|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

关税新闻周期在比特币市场上发动了一波FUD。这是最大交易所上的鲸鱼对此做出反应的方式。

The tariff news cycle has unleashed a wave of FUD on the Bitcoin market. Here’s how the whales on the largest exchange have been reacting to it.

关税新闻周期在比特币市场上发动了一波FUD。这是最大交易所上的鲸鱼对此做出反应的方式。

Recently, one analyst at CryptoQuant has been looking at how the Bitcoin Binance whales have been behaving.

最近,一位CryptoQuant的分析师一直在研究比特币二氧化鲸的表现。

The first indicator the quant shared is the Exchange Whale Ratio. This metric measures the ratio between the sum of the top 10 deposits and the total exchange inflow for any given platform.

第一个指标共享的量子是交换鲸比。该度量标准衡量了前10个存款和任何给定平台的总交换流入之间的比率。

The ten largest transfers to an exchange generally correspond to the activity of the whales. Thus, the Exchange Whale Ratio tells us about how the whale inflow activity compares against that of the entire platform.

向交换的十大转移通常与鲸鱼的活动相对应。因此,交换鲸的比率告诉我们鲸鱼流入活动与整个平台的比较。

As the below chart shows the 365-day exponential moving average (EMA) of the Bitcoin Exchange Whale Ratio for Binance has been climbing up throughout this cycle, meaning that the whales have been making up for an increasingly larger share of the deposits to the exchange.

如下图显示了比特币交换鲸的365天指数移动平均值(EMA)在整个周期中一直在攀升,这意味着鲸鱼已经弥补了越来越大的交易所存款份额。

Generally, investors deposit their coins to exchanges when they want to sell, so the Exchange Whale Ratio having a large value can suggest whales are making up for a big part of the selling activity on the platform.

通常,投资者在想出售时将硬币存放到交换中,因此具有较大价值的交换鲸比可以表明鲸鱼正在弥补平台上销售活动的很大一部分。

The 365-day EMA of the Binance Exchange Whale Ratio has continued to rise recently, implying the bigger picture continues to be that the whales on the largest cryptocurrency exchange are still ramping up their selling pressure.

最近365天的EMA最近继续上升,这意味着最大的加密货币交易所的鲸鱼仍在增加他们的销售压力。

In the short-term view (30-day EMA), however, whales have been losing inflow dominance. It’s possible that this is only a temporary deviation and the trend would go back to that of an increase soon, but in the scenario that it’s truly an early sign of a trend shift, then Bitcoin could see a bullish effect from this.

但是,在短期观点(30天EMA)中,鲸鱼一直在失去流入优势。这可能只是一个暂时的偏差,趋势将恢复到很快的增长,但是在这种情况下,这确实是趋势转变的早期迹象,然后比特币可以从中看到看涨的效果。

The Exchange Whale Ratio only measures what part of the total inflows the whales make up for. Here is another metric that shows the size of the whale exchange inflows themselves:

交换鲸比仅测量鲸鱼弥补的总流入中的哪一部分。这是另一个显示鲸鱼交换本身大小的指标:

As displayed in the above graph, the 30-day sum of the Binance Whale to Exchange Flow measured at around $8.5 billion during last year’s peak. Today, the metric has come down to just $4.9 billion.

如上图所示,在去年的峰值期间,交换流量的30天总和约为85亿美元。今天,该指标降至仅49亿美元。

Thus, it would seem that the whales have significantly lowered their deposit activity during the last few months. The trend is interesting, given that the market has been going through a phase of a panic recently owing to all the news related to the tariffs.

因此,似乎鲸鱼在过去几个月中显着降低了其存款活动。鉴于市场最近经历了与关税有关的所有新闻,因此该市场一直在经历恐慌的阶段,因此这一趋势很有趣。

“In conclusion, during this complicated period, it appears that Binance whales are not panicking,” notes the analyst.

分析师指出:“总而言之,在这个复杂的时期,二元鲸似乎并不感到恐慌。”

BTC Price

BTC价格

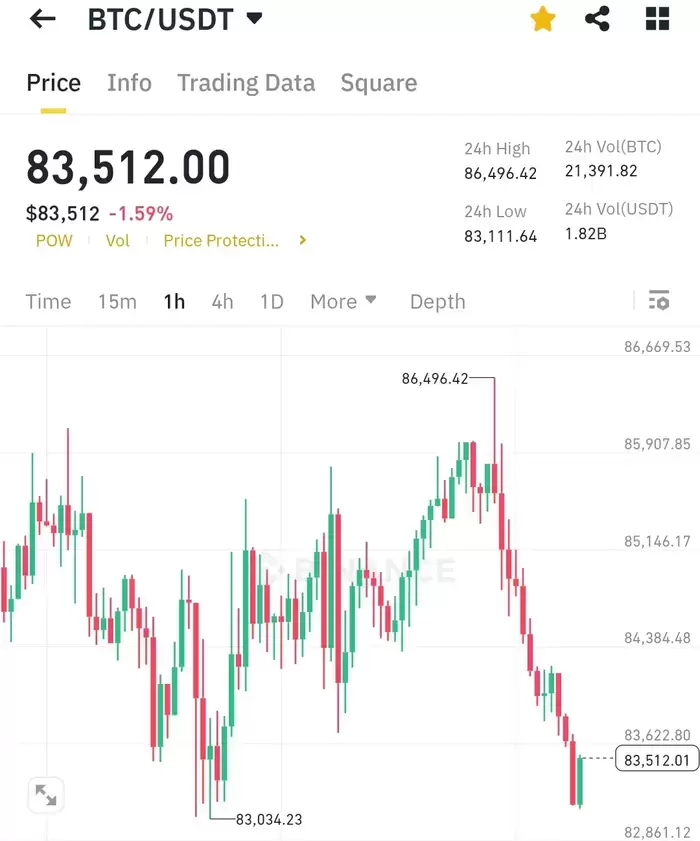

Following a recovery surge of over 7% during the past week, Bitcoin has returned back above the $85,000 level.

在过去一周的恢复速度超过7%之后,比特币返回了高于85,000美元的水平。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

-

-

- NVDA股票DUMBL

- 2025-04-16 13:15:13

- 比特币在早期交易中达到高峰,高达86429.35美元,然后在一夜之间急剧下降至83100美元。

-

-

-

-

-

-

- RWA和Stablecoin区块链Noble Labs将通过引入“ Applayer”来扩展其平台

- 2025-04-16 13:00:12

- 诺布尔(Noble