|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

貝萊德(BlackRock)首席執行官拉里·芬克(Larry Fink)仍然是數字資產的忠實擁護者,但他說,他對比特幣(BTC)可能面臨的風險不大。

BlackRock (NYSE:) CEO Larry Fink said he's still a big fan of digital assets but isn't blind to the possible risks to the U.S. from Bitcoin's (BTC) rise to prominence.

貝萊德(NYSE :)首席執行官拉里·芬克(Larry Fink)表示,他仍然是數字資產的忠實擁護者,但並不是對比特幣(BTC)可能帶來的風險的忠實擁護者。

“The U.S. has benefited from the dollar serving as the world’s reserve currency for decades,” said Fink in his annual letter to shareholders. “But that’s not guaranteed to last forever. If the U.S. doesn't get its debt under control, if deficits keep ballooning, America risks losing that position to digital assets like Bitcoin.”

芬克在他致股東的年度信中說:“美國從一美元中受益於全球儲備貨幣。” “但這不能保證永遠持續下去。如果美國不能控制債務,如果赤字保持膨脹,美國有可能將該立場失去該地位,將其失去像比特幣這樣的數字資產。”

“Now, I'm obviously not anti-digital assets,” Fink continued. “But two things can be true at the same time: Decentralized finance is an extraordinary innovation. It makes markets faster, cheaper, and more transparent. Yet that same innovation could undermine America's economic advantage if investors begin seeing Bitcoin as a safer bet than the dollar.”

“現在,我顯然不是反數字資產,”芬克繼續說道。 “但是兩件事可能同時是正確的:分散的財務是一項非凡的創新。它使市場更快,更便宜,更透明。但是,如果投資者開始將比特幣視為比美元更安全的賭注,那麼同樣的創新可能會破壞美國的經濟優勢。”

Fink’s letter comes at a time of high market uncertainty and anxiety among investors about the economic state of the country amid policy changes set in place by U.S. President Donald Trump. To balance out the national deficit, Fink said, investors should diversify their portfolios to add private market assets in addition to stocks and bonds.

芬克的信是在美國總統唐納德·特朗普(Donald Trump)做出的政策變化的情況下,投資者對國家經濟狀況的高度不確定性和焦慮之際出現。芬克說,為了平衡國家赤字,投資者應多樣化其投資組合以增加私人市場資產,除股票和債券外。

Doubling down on his commitment and belief in digital assets, Fink said he believes that tokenized funds will be as well-known among investors as exchange-traded funds (ETFs), provided that the industry can create a better infrastructure for digital identities, which Fink believes to be a hurdle in getting institutional investors from fully embracing decentralized finance.

Fink說,他認為,在投資者中,他認為將標記的資金與交易所交易資金(ETF)一樣眾所周知,只要該行業可以為數字身份創造更好的基礎架構,Fink認為這是使機構投資者從完全擁抱遺產的財務上。

“Every stock, every bond, every fund— every asset—can be tokenized. If they are, it will revolutionize investing,” he wrote. “If we're serious about building an efficient and accessible financial system, championing tokenization alone won't suffice. We must solve digital verification, too.”

他寫道:“每個股票,每筆債券,每個基金 - 每項資產都可以歸功。 “如果我們認真地建立一個高效且可訪問的金融體系,那麼僅支持令牌化就不夠。我們也必須解決數字驗證。 ”

BlackRock, in January 2024, became one of the issuers to launch a spot bitcoin ETF. Their product, the iShares Bitcoin Trust (IBIT), became the most successful ETF in the history of the asset class. As of today, the fund handles nearly $50 billion in assets, with half of that coming from retail investors. The asset manager has also issued a tokenized money market fund, BUIDL, which is on track to cross $2 billion in assets by April, making it the largest tokenized fund currently on the market.

貝萊德(Blackrock)於2024年1月成為發行比特幣ETF的發行人之一。他們的產品iShares比特幣信託(IBIT)成為資產類歷史上最成功的ETF。截至今天,該基金將處理近500億美元的資產,其中一半來自零售投資者。資產經理還發布了一個令牌化的貨幣市場基金Buidl,該基金有望在4月之前越過20億美元的資產,使其成為目前市場上最大的標記基金。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- PokémonTradingCard Game的Rocket-on Gormat中的10張最佳嬰兒神奇寶貝卡

- 2025-04-02 13:45:12

- 自從他們在Neo Genesis首次亮相以來

-

-

- 比特幣彈跳,當市場等待特朗普的關稅時,Altcoins會做得更好

- 2025-04-02 13:40:12

- 風險資產(包括crypto)在星期二顯示生命的跡象,甚至可能試圖進行集會(最後)。可能是樂觀的。

-

- Qubetics(TICS):加密市場的遊戲規則改變者

- 2025-04-02 13:40:12

- 加密貨幣正在迅速上升,引起了新的和經驗豐富的市場參與者的注意。有很多選擇,很難選擇最佳的100倍加密貨幣。

-

- PI硬幣價格預測今天(4月2日)

- 2025-04-02 13:35:12

- 在預計Pi Coin價格可能會面臨銷售壓力附近的主要支持之後,這正是我們今天所看到的。

-

-

-

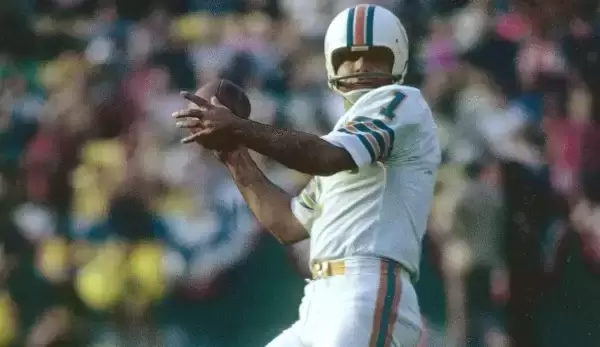

- 從NFL憲法第1和2部分延續。

- 2025-04-02 13:30:12

- 這種海豚的“豆莢”使它的獵物遠處了。通過總共進攻聯盟

-