|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

美國總統大選後,比特幣 (BTC) 的看漲競賽觸及 10 萬美元,這讓加密產業興奮不已。然而,它也標誌著清算

Bitcoin’s (BTC) bullish run towards hitting $100K post-US Presidential elections got the crypto industry excited. However, it has also flagged liquidation risk for some pro-BTC firms ahead.

美國總統選舉後,比特幣 (BTC) 的看漲勢頭達到 10 萬美元,這讓加密產業感到興奮。然而,它也預示著一些支持比特幣的公司未來面臨清算風險。

MicroStrategy (MSTR), which has decided to go heavy on the biggest cryptocurrency, is expected to face a similar danger.

MicroStrategy (MSTR) 決定大力投資最大的加密貨幣,預計也將面臨類似的危險。

Michael Saylor, former CEO of MicroStrategy, announced that the company’s treasury operations had delivered a BTC yield of around 12.3% last week. He added that the firm managed to provide a net benefit of 40,738 BTC to its shareholders. This comes as Bitcoin’s price surged by 35% in the last 30 days to hover around $96K.

MicroStrategy 前執行長 Michael Saylor 宣布,上週該公司資金業務的 BTC 收益率約為 12.3%。他補充說,該公司成功為其股東提供了 40,738 BTC 的淨收益。與此同時,比特幣的價格在過去 30 天內飆升了 35%,徘徊在 96,000 美元左右。

Crypto analyst Willy Woo has highlighted potential risks to MicroStrategy’s Bitcoin strategy in his latest post. He focused on the company’s convertible debt. He suggested that if debt holders do not convert to shares before maturity then it will force MSTR to sell its Bitcoin in order to reimburse debt holders.

加密貨幣分析師 Willy Woo 在他的最新文章中強調了 MicroStrategy 比特幣策略的潛在風險。他專注於公司的可轉換債務。他建議,如果債務持有人在到期前不轉換為股票,那麼將迫使 MSTR 出售其比特幣以償還債務持有人。

This could happen if MicroStrategy’s share price doesn’t pump more than 40% and that too in 5 to 7 years (although it will vary as per each bond). Either MSTR correlation to BTC needs to fail or BTC needs to fail.

如果 MicroStrategy 的股價上漲不超過 40%,並且在 5 到 7 年內也不會上漲(儘管根據每種債券而有所不同),這種情況就可能發生。要麼 MSTR 與 BTC 的相關性失敗,要麼 BTC 失敗。

Woo had earlier warned competitors that are trying to mimic MicroStrategy as it could erode its net asset value premium. Other risks include potential SEC-forced restrictions on Bitcoin purchases and even US government confiscation of crypto assets.

Woo 早些時候警告試圖模仿 MicroStrategy 的競爭對手,因為這可能會侵蝕其淨資產價值溢價。其他風險包括美國證券交易委員會可能強制限制比特幣購買,甚至美國政府沒收加密資產。

This comes in when the investment adviser Gary Black claims MSTR’s shares are overvalued by 73%, estimating fair value at $105. MicroStrategy’s share price is up by a huge 668% in the last year, it was traded at an average price of $388.84 in the last session.

投資顧問加里·布萊克 (Gary Black) 聲稱 MSTR 的股票被高估了 73%,估計公允價值為 105 美元。 MicroStrategy股價去年大幅上漲668%,上一交易日均價為388.84美元。

Bitcoin’s recent upward run has boosted all the related markets with it. BTC price is up and running by 126% on a year-to-date basis (YTD). It went on to hit a fresh all-time high (ATH) of over $99,600 on November 23, 2024. The biggest crypto is trading at an average price of $95,700, at the press time. Its cumulative market cap is now moving toward the $2 trillion mark.

比特幣最近的上漲帶動了所有相關市場的上漲。 BTC 價格今年迄今 (YTD) 上漲了 126%。它於 2024 年 11 月 23 日創下了超過 99,600 美元的歷史新高 (ATH)。其累計市值目前正邁向2兆美元大關。

The application software vendor firm had decided to tie up its fortunes with the biggest crypto but this move can prove to be a generating debt load. As per its last quarter filings, the firm reported a debt of $4.56 billion. It recently completed the issuance of another $3 billion in senior convertible notes due 2029 at a 0% interest rate which now brings its total debt to over $7.56 billion.

這家應用程式軟體供應商公司決定將其財富與最大的加密貨幣捆綁在一起,但此舉可能會產生債務負擔。根據上一季的文件,該公司報告的債務為 45.6 億美元。該公司最近以 0% 的利率完成了另外 30 億美元 2029 年到期的高級可轉換票據的發行,目前其總債務超過 75.6 億美元。

MicroStrategy’s “21/21 Plan” is a bold experiment in corporate finance where raising $42 billion to acquire 500,000 BTC sounds very ambitious. They’re not just buying Bitcoin, they’re doubling down on its future as a corporate treasury asset.

MicroStrategy 的「21/21 計畫」是企業融資領域的一項大膽實驗,籌集 420 億美元收購 50 萬BTC 聽起來非常雄心勃勃。他們不僅購買比特幣,還加倍押注比特幣作為企業財務資產的未來。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

-

- 10月美國核心PCE物價指數年增2.8%,BTC價格突破97,000美元

- 2024-11-28 18:25:02

- 週三,美國10月核心PCE物價指數年增2.8%,符合預期,但仍高於聯準會2%的目標。

-

- Kraken NFT 市場將於 11 月 27 日關閉,理由是策略轉變

- 2024-11-28 18:25:02

- Kraken 在給客戶的電子郵件中確認,該平台將於 11 月 27 日進入僅限提款階段。

-

-

![LCX [LCX] 恢復看漲市場結構,但能否突破 0.33 美元阻力? LCX [LCX] 恢復看漲市場結構,但能否突破 0.33 美元阻力?](/uploads/2024/11/28/cryptocurrencies-news/articles/lcx-lcx-regains-bullish-market-structure-beat-resistance/image-1.jpg)

- LCX [LCX] 恢復看漲市場結構,但能否突破 0.33 美元阻力?

- 2024-11-28 18:25:02

- LCX [LCX]近兩個月來首次在一日時間框架內恢復看漲市場結構。

-

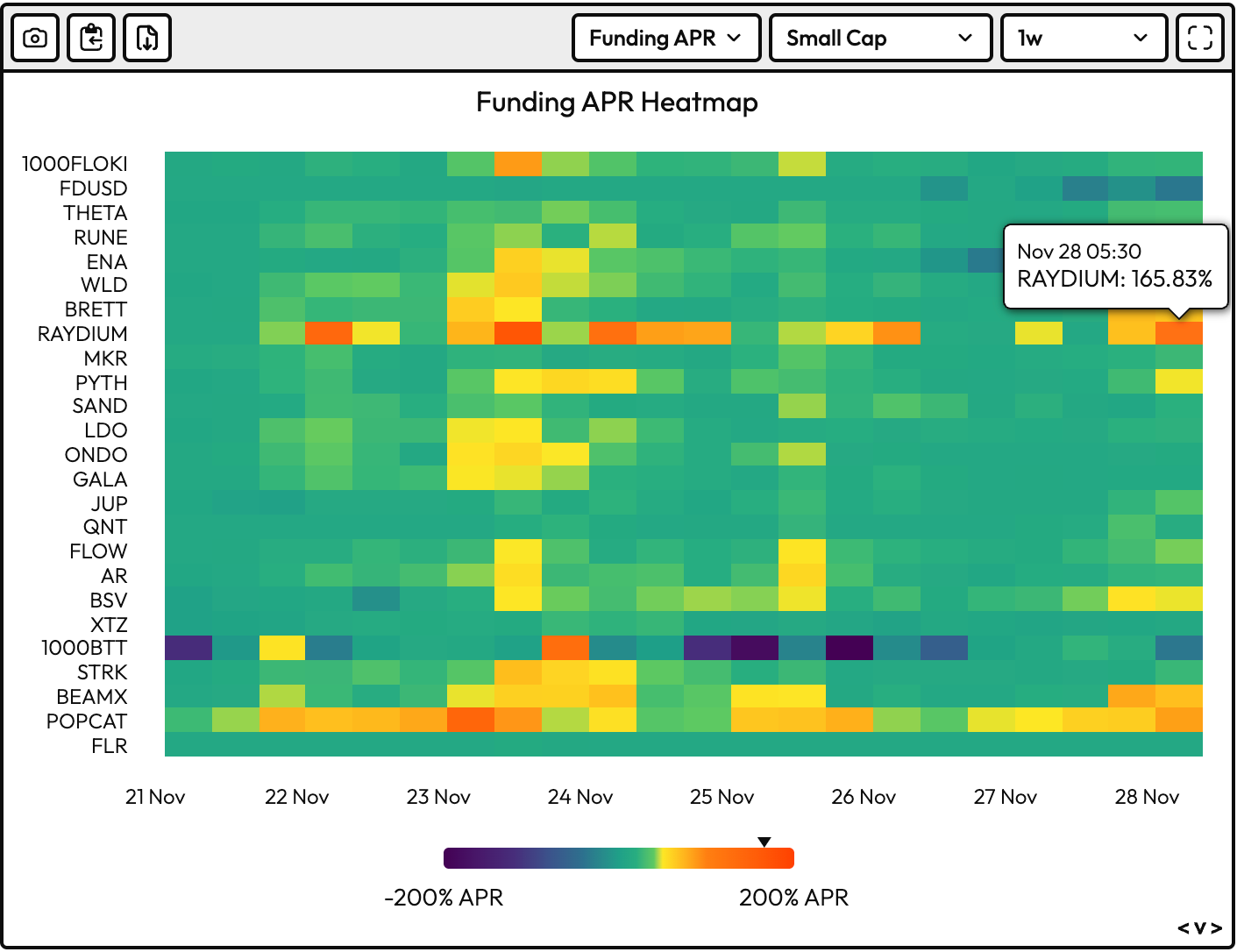

- 數據顯示,Raydium 的 RAY 代幣是最過熱的加密貨幣

- 2024-11-28 18:20:01

- 比特幣(BTC)最近的看漲停頓後,小盤代幣的年化永久融資利率已經冷卻了更廣泛的市場

-