|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

贝莱德(BlackRock)首席执行官拉里·芬克(Larry Fink)仍然是数字资产的忠实拥护者,但他说,他对比特币(BTC)可能面临的风险不大。

BlackRock (NYSE:) CEO Larry Fink said he's still a big fan of digital assets but isn't blind to the possible risks to the U.S. from Bitcoin's (BTC) rise to prominence.

贝莱德(NYSE :)首席执行官拉里·芬克(Larry Fink)表示,他仍然是数字资产的忠实拥护者,但并不是对比特币(BTC)可能带来的风险的忠实拥护者。

“The U.S. has benefited from the dollar serving as the world’s reserve currency for decades,” said Fink in his annual letter to shareholders. “But that’s not guaranteed to last forever. If the U.S. doesn't get its debt under control, if deficits keep ballooning, America risks losing that position to digital assets like Bitcoin.”

芬克在他致股东的年度信中说:“美国从一美元中受益于全球储备货币。” “但这不能保证永远持续下去。如果美国不能控制债务,如果赤字保持膨胀,美国有可能将该立场失去该地位,将其失去像比特币这样的数字资产。”

“Now, I'm obviously not anti-digital assets,” Fink continued. “But two things can be true at the same time: Decentralized finance is an extraordinary innovation. It makes markets faster, cheaper, and more transparent. Yet that same innovation could undermine America's economic advantage if investors begin seeing Bitcoin as a safer bet than the dollar.”

“现在,我显然不是反数字资产,”芬克继续说道。 “但是两件事可能同时是正确的:分散的财务是一项非凡的创新。它使市场更快,更便宜,更透明。但是,如果投资者开始将比特币视为比美元更安全的赌注,那么同样的创新可能会破坏美国的经济优势。”

Fink’s letter comes at a time of high market uncertainty and anxiety among investors about the economic state of the country amid policy changes set in place by U.S. President Donald Trump. To balance out the national deficit, Fink said, investors should diversify their portfolios to add private market assets in addition to stocks and bonds.

芬克的信是在美国总统唐纳德·特朗普(Donald Trump)做出的政策变化的情况下,投资者对国家经济状况的高度不确定性和焦虑之际出现。芬克说,为了平衡国家赤字,投资者应多样化其投资组合以增加私人市场资产,除股票和债券外。

Doubling down on his commitment and belief in digital assets, Fink said he believes that tokenized funds will be as well-known among investors as exchange-traded funds (ETFs), provided that the industry can create a better infrastructure for digital identities, which Fink believes to be a hurdle in getting institutional investors from fully embracing decentralized finance.

Fink说,他认为,在投资者中,他认为将标记的资金与交易所交易资金(ETF)一样众所周知,只要该行业可以为数字身份创造更好的基础架构,Fink认为这是使机构投资者从完全拥抱遗产的财务上。

“Every stock, every bond, every fund— every asset—can be tokenized. If they are, it will revolutionize investing,” he wrote. “If we're serious about building an efficient and accessible financial system, championing tokenization alone won't suffice. We must solve digital verification, too.”

他写道:“每个股票,每笔债券,每个基金 - 每项资产都可以归功。 “如果我们认真地建立一个高效且可访问的金融体系,那么仅支持令牌化就不够。我们也必须解决数字验证。”

BlackRock, in January 2024, became one of the issuers to launch a spot bitcoin ETF. Their product, the iShares Bitcoin Trust (IBIT), became the most successful ETF in the history of the asset class. As of today, the fund handles nearly $50 billion in assets, with half of that coming from retail investors. The asset manager has also issued a tokenized money market fund, BUIDL, which is on track to cross $2 billion in assets by April, making it the largest tokenized fund currently on the market.

贝莱德(Blackrock)于2024年1月成为发行比特币ETF的发行人之一。他们的产品iShares比特币信托(IBIT)成为资产类历史上最成功的ETF。截至今天,该基金将处理近500亿美元的资产,其中一半来自零售投资者。资产经理还发布了一个令牌化的货币市场基金Buidl,该基金有望在4月之前越过20亿美元的资产,使其成为目前市场上最大的标记基金。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 比特币弹跳,当市场等待特朗普的关税时,Altcoins会做得更好

- 2025-04-02 13:40:12

- 风险资产(包括crypto)在星期二显示生命的迹象,甚至可能试图进行集会(最后)。可能是乐观的。

-

- Qubetics(TICS):加密市场的游戏规则改变者

- 2025-04-02 13:40:12

- 加密货币正在迅速上升,引起了新的和经验丰富的市场参与者的注意。有很多选择,很难选择最佳的100倍加密货币。

-

- PI硬币价格预测今天(4月2日)

- 2025-04-02 13:35:12

- 在预计Pi Coin价格可能会面临销售压力附近的主要支持之后,这正是我们今天所看到的。

-

-

-

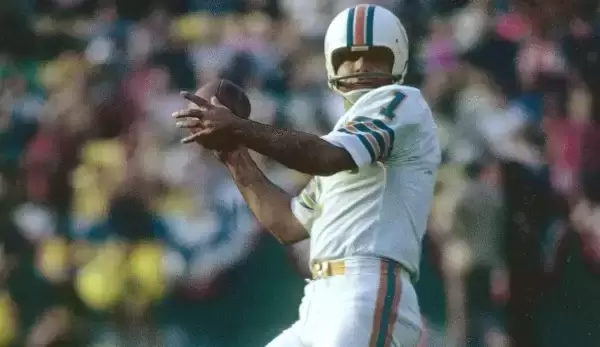

- 从NFL宪法第1和2部分延续。

- 2025-04-02 13:30:12

- 这种海豚的“豆荚”使它的猎物远处了。通过总共进攻联盟

-

-

-

- 伊莎贝尔·福克森·杜克(Isabel Foxen Duke)的原始采访

- 2025-04-02 13:20:12

- 由Odaily Planet Daily Golem编译