|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特币减半定于 2024 年 4 月进行,由于生产成本增加以及随后出售 BTC,比特币减半可能会给 BTC 矿商带来高达 50 亿美元的损失。该事件历来导致比特币价格下跌,预计将导致市场供应短缺。由于奖励减半,矿工面临收入下降,每日潜在损失达 450 BTC。这种影响可能会延伸到山寨币的表现,导致公司投资额外的设备并收购竞争对手,以应对利润减少。

Bitcoin Halving Event: Miners Face Losses of $5 Billion

比特币减半事件:矿工面临50亿美元损失

The impending Bitcoin (BTC) halving event, scheduled for April 20, 2024, has raised significant concerns for the cryptocurrency's miners. This landmark event, which occurs every four years, typically reduces the mining rewards by half, resulting in a potential shortage of BTC supply in the market. However, this adjustment also poses a financial challenge for miners, who face escalating costs in equipment and energy consumption.

即将于 2024 年 4 月 20 日举行的比特币 (BTC) 减半事件引起了加密货币矿工的严重担忧。这一具有里程碑意义的事件每四年发生一次,通常会将挖矿奖励减少一半,导致市场上的 BTC 供应可能出现短缺。然而,这一调整也给矿商带来了财务挑战,他们面临着设备和能源消耗成本不断上升的问题。

Loss Projections and Market Implications

损失预测和市场影响

According to research conducted by Markus Thielen, head of research at 10x Research, the halving event could result in an industry-wide loss of approximately $5 billion for miners. This loss stems from the projected decline in daily mining rewards from 900 to 450 BTC. The reduction in revenue could have a significant impact on the profitability of mining operations.

根据 10x Research 研究主管 Markus Thielen 进行的研究,减半事件可能会给矿工带来约 50 亿美元的全行业损失。这一损失源于每日挖矿奖励预计从 900 BTC 下降至 450 BTC。收入的减少可能会对采矿业务的盈利能力产生重大影响。

Thielen predicts that this decline in revenue could lead to a prolonged period of downward pressure on BTC prices, potentially lasting for four to six months. This scenario is supported by historical evidence; following the 2020 halving, BTC prices remained within a tight range between $9,000 and $11,500 for five months.

蒂伦预测,收入的下降可能会导致比特币价格长期承受下行压力,可能持续四到六个月。这种情况有历史证据支持; 2020 年减半后,比特币价格连续五个月保持在 9,000 美元至 11,500 美元之间的窄幅区间内。

Industry Response and Mitigation Strategies

行业应对和缓解策略

In anticipation of the revenue losses, some mining companies are taking proactive measures to mitigate the impact. CleanSpark Inc. and Marathon Digital Holdings Inc. have announced plans to invest in new mining equipment and acquire smaller competitors. These acquisitions aim to compensate for the expected decline in revenue by increasing production capacity.

考虑到收入损失,一些矿业公司正在采取积极措施来减轻影响。 CleanSpark Inc. 和 Marathon Digital Holdings Inc. 宣布计划投资新采矿设备并收购规模较小的竞争对手。这些收购旨在通过增加产能来弥补预期的收入下降。

Marathon, the world's largest Bitcoin miner, currently generates 28-30 BTC per day. After the halving, this production is expected to fall to 14-15 BTC per day. Marathon's CEO, Peter Thiel, has estimated that the company's break-even point will be over $46,000 per BTC to remain profitable after the halving.

Marathon 是全球最大的比特币矿商,目前每天产出 28-30 BTC。减半后,产量预计将降至每天 14-15 BTC。 Marathon 首席执行官 Peter Thiel 估计,公司的盈亏平衡点将超过每 BTC 46,000 美元,以在减半后保持盈利。

BTC Halving Details

BTC减半详情

The halving event is a programmed decrease in the mining rewards for each block mined in the Bitcoin blockchain. It occurs every 210,000 blocks and reduces the reward by half. In 2024, the reward will be cut from 6.25 to 3.125 BTC. This process continues until the last BTC is mined, which is estimated to occur around the year 2140.

减半事件是比特币区块链中开采的每个区块的采矿奖励的有计划的减少。每 210,000 个区块就会发生一次,并将奖励减少一半。 2024 年,奖励将从 6.25 BTC 削减至 3.125 BTC。这个过程一直持续到最后一个 BTC 被开采出来,预计发生在 2140 年左右。

Current Market Conditions

目前的市场状况

At the time of writing, BTC is trading at $66,307.84, with a market capitalization of $1,307,906,058,239. The circulating supply of BTC stands at 19,683,106, out of a maximum supply of 21 million.

截至撰写本文时,BTC 交易价格为 66,307.84 美元,市值为 1,307,906,058,239 美元。 BTC 的流通供应量为 19,683,106,最大供应量为 2100 万。

Conclusion

结论

The upcoming Bitcoin halving event is a significant market event with potential implications for both miners and investors. Miners face financial challenges due to declining rewards, while investors may experience a prolonged period of market volatility. The industry is responding with proactive measures, but the full impact of the halving remains to be seen. As the event approaches, investors and miners alike should monitor market developments closely to navigate the potential opportunities and risks.

即将到来的比特币减半事件是一个重大市场事件,对矿工和投资者都有潜在影响。由于回报下降,矿工面临财务挑战,而投资者可能会经历长期的市场波动。该行业正在采取积极措施应对,但减半的全面影响仍有待观察。随着活动的临近,投资者和矿商都应密切关注市场发展,以把握潜在的机遇和风险。

免责声明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

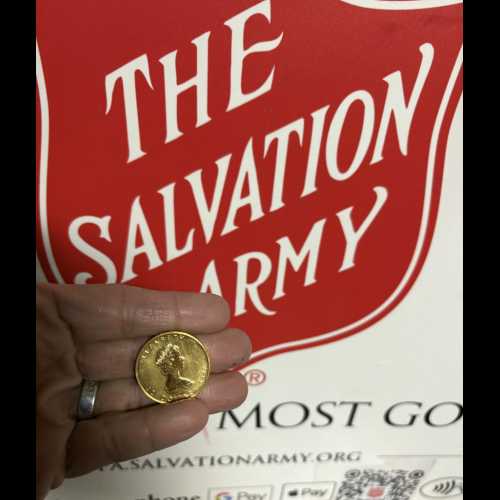

- 匿名捐赠者将稀有金币投入救世军水壶中

- 2024-12-28 12:35:02

- 这是圣诞节期间常见的景象和声音——作为救世军年度活动的一部分,路人将钞票和硬币投入红色水壶中,志愿者敲响了铃声。

-

-

-

- Floki Inu (FLOKI) 在潜在 200% 飙升之前盘整

- 2024-12-28 12:35:02

- Floki Inu (FLOKI) 在持续的市场动荡中表现出韧性,预示着令人印象深刻的上升轨迹的潜力。

-

- Pudgy Penguins [PENGU] 在市值方面翻转了 Dogwifhat [WIF]

- 2024-12-28 12:35:02

- 过去一周山寨币的价格表现表明,模因币现在将继续存在。

-

-

- Galaxy Digital 预计美国政府将在 2025 年停止购买比特币

- 2024-12-28 12:35:02

- Galaxy Digital 研究部门预测美国政府将在 2025 年停止购买比特币

-