|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BTIG 分析師預測,由於大量比特幣投資,MicroStrategy 的股價已飆升 150%,該股可能會隨著加密貨幣的上漲而繼續攀升。 Andrew Harte 將目標價提高至 1,800 美元,暗示較當前水準可能上漲 10%。這一目標明顯高於他之前預計的 780 美元。儘管該股最近有所上漲,但華爾街的目標價卻落後了,MicroStrategy 在 3 月創下了 1999.99 美元的盤中歷史新高。

MicroStrategy's Bitcoin-Driven Surge Poised for Further Gains, Analysts Assert

分析師斷言,MicroStrategy 受比特幣驅動的飆升有望進一步上漲

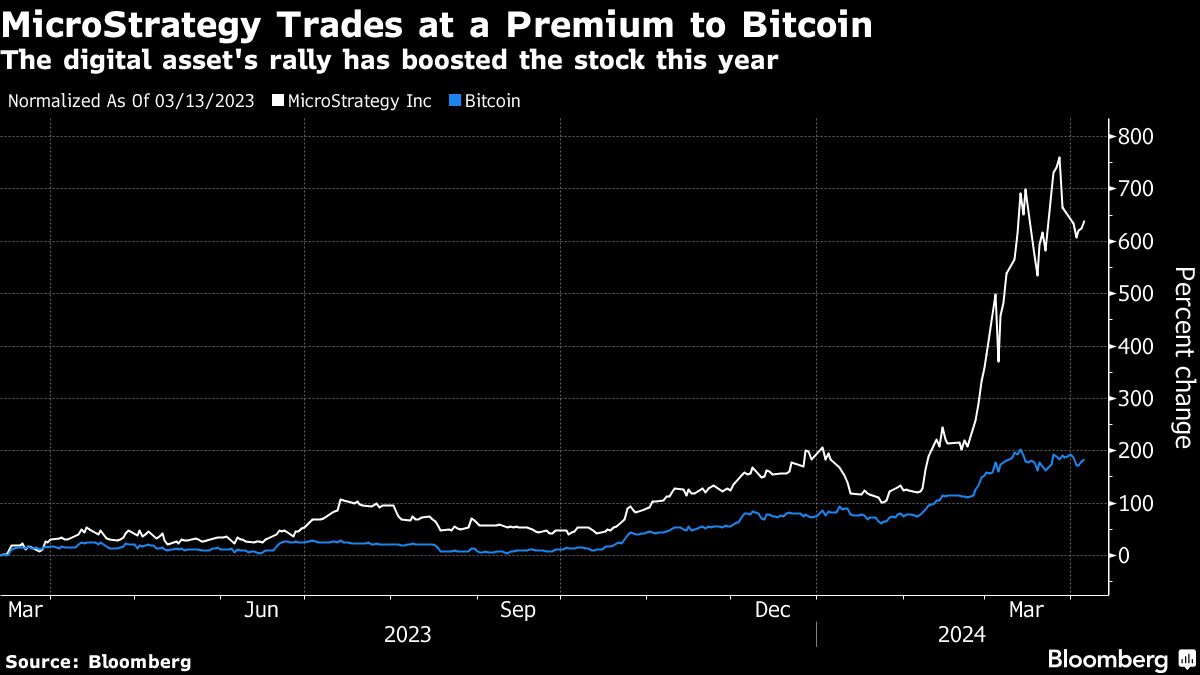

MicroStrategy Incorporated's (NASDAQ: MSTR) remarkable surge of 150% attributed to its substantial investment in Bitcoin has the potential to extend even further, driven by the cryptocurrency's sustained growth. This bullish outlook is shared by analysts at BTIG LLC, who have recently revised their price target higher.

MicroStrategy Incorporated(NASDAQ:MSTR)由於其對比特幣的大量投資而實現了 150% 的驚人飆升,並且在加密貨幣持續增長的推動下,其股價還有可能進一步上漲。 BTIG LLC 的分析師也認同這種看漲前景,他們最近上調了目標價。

Andrew Harte, an analyst at BTIG, has raised his price target to $1,800, implying an additional 10% upside from current trading levels. This adjustment represents more than double his previous target of $780.

BTIG 分析師 Andrew Harte 將目標價提高至 1,800 美元,這意味著比目前交易水準還有 10% 的上漲空間。這項調整是他先前目標 780 美元的兩倍多。

The disparity between Wall Street's price targets and MicroStrategy's recent stock performance highlights the company's outperformance in recent weeks. As of March 18, MicroStrategy held over 214,000 Bitcoin, a position that has closely mirrored the soaring value of the digital asset, eclipsing its own gains.

華爾街的目標價與 MicroStrategy 最近的股票表現之間的差異凸顯了該公司最近幾週的優異表現。截至 3 月 18 日,MicroStrategy 持有超過 214,000 個比特幣,這一部位密切反映了數位資產價值的飆升,超過了其自身收益。

The heightened valuation of MicroStrategy shares reflects investors' willingness to pay a premium for the company's exposure to Bitcoin. Harte's sum-of-the-parts analysis indicates that this premium has stabilized at a level exceeding 2x.

MicroStrategy 股票估值的提高反映了投資者願意為該公司的比特幣風險支付溢價。 Harte 的綜合分析表明,這項溢價已穩定在超過 2 倍的水平。

Harte anticipates that MicroStrategy will continue to benefit from positive catalysts for Bitcoin throughout the year, including the highly anticipated Bitcoin halving event expected this April. This event, which reduces the supply of newly mined Bitcoin, has historically boosted the cryptocurrency's price.

Harte 預計 MicroStrategy 將繼續受益於全年比特幣的積極催化劑,包括預計今年 4 月備受期待的比特幣減半事件。這事件減少了新開採的比特幣的供應,歷史上曾推高加密貨幣的價格。

Bitcoin's impressive rally of over 50% to record highs this year has also spurred MicroStrategy's upward trajectory, given its strategy of raising capital to acquire more of the digital asset.

鑑於 MicroStrategy 採取了籌集資金以收購更多數位資產的策略,比特幣今年令人印象深刻地上漲了 50% 以上,創下歷史新高,也刺激了 MicroStrategy 的上升軌跡。

However, it is important to note that the tight correlation between MicroStrategy's stock price and Bitcoin carries inherent risks. The stock trades at a premium to the value of its Bitcoin holdings, making it susceptible to more significant declines in the event of a cryptocurrency market downturn.

然而,值得注意的是,MicroStrategy 股價與比特幣之間的緊密相關性存在固有風險。該股票的交易價格高於其持有的比特幣價值,因此在加密貨幣市場低迷的情況下,該股票容易遭受更大幅度的下跌。

On Friday, MicroStrategy shares fell as much as 3.2% in intraday trading, influenced by a reversal in Bitcoin's price.

週五,受比特幣價格逆轉的影響,MicroStrategy 股價盤中下跌 3.2%。

Harte's analysis includes both upside and downside scenarios for MicroStrategy. He estimates that shares could potentially fall to $700 if the premium on the company's Bitcoin holdings shrinks and regulatory pressures weigh on the cryptocurrency market, causing Bitcoin's price to decline towards $48,000.

Harte 的分析包括 MicroStrategy 的上行和下行情境。他估計,如果該公司持有的比特幣溢價縮小並且監管壓力打壓加密貨幣市場,導致比特幣價格跌至 48,000 美元,那麼股價可能會跌至 700 美元。

Conversely, a bullish scenario where Bitcoin surges above $90,000 and the premium on MicroStrategy's holdings expands suggests a stock price of $2,700, representing a nearly 70% gain from current levels.

相反,如果比特幣飆升至 90,000 美元以上且 MicroStrategy 持有的溢價擴大,則股價將上漲至 2,700 美元,較目前水準上漲近 70%。

For the immediate term, the April Bitcoin halving is anticipated to serve as a positive catalyst for the stock and the cryptocurrency's price. Harte notes that following the previous three halving events, the price of Bitcoin increased significantly in the following year.

就短期而言,四月的比特幣減半預計將成為該股和加密貨幣價格的積極催化劑。 Harte 指出,在前三次減半事件之後,比特幣的價格在接下來的一年中大幅上漲。

Harte's analysis underscores investors' perception of Bitcoin as a hedge against inflation, particularly in the context of central banks' expansive fiscal stimulus. He anticipates continued adoption of Bitcoin by institutional investors as it gains recognition as a disinflationary asset.

哈特的分析強調了投資者將比特幣視為通膨對沖工具的看法,特別是在央行擴大財政刺激的背景下。他預計,隨著比特幣作為一種通貨緊縮資產的認可,機構投資者將繼續採用比特幣。

In conclusion, MicroStrategy's surge driven by its Bitcoin investment has the potential to extend further, supported by analysts' bullish outlook. However, investors should be mindful of the risks associated with the stock's close correlation to Bitcoin's price fluctuations.

總之,在分析師看漲前景的支持下,MicroStrategy 由比特幣投資推動的飆升有可能進一步延續。然而,投資者應注意該股票與比特幣價格波動密切相關的風險。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

- 華盛頓州立大學經濟學教授對擬議的「狗狗幣」的有效性表示懷疑

- 2024-11-19 16:10:02

- 華盛頓州立大學經濟學院助理教授克里斯多福克拉克指出,長期聯邦就業趨勢顯示聯邦工作人員的比例

-

- 隨著比特幣的走強,以下是今天的贏家和輸家

- 2024-11-19 16:10:02

- 今天,加密貨幣市場繼續其上漲趨勢,排名前 10 位的加密貨幣大部分都在綠區交易。比特幣交易價格為 91,000 美元

-

-

-

-

-

-

- 不為人知的漣漪效應:加密動態如何形塑全球經濟

- 2024-11-19 16:10:02

- 隨著加密貨幣市場的潮起潮落,其影響遠遠超出了投資者的投資組合,影響著全球經濟、社區和個人。