|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Omni 代幣 (OMNI) 在空投分發和交易所上市後價值縮水超過 56%,投資者遭受了重大損失。這一下跌與更廣泛的市場低迷一致,比特幣和以太坊也面臨損失。此外,假冒的 OMNI 代幣導致投資者透過「拉扯」騙局損失資金,凸顯了加密貨幣行業中持續存在的詐欺活動。

Omni Token Plunges 56% After Airdrop and Exchange Listing, Amidst Scam Concerns

空投和交易所上市後,Omni 代幣暴跌 56%,引發詐騙擔憂

Omni Network (OMNI) has witnessed a precipitous decline in its market value, shedding over 56% since its airdrop distribution and exchange listing on April 17, 2024. The token's value has plummeted from $53 to $23 within the past 24 hours, according to data from CoinGecko.

Omni Network (OMNI) 的市值自2024 年4 月17 日空投分送和交易所上市以來,市值急劇下跌,跌幅超過56%。 $23 來自 CoinGecko。

Airdrop Distribution and Market Impact

空投分佈及市場影響

Starting at 11 am UTC on Wednesday, Omni distributed approximately 3% of its total token supply of 100 million to early adopters who had interacted with the blockchain before its launch. The airdrop allocation extended to the platform's community, restakers in EigenLayer, and those who participated in Beacon.

從世界標準時間週三上午 11 點開始,Omni 將其 1 億代幣總供應量中的約 3% 分發給了在區塊鏈發布前與區塊鏈進行過互動的早期採用者。空投分配範圍擴大到平台社群、EigenLayer 中的 retakes 以及 Beacon 的參與者。

Within the first hour of the token's distribution and listing on major exchanges such as Binance, ByBit, Bitget, and KuCoin, its value had already dipped by 30%, from $53 to around $39. The token's decline continued throughout the day, with its market cap slipping from $560 million before the airdrop to a mere $245 million. At the time of writing, its 24-hour trading volume stands at $737 million.

在該代幣在 Binance、ByBit、Bitget 和 KuCoin 等主要交易所發行和上市的第一個小時內,其價值已下跌 30%,從 53 美元跌至 39 美元左右。該代幣全天持續下跌,市值從空投前的 5.6 億美元跌至僅 2.45 億美元。截至撰寫本文時,其 24 小時交易量為 7.37 億美元。

Broader Market Downturn and Fake Token Scam

更廣泛的市場低迷和假代幣騙局

The decline in OMNI's value mirrors the broader downturn in the cryptocurrency market, which has seen Bitcoin (BTC) and Ethereum (ETH), the industry's two leading cryptocurrencies, plunge below $60,000 and $3000 respectively before recovering slightly.

OMNI 價值的下跌反映了加密貨幣市場更廣泛的低迷,業界兩種領先的加密貨幣比特幣 (BTC) 和以太幣 (ETH) 分別跌破 60,000 美元和 3000 美元,然後略有回升。

Adding fuel to the fire, scammers have capitalized on the excitement surrounding the Omni token launch by creating a fake token with the same name (OMNI). According to PeckShield, a blockchain security company that identified and exposed the scam, the counterfeit project executed a "rug pull," causing the fake token's value to plummet by 100%.

火上澆油的是,詐騙者利用 Omni 代幣發布帶來的興奮感,創造了同名的假代幣 (OMNI)。據識別並揭露該騙局的區塊鏈安全公司 PeckShield 稱,該假冒項目執行了一次“拉扯”,導致假代幣的價值暴跌 100%。

Prevalent Rug Pull Scams in the Cryptocurrency Industry

加密貨幣產業中普遍存在的拉扯騙局

Rug pulls, a fraudulent scheme in which developers abruptly withdraw liquidity from a project, leaving investors with worthless tokens, have become an alarmingly common occurrence in the cryptocurrency industry. In 2023, the industry incurred $1.7 billion in losses due to fraudulent activities, with $760 million of that amount attributed to rug pulls and related scams, as reported by blockchain security firm Quantstamp.

「Rug Pulls」是一種欺詐性計劃,開發人員突然從專案中撤回流動性,讓投資者持有毫無價值的代幣,這在加密貨幣行業中已成為一種令人震驚的常見現象。根據區塊鏈安全公司 Quantstamp 報道,2023 年,該產業因詐欺活動蒙受了 17 億美元的損失,其中 7.6 億美元歸因於拉扯和相關詐騙。

The recent rug pull involving fake Omni tokens is just one of many such scams that have plagued the industry in recent months. In March 2024, OrdiZK, a cryptocurrency project that promised to connect the Bitcoin, Ethereum, and Solana blockchains, pulled the rug on its investors, causing the token's value to plummet by 99%.

最近涉及假 Omni 代幣的騙局只是近幾個月來困擾該行業的眾多此類騙局之一。 2024 年 3 月,承諾連接比特幣、以太坊和 Solana 區塊鏈的加密貨幣專案 OrdiZK 對其投資者發動了攻擊,導致該代幣的價值暴跌 99%。

Ongoing Vigilance and Regulatory Scrutiny

持續保持警覺和監管審查

The proliferation of rug pulls has prompted increased vigilance from regulatory authorities. The U.S. Securities and Exchange Commission (SEC) has been cracking down on fraudulent cryptocurrency schemes, including rug pulls.

地毯拉絲的激增引起了監管機構的高度警覺。美國證券交易委員會(SEC)一直在打擊欺詐性加密貨幣計劃,包括地毯拉動。

Investors are urged to exercise due diligence when investing in new and unproven cryptocurrencies. Researching the team behind the project, understanding the project's purpose and potential, and only investing what one can afford to lose are crucial precautions to mitigate the risk of falling victim to rug pulls.

敦促投資者在投資新的和未經證實的加密貨幣時進行盡職調查。研究計畫背後的團隊,了解計畫的目的和潛力,並只投資可以承受的損失,是降低成為拉動受害者風險的關鍵預防措施。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- 俄羅斯將從 2025 年 1 月 1 日起禁止多個地區的比特幣挖礦

- 2024-12-25 14:40:01

- 俄羅斯政府最近宣布,該國多個地區將禁止比特幣開採。該措施將於2025年1月1日開始實施,有效期為6年。

-

- 儘管存在可疑交易和大量 USDC 外流,Hyperliquid (HYPE) 對攻擊索賠不屑一顧

- 2024-12-25 14:40:01

- 12 月 23 日,USDC 大量外流,引發了對網路潛在安全攻擊的擔憂。

-

-

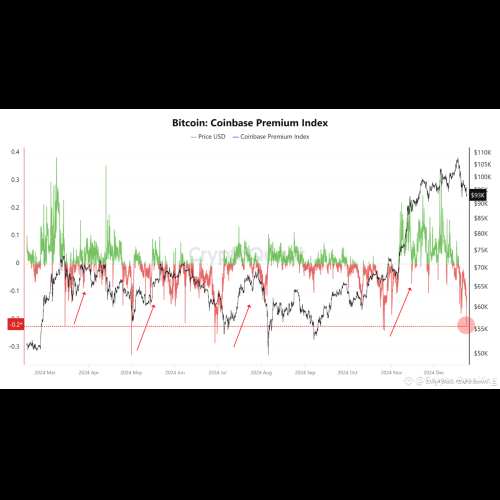

- Quant 表示,比特幣 Coinbase 溢價給出了潛在的買入訊號

- 2024-12-25 14:35:02

- 一位量化分析師解釋了比特幣 Coinbase 溢價指數的最新趨勢如何意味著該資產的買入機會。

-

- 2024年加密產業回顧

- 2024-12-25 14:30:59

- 2024 年對加密產業來說是動盪的一年。比特幣現貨ETF推出,機構加速採用,帶來產業繁榮

-

-

-

- 莫迪總理將在阿塔爾·比哈里·瓦杰帕伊誕辰紀念日為肯貝特瓦河連接工程奠基

- 2024-12-25 14:30:59

- 總理莫迪將在前總理阿塔爾·比哈里·瓦杰帕伊誕辰之際為該國首個肯-貝特瓦河流連接項目在克久拉霍奠基

-

- 萊特幣(LTC)今年平均每日活躍地址顯著增加

- 2024-12-25 14:30:59

- 鏈上數據顯示,今年萊特幣每日活躍地址指標較去年大幅增加。