|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特幣(BTC)最近的看漲停頓後,小盤代幣的年化永久融資利率已經冷卻了更廣泛的市場

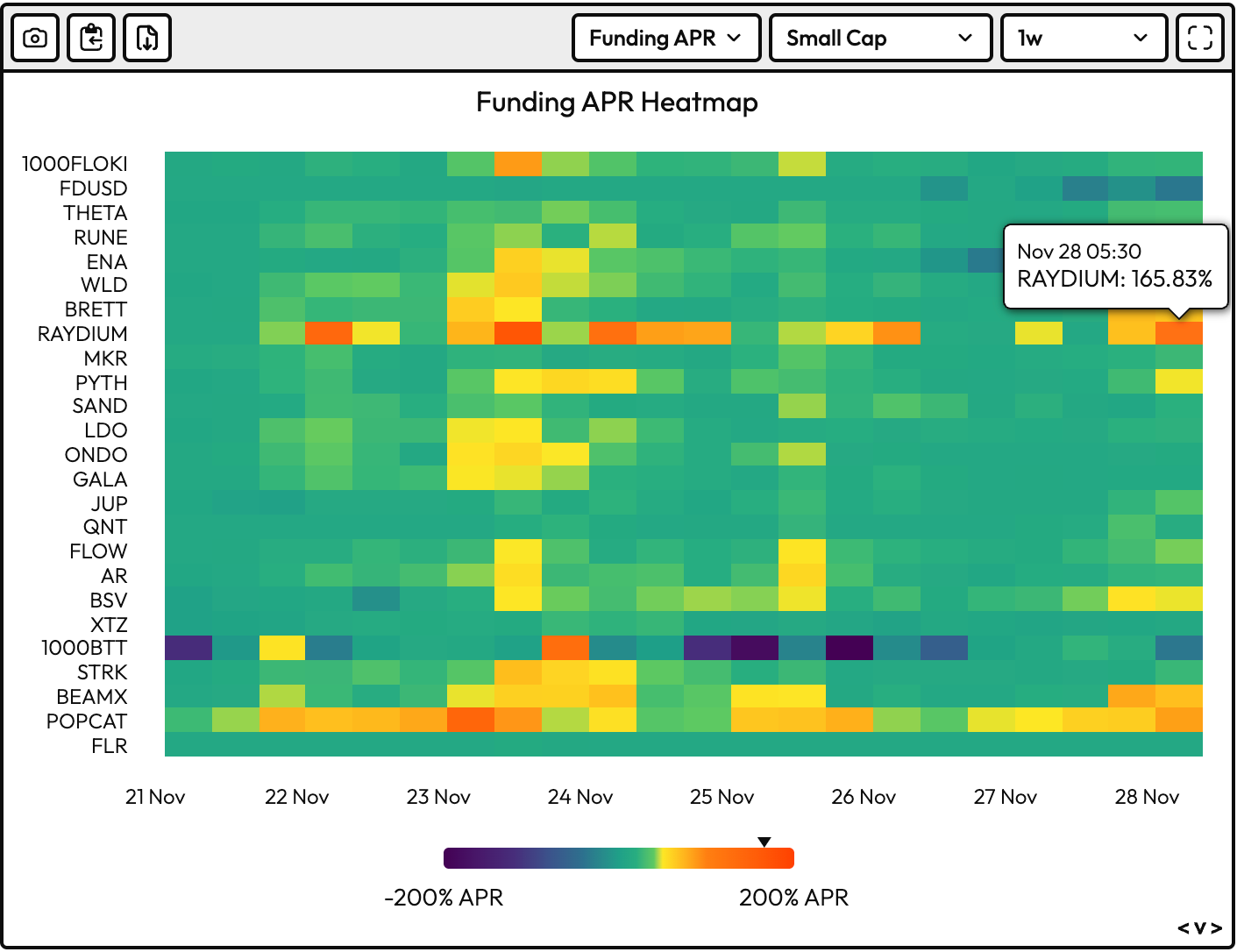

As bitcoin’s (BTC) recent bullish pause has cooled jets in the broader market, annualized perpetual funding rates in small cap tokens have normalized costs associated with betting on price rallies. But one token is still blazing hot.

由於比特幣(BTC)最近的看漲停頓已經冷卻了更廣泛的市場,小盤代幣的年化永續融資利率已經使與押注價格上漲相關的成本正常化。但有一個代幣仍然炙手可熱。

Solana-based decentralized exchange Raydium’s native cryptocurrency, RAY, is the only coin with annualized perpetual funding rates still exceeding 160%, making it the most overheated cryptocurrency among small-, mid- and large-cap tokens, according to data from VeloData.

根據VeloData 的數據,基於Solana 的去中心化交易所Raydium 的原生加密貨幣RAY 是唯一一個年化永續資金利率仍超過160% 的加密貨幣,使其成為小、中、大盤代幣中最過熱的加密貨幣。

The elevated rate suggests the market for RAY is overcrowded with long positions, with leverage skewed heavily toward the bullish side. In such conditions, even a slight dip in price can shake the confidence of over-leveraged bulls, especially late entrants, triggering a mass unwinding of long positions, which often exacerbates the price decline, leading to a more pronounced sell-off.

利率上升顯示 RAY 市場多頭部位過度擁擠,槓桿嚴重偏向看漲方向。在這種情況下,即使價格略有下跌,也會動搖槓桿過高的多頭,尤其是後來進入者的信心,引發多頭頭寸的大規模平倉,這往往會加劇價格下跌,導致更明顯的拋售。

畢竟,衍生品市場的參與者通常會放大現貨市場的趨勢,因為他們可以通過多頭或空頭頭寸進行高達 50 倍的槓桿交易。當市場參與者過度看漲時,任何看跌跡象都可能導致信心危機,從而引發多頭頭寸的快速平倉。

畢竟,衍生品市場的參與者通常會放大現貨市場的趨勢,因為他們可以通過多頭或空頭頭寸進行高達 50 倍的槓桿交易。當市場參與者過度看漲時,任何看跌跡象都可能導致信心危機,從而引發多頭頭寸的快速平倉。

毕竟,衍生品市场参与者通常会放大现货市场的趋势,因为他们可以进行高达 50 倍杠杆的多头或空头头寸。当市场参与者过度看涨时,任何看跌迹象都可能导致信心危机,从而引发多头头寸的快速平仓。

畢竟,衍生性商品市場參與者通常會放大現貨市場的趨勢,因為他們可以進行高達50 倍槓桿的多頭或空頭部位。當市場參與者過度看漲時,任何看跌跡像都可能導致信心危機,從而引發多頭部位的快速平倉。

Tokens with a market capitalization of less than $5 billion, such as RAY, are particularly vulnerable to shenanigans in the derivatives market.

市值低於 50 億美元的代幣(例如 RAY)特別容易受到衍生性商品市場中的惡作劇的影響。

It’s easy to see why bulls have thrown caution to the wind. Despite the recent 17% price pullback to $5.39, RAY is still up 67% for the month versus market leader BTC’s 35% surge, CoinDesk data show.

很容易理解為什麼多頭將謹慎拋在了腦後。 CoinDesk 數據顯示,儘管最近價格回落 17% 至 5.39 美元,但 RAY 本月仍上漲 67%,而市場領導者 BTC 則飆升 35%。

The market-beating rise comes amid record activity on Raydium. According to data source Artemis, Raydium has registered a trading volume of $117.8 billion this month, nearly twice the entire Ethereum-based DEX volume of $66.8 billion. Raydium has generated $175 million in fees versus Ethereum’s $168 million. Ethereum is the world’s largest smart contract blockchain.

此次上漲是在 Raydium 創紀錄的活動之際出現的。根據數據來源 Artemis 的數據,Raydium 本月的交易量為 1,178 億美元,幾乎是基於以太坊的 DEX 總交易量 668 億美元的兩倍。 Raydium 已產生 1.75 億美元的費用,而以太坊則為 1.68 億美元。以太坊是世界上最大的智慧合約區塊鏈。

Note that much of the record activity on Raydium occurred early this month, primarily driven by the memecoin frenzy, which propelled trading volumes to record highs, fueling significant interest in the RAY token. However, the frenzied momentum has begun to cool, weakening the underlying support for a sustained rise in the RAY token.

請注意,Raydium 上的大部分創紀錄活動發生在本月初,主要是由 memecoin 狂熱推動的,這推動交易量創下歷史新高,激發了人們對 RAY 代幣的濃厚興趣。然而,瘋狂的勢頭已經開始降溫,削弱了RAY代幣持續上漲的底層支撐。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

- 狗狗幣市值超越保時捷,標誌著不斷發展的金融領域的里程碑

- 2024-11-28 20:35:02

- 狗狗幣(DOGE)是最受歡迎的迷因加密貨幣之一,它剛剛創下了超越保時捷市值 547 億美元的重要里程碑。

-

-

-

-

-

-

-