|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

幾天前,該公司宣布購買價值 11 億美元的比特幣,使其持有量達到 244,800 個代幣。

Nasdaq-listed bitcoin development firm MicroStrategy (MSTR) announced Monday that it intends to offer $700 million aggregate principal amount of convertible senior notes due 2028.

納斯達克上市的比特幣開發公司 MicroStrategy (MSTR) 週一宣布,打算發行本金總額為 7 億美元的 2028 年到期的可轉換優先票據。

The company plans to use the proceeds of the offering to redeem $500 million worth of senior secured notes with 6.125% annual yield maturing in 2028, the press release said. It will use the rest of the proceeds to purchase more bitcoin (BTC) and for general corporate uses.

新聞稿稱,該公司計劃利用此次發行的收益贖回價值 5 億美元的優先擔保票據,年收益率為 6.125%,將於 2028 年到期。它將用剩餘的收益購買更多的比特幣(BTC)並用於一般企業用途。

The firm also plans to grant to the initial purchasers of the notes an option to buy up to an additional $105 million aggregate principal amount of notes within a 13-day period starting on the issuance date of the first notes. The company said it may redeem for cash all or a portion of the notes on or after December 20, 2027, subject to certain conditions.

該公司還計劃向票據的初始購買者授予在第一批票據發行之日起 13 天內額外購買本金總額最多 1.05 億美元票據的選擇權。該公司表示,在符合某些條件的情況下,可能會在 2027 年 12 月 20 日或之後贖回全部或部分票據。

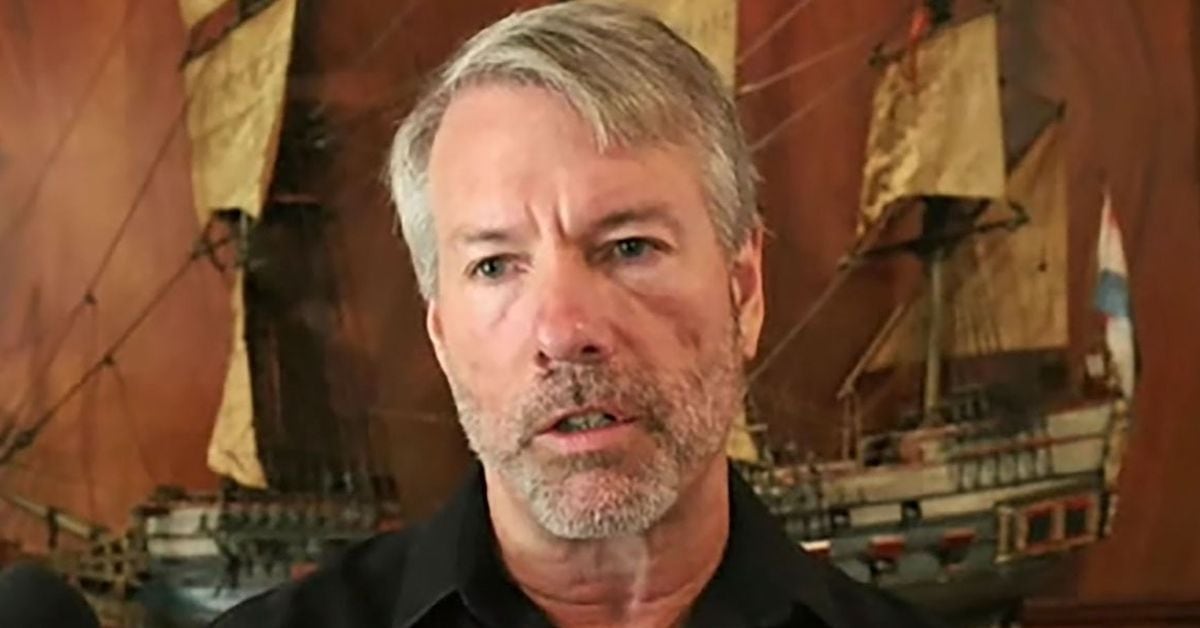

The company, led by Executive Chairman Michael Saylor, started purchasing bitcoin in 2020, adopting it as a reserve asset for its treasury. Since then, it has become the largest corporate buyer of bitcoin, accumulating 244,800 BTC, worth roughly $14.2 billion at current prices. Only days ago, MicroStrategy disclosed the purchase of an additional $1.1 billion worth of bitcoin, leaving it with $900 million available under a previous offering.

該公司由執行主席 Michael Saylor 領導,於 2020 年開始購買比特幣,將其作為其財務的儲備資產。此後,它成為比特幣最大的企業買家,累積了 244,800 BTC,以當前價格計算價值約 142 億美元。就在幾天前,MicroStrategy 披露額外購買了價值 11 億美元的比特幣,使其在先前的發行中擁有 9 億美元的可用資金。

Recently, other public companies such as Semler Scientific and Japanese investment adviser Metaplanet have followed MicroStrategy's footprints to issue debt to accumulate bitcoin.

最近,Semler Scientific 和日本投資顧問 Metaplanet 等其他上市公司也紛紛效法 MicroStrategy 的足跡,發行債務來累積比特幣。

MSTR shares slid 4.9% during regular trading today alongside a sizable decline in the price of bitcoin. Shares are down another 1.6% in after hours trading. They remain higher by about 300% on a year-over-year basis.

MSTR 股價在今天的常規交易中下跌 4.9%,同時比特幣價格也大幅下跌。盤後交易中,該股又下跌 1.6%。它們仍同比增長約 300%。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

- Kishu(OK X)將注意力作為高利潤機會,基金為0.15%。

- 2025-04-04 10:30:12

- FTT有機會每天損失15.66美元,每天損失291.8美元。

-

- 唐納德·特朗普(Donald Trump)的新185個國家關稅計劃將比特幣和加密貨幣市場陷入短暫的混亂

- 2025-04-04 10:25:12

- 比特幣以及整個加密貨幣市場,在過去的幾個小時中,新浪的看跌感官擊中

-

-

- 隨著2025年4月的展開,加密貨幣市場處於不斷變化狀態

- 2025-04-04 10:20:12

- 比特幣(BTC)保持其位置約為85,000美元,以太坊(ETH)和XRP試圖獲得動力

-

-

- 加密貨幣市場正經歷著巨大的湍流,以太坊(ETH)也不例外

- 2025-04-04 10:15:28

- 加密貨幣市場正經歷著巨大的湍流,以太坊(ETH)也不例外。以太坊(ETH)墜毀以下

-

-