|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

作為一項對加密貨幣友善的重大舉措,英國倫敦證券交易所 (LSE) 將於 5 月 28 日推出比特幣和以太幣的交易所交易票據 (ETN)。此舉針對專業投資者和交易員,將英國定位為加密貨幣業務和投資的中心。

United Kingdom Embraces Cryptocurrency Integration with London Stock Exchange Exchange Traded Note Launch

英國擁抱加密貨幣整合並推出倫敦證券交易所交易所交易票據

In a significant development for the cryptocurrency industry, the United Kingdom has announced its intention to merge traditional regulated markets with the digital asset realm. Commencing on May 28, 2024, the London Stock Exchange (LSE) will debut exchange traded notes (ETNs) linked to Bitcoin and Ethereum, two of the most prominent cryptocurrencies.

英國宣布打算將傳統監管市場與數位資產領域合併,這是加密貨幣產業的重大發展。從 2024 年 5 月 28 日開始,倫敦證券交易所 (LSE) 將首次推出與比特幣和以太坊這兩種最著名的加密貨幣掛鉤的交易所交易票據 (ETN)。

ETNs: A Bridge Between Traditional and Cryptocurrency Markets

ETN:傳統市場與加密貨幣市場之間的橋樑

ETNs, introduced by Barclays Bank in 2006, are investment vehicles that facilitate the trading of various assets, including commodities and currencies. They are issued by banks as unsecured debt securities and track the performance of an index. In the case of the LSE's ETNs, the underlying indices are Bitcoin and Ethereum, whose recent price surges have fueled the ongoing bull run in the cryptocurrency market.

ETN 由巴克萊銀行於 2006 年推出,是促進包括商品和貨幣在內的各種資產交易的投資工具。它們由銀行作為無擔保債務證券發行,並追蹤指數的表現。就倫敦證券交易所的 ETN 而言,基礎指數是比特幣和以太坊,其最近的價格飆升推動了加密貨幣市場的持續牛市。

LSE's Crypto ETN Strategy

倫敦證券交易所的加密貨幣 ETN 策略

The LSE has established specific guidelines for financial institutions seeking to issue ETNs on its platform. All crypto ETNs must be backed by physical cryptocurrency assets, with the underlying Bitcoin and Ethereum assets held by a custodian licensed for Anti-Money Laundering compliance in the United States, United Kingdom, or European Union.

倫敦證券交易所為尋求在其平台上發行 ETN 的金融機構制定了具體準則。所有加密 ETN 都必須由實體加密貨幣資產支持,基礎比特幣和以太幣資產由在美國、英國或歐盟獲得反洗錢合規許可的託管人持有。

Tradability and Settlement

交易與結算

Crypto ETNs are traded on their designated segments and settled through Euroclear UK & Ireland or Euroclear Bank & Clear Stream Bank (ICSD). This ensures transparency, efficiency, and compliance within the trading process.

加密貨幣 ETN 在其指定部分進行交易,並透過 Euroclear UK & Ireland 或 Euroclear Bank & Clear Stream Bank (ICSD) 進行結算。這確保了交易流程的透明度、效率和合規性。

Tax Implications

稅務影響

ETN investors are liable for taxation only upon realizing profits from their investments, providing a potential tax advantage compared to direct cryptocurrency ownership.

ETN 投資者只有在實現投資利潤時才需要納稅,與直接擁有加密貨幣相比,這提供了潛在的稅收優勢。

Risks Associated with ETNs

與 ETN 相關的風險

ETNs are not overseen by a board of directors and carry credit risk, as they represent unsecured debt. Additionally, their liquidity may be limited, and investors may face holding-period risk due to potential price fluctuations in the underlying indices.

ETN 不受董事會監督,並且存在信用風險,因為它們代表無擔保債務。此外,其流動性可能有限,投資者可能因基礎指數的潛在價格波動而面臨持有期風險。

Benefits for the United Kingdom

對英國的好處

The United Kingdom's decision to embrace cryptocurrency integration through ETNs reflects its commitment to becoming a global hub for the digital asset industry. It aligns with the government's strategy to capitalize on the rapidly expanding cryptocurrency sector, which is currently valued at an estimated $2.60 trillion. By providing a regulated platform for crypto ETNs, the LSE aims to attract institutional investors and foster innovation within the UK's financial ecosystem.

英國決定透過 ETN 進行加密貨幣整合,反映了其致力於成為數位資產產業全球中心的承諾。它符合政府利用快速擴張的加密貨幣行業的策略,該行業目前價值估計為 2.6 兆美元。透過為加密 ETN 提供受監管的平台,倫敦證券交易所旨在吸引機構投資者並促進英國金融生態系統內的創新。

Implications for Investors

對投資者的影響

Crypto ETNs provide investors with an opportunity to gain exposure to the cryptocurrency market without the complexities of owning and storing digital assets directly. They offer a more accessible and potentially less risky alternative to direct cryptocurrency investment. However, investors must carefully consider the risks associated with ETNs before making any investment decisions.

加密 ETN 為投資者提供了接觸加密貨幣市場的機會,而無需直接擁有和儲存數位資產的複雜性。它們提供了一種比直接加密貨幣投資更容易獲得且風險可能更低的替代方案。然而,投資者在做出任何投資決定之前必須仔細考慮與 ETN 相關的風險。

Conclusion

結論

The launch of crypto ETNs on the London Stock Exchange is a significant step in the convergence of traditional finance and digital assets. It demonstrates the United Kingdom's commitment to supporting the growth of the cryptocurrency industry while maintaining regulatory oversight. As the cryptocurrency market continues to evolve, ETNs are poised to play an increasingly important role as a bridge between these two worlds, offering investors greater access and investment opportunities within the digital asset landscape.

倫敦證券交易所推出加密 ETN 是傳統金融與數位資產融合的重要一步。它表明英國致力於支持加密貨幣行業的發展,同時保持監管監督。隨著加密貨幣市場的不斷發展,ETN 將作為這兩個世界之間的橋樑發揮越來越重要的作用,為投資者在數位資產領域提供更多的機會和投資機會。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

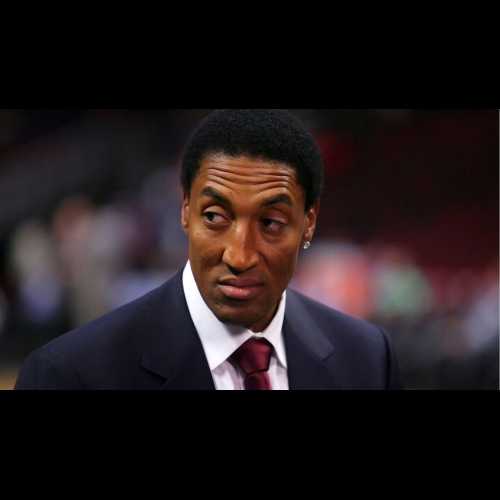

- 史考提·皮朋暫停推廣加密貨幣,提醒球迷失敗並不是結束

- 2024-12-30 01:15:02

- 這位芝加哥公牛隊的傳奇人物不再不斷地推動他的硬幣 $BALL,而是提醒他的追隨者,失敗並不是一切的結束

-

-

-

- 如果 XRP 恢復 2018 年比特幣市值的百分比,XRP 價格有可能達到兩位數

- 2024-12-30 01:15:02

- 在聯準會對經濟的強硬立場導致大盤回調的背景下,XRP 遭受了巨大打擊。