|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

本文是「媒體策略的現實檢驗」系列文章的第 7 部分。許多經驗豐富的媒體行業專業人士認為,媒體業務是

Many seasoned professionals in the media industry argue that the media business is inherently dynamic. Therefore, tactical agility and rapid time-to-🧃market are more critical than other trade-offs, such as adherence to strategy, the quality of the technology built, and maintaining data standards.

許多經驗豐富的媒體產業專業人士認為,媒體業務本質上是動態的。因此,戰術敏捷性和快速上市時間比其他權衡更為重要,例如遵守戰略、所建立技術的品質以及維護資料標準。

Yes, this is partially true because media companies earn by capitalizing in bursts of short-lived topics that are in public imagination. This articulates why content teams need to be constantly on their feet but it doesn’t explain why business-product-technology functions value tactical agility over strategic asset building.

是的,這在某種程度上是正確的,因為媒體公司透過利用公眾想像中的短暫話題來賺錢。這闡明了為什麼內容團隊需要不斷站穩腳跟,但它並不能解釋為什麼業務-產品-技術功能更重視戰術敏捷性而不是戰略資產建立。

My working theory is that media companies, having ceded strategic control to algorithmic marketplaces, are forced into premature revenue diversification to mitigate black swan risks and seasonal fluctuations. This leads to a portfolio of revenue streams, each generating small amounts of money.

我的工作理論是,媒體公司將策略控制權讓給演算法市場後,被迫過早實現收入多元化,以減輕黑天鵝風險和季節性波動。這會產生一系列收入流,每個收入流都會產生少量資金。

Let’s explore both ideas — revenue maximization and revenue diversification.

讓我們探討這兩個想法——收入最大化和收入多元化。

Revenue Maximization

收入最大化

To maintain focus and maximize ROI, businesses typically prioritize maximizing revenue from a single model before considering diversification. Below are few examples of successful revenue maximization:

為了保持專注並最大化投資報酬率,企業通常會優先考慮最大化單一模式的收入,然後再考慮多角化。以下是成功實現收入最大化的幾個例子:

Netflix: Streaming service

Netflix:串流服務

Spotify: Music streaming service

Spotify:音樂串流服務

Coinbase: Cryptocurrency exchange

Coinbase:加密貨幣交易所

Stripe: Payment processing service

Stripe:支付處理服務

Zoom: Video conferencing service

Zoom:視訊會議服務

These businesses have prioritized building a single revenue stream and scaled it to become clear leaders in their respective categories. They have not diversified into other models prematurely.

這些企業優先考慮建立單一收入來源,並擴大其規模,成為各自類別中明顯的領導者。他們還沒有過早地多元化發展其他模式。

Revenue Diversification

收入多元化

Media companies, like hedge funds, diversify into a portfolio of revenue streams: direct and indirect ads, sponsored content, affiliate marketing, subscriptions, and micro-transactions.

媒體公司,如對沖基金,多元化收入來源組合:直接和間接廣告、贊助內容、聯盟行銷、訂閱和微交易。

In 2023-2024, OpenAI has signed deals with News Corp., Financial Times, Associated Press, Axel Springer, Le Monde, Reddit, where media companies provide content for AI models in exchange for financial compensation. This quick-win licensing strategy helps diversify revenue in the short-term while shifting costs/externalities that are hard to measure, like impact on brand and direct relationship with audience, into the future.

2023-2024年,OpenAI已與新聞集團、金融時報、美聯社、Axel Springer、Le Monde、Reddit簽署協議,媒體公司為AI模型提供內容以換取經濟補償。這種快速獲勝的授權策略有助於在短期內實現收入多元化,同時將難以衡量的成本/外部性(例如對品牌的影響以及與受眾的直接關係)轉移到未來。

Why It Matters

為什麼它很重要

Premature revenue diversification has several drawbacks:

過早的收入多元化有幾個缺點:

It prevents the company from scaling a single revenue stream to become a clear category leader.

它阻止公司擴大單一收入來源,成為明顯的類別領導者。

This leads to lower revenue per stream and higher costs to service each stream.

這會導致每個流的收入降低,並且服務每個流的成本更高。

It makes the company less valuable to partners and investors because there is no clear franchise.

由於沒有明確的特許經營權,這使得公司對合作夥伴和投資者的價值降低。

It prevents the company from making bold bets on new technologies because there is less money available for R&D.

它阻止公司在新技術上大膽押注,因為可用於研發的資金較少。

It makes the company more vulnerable to changes in the market because there is less diversification of revenue sources.

由於收入來源的多元化程度較低,這使得該公司更容易受到市場變化的影響。

For example, if media companies had focused on building their own algorithmic marketplaces instead of prematurely diversifying into quick-win licensing deals, they would have been able to make bold bets on AI models that could have sustained gains over the long term.

例如,如果媒體公司專注於建立自己的演算法市場,而不是過早多元化進入快速獲勝的授權交易,他們就能夠大膽地押注於能夠長期持續收益的人工智慧模型。

Implications on AI

對人工智慧的影響

In the absence of clear abstractions defined by the product function, the pressure to make decisions quickly results in side effects that make deploying AI at scale a challenge: concept drift, data drift, label drift, feature drift, covariate drift, etc. Let’s evaluate two of these:

在缺乏產品功能定義的清晰抽象的情況下,快速做出決策的壓力會導致副作用,使大規模部署人工智慧成為一項挑戰:概念漂移、資料漂移、標籤漂移、特徵漂移、協變量漂移等。讓我們評估一下其中兩個:

AI models learn to predict output by relying on patterns in the input data. Concept drift occurs when this relationship is no longer valid. For example, if the product and editorial teams introduce a new content format that shifts user interest, concept drift will occur. This is especially true if the feature was launched to reduce time to market without updating data standards and algorithms.

人工智慧模型學習根據輸入資料中的模式來預測輸出。當這種關係不再有效時,就會發生概念漂移。例如,如果產品和編輯團隊引入一種新的內容格式來改變使用者的興趣,就會發生概念漂移。如果推出該功能是為了縮短上市時間而不更新資料標準和演算法,則尤其如此。

Data drift occurs when an undocumented change to data structure, semantics, or distribution happens. For example, sudden changes to the user interface result in a change in how users navigate the website. This is one of the reasons why most algorithmic marketplaces, like Google, X, Facebook, Instagram, LinkedIn, etc., have broadly maintained their user experience over the last two decades.

當資料結構、語意或分佈發生未記錄的變更時,就會發生資料漂移。例如,使用者介面的突然變化會導致使用者瀏覽網站的方式發生變化。這就是為什麼大多數演算法市場(如 Google、X、Facebook、Instagram、LinkedIn 等)在過去二十年中基本上保持用戶體驗的原因之一。

Constant diversification and frequent changes make the overall system highly susceptible to drift, which makes sustaining gains from AI models unreliable.

持續的多樣化和頻繁的變化使得整個系統極易發生漂移,這使得人工智慧模型的持續效益變得不可靠。

Conclusion

結論

To escape this predicament, media companies must regain strategic control by investing in becoming algorithmic marketplaces themselves. If transformation is not feasible, they must accept low ROI due to revenue diversification as a necessary cost of doing business.

為了擺脫這種困境,媒體公司必須透過投資成為演算法市場來重新獲得策略控制權。如果轉型不可行,他們就必須接受因收入多元化而導致的低投資報酬率作為開展業務的必要成本。

Curious how I’m managing to write? I created a CustomGPT for myself, which serves as my go-to editor and audits my first draft. Here’s the link—give it a spin! It’s free to use.

好奇我是如何寫作的嗎?我為自己創建了一個 CustomGPT,它作為我的首選編輯器並審查我的初稿。這是連結——試一試!它可以免費使用。

https://chatgpt.com/g/g-hgI62sWPm-mediaflywheels-review-opinion-pieces

Want to republish it? This post was released under CC BY-ND — you can republish it as is with the following credit and backlinks: ‘Originally published by Ritvvij Parrikh on The Times of India. The author retains the copyright and any other ancillary rights to the post.

想要重新發布嗎?這篇文章是在 CC BY-ND 下發布的——您可以按原樣重新發布,並帶有以下來源和反向連結:“最初由 Ritvvij Parrikh 在《印度時報》上發表。”作者保留該帖子的版權和任何其他附屬權利。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

- 由於市場波動,XRP 跌至 2.2 美元,引發投資者擔憂

- 2024-12-20 20:45:02

- XRP 價格下跌之際,更廣泛的加密貨幣市場面臨更大的波動性。有幾個因素導致了這種低迷:

-

- k:** 幣安的 Solana Liquid 質押代幣 BNSOL 的 TVL 達到 10 億美元

- 2024-12-20 20:45:02

-

-

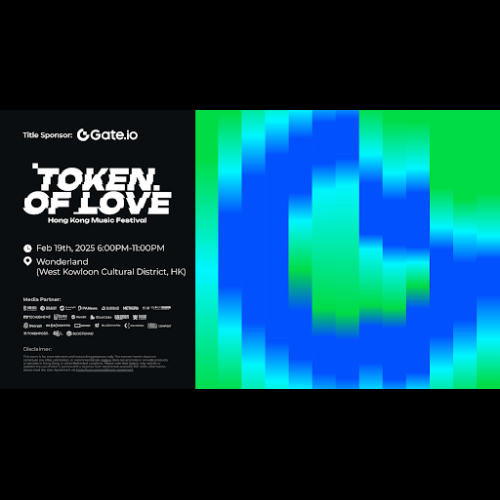

- Gate.io宣布冠名《愛的信物》香港音樂節

- 2024-12-20 20:45:02

- 音樂和 Web3 創新的開創性全球慶典。預定2025年2月19日

-

-

-

-