|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

经验丰富的交易员和分析师本杰明·考恩 (Benjamin Cowen) 在实现对卡尔达诺 (ADA) 的看跌预测后发现自己处于争议的中心。

Crypto veteran Benjamin Cowen has found himself at the center of a brewing discussion after his bearish prediction for Cardano (ADA) came to fruition.

在他对卡尔达诺(ADA)的悲观预测成为现实后,加密货币资深人士本杰明·考恩(Benjamin Cowen)发现自己处于酝酿讨论的中心。

Cowen had predicted that ADA would capitulate against Bitcoin, targeting 400 SATS. As the ADA/BTC trading pair hit the predicted 490 SATS level, and with ADA’s continuous decline, several critics have accused Cowen of influencing the asset’s price trajectory through his large audience and consistent coverage of ADA’s potential capitulation.

Cowen 曾预测 ADA 将向比特币投降,目标是 400 SATS。随着 ADA/BTC 交易对达到预期的 490 SATS 水平,并且随着 ADA 的持续下跌,一些批评者指责 Cowen 通过其大量受众和对 ADA 潜在投降的持续报道影响了该资产的价格轨迹。

In response to the criticism, Cowen took to X (formerly Twitter) to acknowledge his successful prediction and share his perspective on the matter. However, his post quickly attracted a wave of responses, particularly from Cardano enthusiasts, who expressed their dissatisfaction with Cowen’s role in ADA’s price struggles.

作为对批评的回应,Cowen 在 X(以前的 Twitter)上承认了他的成功预测并分享了他对此事的看法。然而,他的帖子很快引起了一波回应,尤其是卡尔达诺爱好者,他们对考恩在 ADA 价格斗争中所扮演的角色表示不满。

Among the critics was “Cardano Whale,” a prominent ADA supporter, who highlighted Cowen’s vast following and his frequent updates on ADA’s potential capitulation, which, according to the critic, contributed to the negative market sentiment for the asset.

批评者中有一位著名的 ADA 支持者“Cardano Whale”,他强调了 Cowen 的庞大追随者以及他对 ADA 潜在投降的频繁更新,据批评者称,这导致了该资产的负面市场情绪。

Cowen, known for his extensive following and crypto market analysis, has faced scrutiny for his role in influencing ADA’s price decline. Countering the criticism, Cowen maintained that while his audience is indeed large, he does not dictate market movements.

Cowen 以其广泛的追随者和加密货币市场分析而闻名,他因其在影响 ADA 价格下跌中所扮演的角色而面临审查。针对批评,考恩坚称,虽然他的听众确实很多,但他并不决定市场走势。

Emphasizing the nature of being an analyst, Cowen stated that both correct and incorrect calls are part of the job, and the responsibility lies with the investors to make informed decisions. "Blaming an analyst for price declines is a misguided approach,” remarked Cowen.

考恩强调了分析师的本质,他表示正确和错误的预测都是工作的一部分,投资者有责任做出明智的决定。考恩表示:“将价格下跌归咎于分析师是一种错误的做法。”

Despite Cowen’s defense, several Cardano supporters remained unconvinced, arguing that analysts with large followings can indeed influence markets. One user pointed out that having 800,000 followers could certainly sway investor decisions, as people often rely on reputable analysts for guidance. However, Cowen dismissed the idea, reiterating that while he shares his perspectives, he isn’t responsible for individual market moves.

尽管考恩进行了辩护,但卡尔达诺的几位支持者仍然不相信,他们认为拥有大量追随者的分析师确实可以影响市场。一位用户指出,拥有 80 万粉丝肯定会影响投资者的决策,因为人们经常依赖信誉良好的分析师的指导。然而,考恩驳回了这个想法,并重申,虽然他分享自己的观点,但他不对个别市场走势负责。

In a separate encounter, another X user shared a similar experience, where a Cardano advocate attacked him for his analysis of ADA’s potential decline. The user highlighted the absurdity of blaming an analyst for market movements, further emphasizing that investors should conduct their own research and make informed decisions.

在另一次遭遇中,另一位 X 用户也分享了类似的经历,一位卡尔达诺拥护者攻击他对 ADA 潜在衰退的分析。该用户强调了将市场走势归咎于分析师的荒谬性,并进一步强调投资者应该进行自己的研究并做出明智的决定。

The discussion surrounding Cowen’s impact reflects broader concerns within the crypto community about the influence of social media figures. As highlighted by Cowen himself, being an analyst in the crypto space often entails making bold predictions, which can either hit or miss. However, the role of these predictions and the discourse surrounding them in shaping market sentiment is a topic that continues to be debated.

围绕考恩影响的讨论反映了加密社区内部对社交媒体人物影响力的更广泛担忧。正如考恩本人所强调的那样,作为加密货币领域的分析师通常需要做出大胆的预测,这些预测可能会成功,也可能会失败。然而,这些预测以及围绕它们的讨论在塑造市场情绪方面的作用是一个仍在争论的话题。

免责声明:info@kdj.com

所提供的信息并非交易建议。根据本文提供的信息进行的任何投资,kdj.com不承担任何责任。加密货币具有高波动性,强烈建议您深入研究后,谨慎投资!

如您认为本网站上使用的内容侵犯了您的版权,请立即联系我们(info@kdj.com),我们将及时删除。

-

- 查尔斯·霍斯金森提议布莱恩·阿姆斯特朗在白宫监督加密货币政策

- 2024-11-22 03:55:02

- 据报道,当选总统唐纳德·特朗普的过渡团队正在考虑设立一个专门的白宫职位来监督加密货币政策

-

-

-

- ETF 跨越 1000 亿美元的历史里程碑

- 2024-11-22 03:55:02

- 本周三,美国批准的 12 只比特币现货 ETF 管理资产总计达到 1005.5 亿美元

-

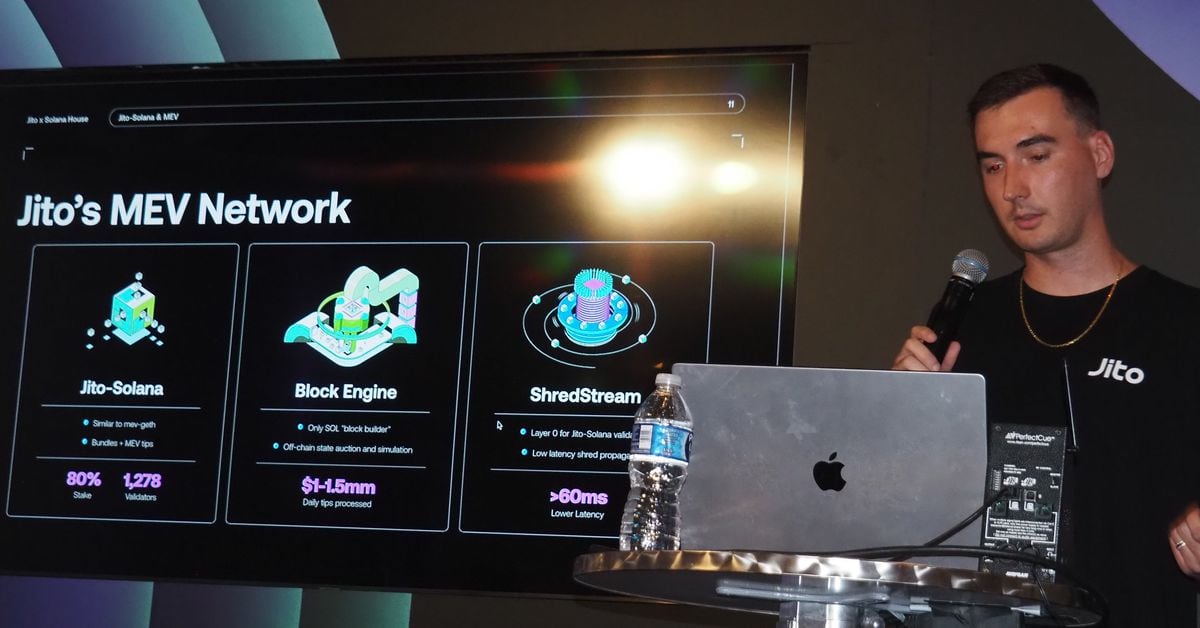

- Jito 代币持有者将根据 TipRouter 提案获得发薪日

- 2024-11-22 03:55:02

- Jito 经济轨道的重组正在进行中。

-

-

-

-