。 20,000-22,000点的支撑位至关重要,因为潜在的突破可能会削弱其看涨势头。 比特币现金(BCH):比特币现金在回调后重新走强,成功突破7,300,000-8,000,000阻力位。 BCH即将测试的区间为10,000,000-12,000,000,这带来了巨大的市场机会。 看跌加密资产

- Giant Mammoth (GMMT): While Giant Mammoth's 4-hour trend remains bullish, its inability to correct its downward trajectory has created concerns. Candles below the WMA/75 exert negative pressure on GMMT, and a breach of the 4,500-5,000 support level could lead to a significant price decline.

- Efforce (WOZX): Efforce has attempted to repair its downtrend after touching its lowest price point on INDODAX. However, a breakout of the 170-240 resistance level is essential for a potential recovery.

- ABBC Coin (ABBC): Despite the MACD indicator's indecisiveness, ABBC Coin has experienced a weakening trend, with the 400 level serving as a critical support level.

- Tellor (TRB): Tellor is facing a potential downtrend, which can be reversed if a full candle is formed above the EMA/200. Confirmation of an uptrend requires a breakout of the 1,750,000-2,000,000 resistance level.

- Chainbing (CBG): Chainbing has exhibited stagnant price movement within the 2,400-3,400 range. A positive breakout could lead to a potential rally towards 5,000-6,000, potentially crossing the EMA/200 line.

Technical Analysis Notes

巨型猛犸象 (GMMT):虽然巨型猛犸象的 4 小时趋势仍然看涨,但其无法纠正其下行轨迹引发了担忧。低于 WMA/75 的蜡烛对 GMMT 产生负面压力,突破 4,500-5,000 支撑位可能导致价格大幅下跌。 Efforce (WOZX):Efforce 在触及 INDODAX 最低价格点后试图修复其下跌趋势。然而,突破170-240阻力位对于潜在的复苏至关重要。 ABBC Coin(ABBC):尽管MACD指标犹豫不决,但ABBC Coin已经经历了走弱趋势,其中400水平作为关键支撑位。 (TRB):Teller 面临潜在的下降趋势,如果在 EMA/200 上方形成完整的蜡烛,则趋势可能会逆转。上升趋势的确认需要突破 1,750,000-2,000,000 的阻力位。Chainbing (CBG):Chainbing 在 2,400-3,400 区间内表现出停滞的价格走势。积极突破可能导致反弹至 5,000-6,000 点,并有可能突破 EMA/200 线。 技术分析笔记

- When EMA 5 crosses WMA 75, 85, and EMA 200 lines, and these lines intersect from bottom to top, the market trend tends to be upward (bullish).

- The tables presented indicate that when EMA 5 is higher than WMA 75, 85, and EMA 200, the market tends to rise (bullish).

- When the RSI and MACD values show the same condition, the market is showing the same trend; an overbought condition indicates that the market is at the point of changing trend direction.

Disclaimer

当 EMA 5 穿过 WMA 75、85 和 EMA 200 线,并且这些线从下到上相交时,市场趋势趋于向上(看涨)。所提供的表格表明,当 EMA 5 高于 WMA 75、85 时,当RSI和MACD值显示相同的情况时,市场呈现相同的趋势;超买状况表明市场正处于改变趋势方向的时刻。免责声明

All content, including text, analysis, predictions, and images in the form of graphics or charts, as well as news published on this website, is solely intended for informational purposes and should not be construed as a recommendation or suggestion to engage in any crypto asset transactions. Trading decisions are exclusively made by the user, and any resulting profits or losses are not the responsibility of INDODAX.

所有内容,包括文本、分析、预测和图形或图表形式的图像,以及本网站上发布的新闻,仅供参考,不应被视为从事任何加密货币的推荐或建议。资产交易。交易决定完全由用户做出,由此产生的任何利润或损失均不由 INDODAX 承担。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 比特币对四月的前景似乎不确定,因为投资者仍然谨慎

- 2025-04-05 16:40:12

- 最近的比特币价值下降使许多人想知道加密货币是否可以很快恢复。

-

- 比特币(BTC)市场显示了即将到来的价格篮板的迹象

- 2025-04-05 16:40:12

- 比特币市场目前的交易价格低于其历史最高水平。 2月的下降了17.5%

-

-

- PI硬币价格继续下降,价值损失超过4%,滑倒低于$ 0.70

- 2025-04-05 16:35:12

- PI网络面临着社区的反对,对其沟通和生态系统活动的批评。尽管宣布了Pifest

-

-

- NFT市场挣扎:随着主要平台关闭的销售量

- 2025-04-05 16:30:12

- 根据Binance Research的数据,NFT市场在2025年3月面临重大衰退。前10个区块链的销量下降了12.4%

-

-

- 比特币创作者萨托岛中村今天将满50岁

- 2025-04-05 16:25:12

- 2025年4月5日,标志着萨托西·纳卡本(Satoshi Nakamoto)的50岁生日 - 比特币背后的神秘人物。

-