|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cryptocurrency News Articles

MicroStrategy's Bitcoin Bonanza Poised to Continue, Analysts Bullish

Apr 06, 2024 at 01:06 am

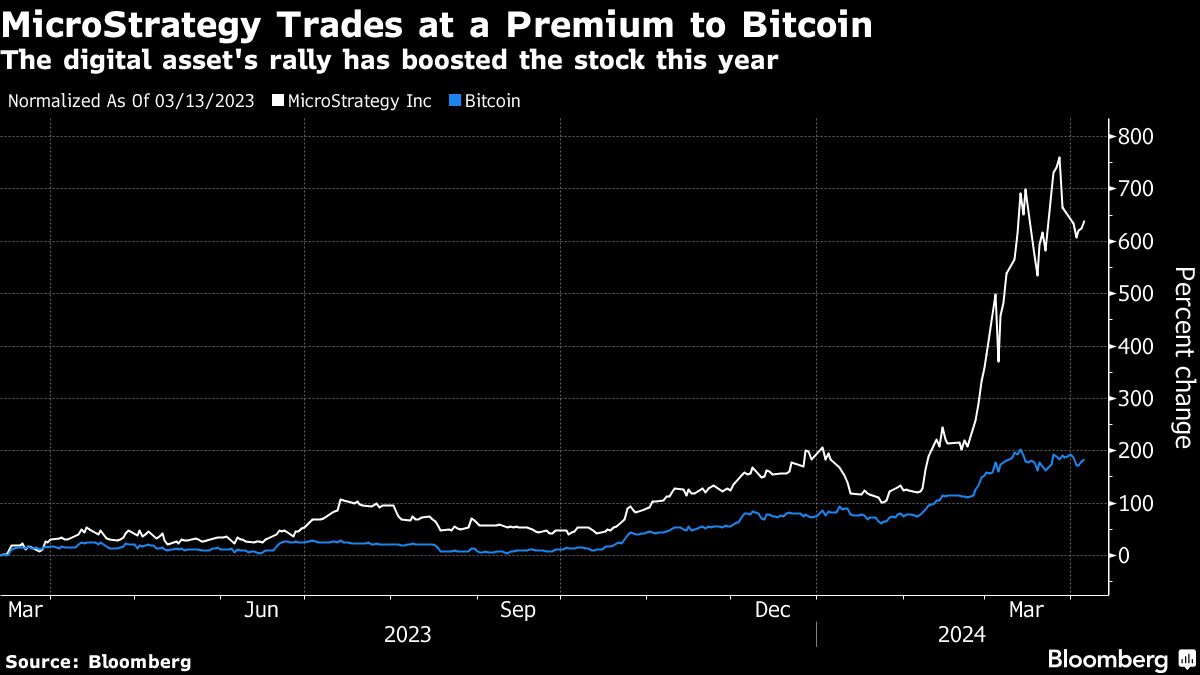

BTIG analysts predict that MicroStrategy's stock, which has surged 150% due to its significant Bitcoin investment, could continue to climb alongside the rising cryptocurrency. Andrew Harte raised his price target to $1,800, suggesting a potential 10% increase from current levels. This target is significantly higher than his previous estimate of $780. Despite the stock's recent rally, Wall Street's price targets have fallen behind, with MicroStrategy's intraday record high of $1999.99 set in March.

MicroStrategy's Bitcoin-Driven Surge Poised for Further Gains, Analysts Assert

MicroStrategy Incorporated's (NASDAQ: MSTR) remarkable surge of 150% attributed to its substantial investment in Bitcoin has the potential to extend even further, driven by the cryptocurrency's sustained growth. This bullish outlook is shared by analysts at BTIG LLC, who have recently revised their price target higher.

Andrew Harte, an analyst at BTIG, has raised his price target to $1,800, implying an additional 10% upside from current trading levels. This adjustment represents more than double his previous target of $780.

The disparity between Wall Street's price targets and MicroStrategy's recent stock performance highlights the company's outperformance in recent weeks. As of March 18, MicroStrategy held over 214,000 Bitcoin, a position that has closely mirrored the soaring value of the digital asset, eclipsing its own gains.

The heightened valuation of MicroStrategy shares reflects investors' willingness to pay a premium for the company's exposure to Bitcoin. Harte's sum-of-the-parts analysis indicates that this premium has stabilized at a level exceeding 2x.

Harte anticipates that MicroStrategy will continue to benefit from positive catalysts for Bitcoin throughout the year, including the highly anticipated Bitcoin halving event expected this April. This event, which reduces the supply of newly mined Bitcoin, has historically boosted the cryptocurrency's price.

Bitcoin's impressive rally of over 50% to record highs this year has also spurred MicroStrategy's upward trajectory, given its strategy of raising capital to acquire more of the digital asset.

However, it is important to note that the tight correlation between MicroStrategy's stock price and Bitcoin carries inherent risks. The stock trades at a premium to the value of its Bitcoin holdings, making it susceptible to more significant declines in the event of a cryptocurrency market downturn.

On Friday, MicroStrategy shares fell as much as 3.2% in intraday trading, influenced by a reversal in Bitcoin's price.

Harte's analysis includes both upside and downside scenarios for MicroStrategy. He estimates that shares could potentially fall to $700 if the premium on the company's Bitcoin holdings shrinks and regulatory pressures weigh on the cryptocurrency market, causing Bitcoin's price to decline towards $48,000.

Conversely, a bullish scenario where Bitcoin surges above $90,000 and the premium on MicroStrategy's holdings expands suggests a stock price of $2,700, representing a nearly 70% gain from current levels.

For the immediate term, the April Bitcoin halving is anticipated to serve as a positive catalyst for the stock and the cryptocurrency's price. Harte notes that following the previous three halving events, the price of Bitcoin increased significantly in the following year.

Harte's analysis underscores investors' perception of Bitcoin as a hedge against inflation, particularly in the context of central banks' expansive fiscal stimulus. He anticipates continued adoption of Bitcoin by institutional investors as it gains recognition as a disinflationary asset.

In conclusion, MicroStrategy's surge driven by its Bitcoin investment has the potential to extend further, supported by analysts' bullish outlook. However, investors should be mindful of the risks associated with the stock's close correlation to Bitcoin's price fluctuations.

Disclaimer:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

- Big Time Studios Introduces $OL Token to Supercharge Its Open Loot Web3 Gaming Platform and Marketplace

- Nov 19, 2024 at 06:30 pm

- Big Time Studios, a Web3 gaming trailblazer and creator of the Open Loot platform and hit game Big Time, which has already processed a half billion dollars in total transaction volume, is making waves again.

-

- The Next Shiba Inu? 5 Promising New Meme Coins to Watch in 2023

- Nov 19, 2024 at 06:30 pm

- Attention is turning to new digital coins that might match the spectacular rise of tokens like Shiba Inu. Innovative projects with strong communities are emerging, capturing interest with their unique ideas. These assets hold the potential for significant growth, sparking excitement among investors seeking the next big opportunity.

-

-

-

-

-