|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

本月到目前為止,以太坊原生加密貨幣實現了大幅上漲。然而,許多分析師認為,與一些競爭對手相比,該公司的表現不佳。

Ethereum price enjoyed a moderate uptick so far this month. But many feel that it has underperformed compared to some of its rivals. Could this be about to change?

本月到目前為止,以太幣價格略有上漲。但許多人認為,與一些競爭對手相比,它的表現不佳。這會改變嗎?

There are multiple signs that point to the possibility of a major ETH rally. For starters, Ethereum futures open interest recently soared to its highest level in its entire history. It peaked at $21.22 billion in the last 24 hours.

有多種跡象表明 ETH 可能會大幅上漲。首先,以太坊期貨的未平倉合約最近飆升至其歷史上的最高水準。過去 24 小時內最高達到 212.2 億美元。

This is not the first time that ETH futures open interest surged to record highs. But it is interesting to note that ETH has been experiencing higher open interest in 2024 compared to the previous bull run.

這並不是 ETH 期貨持倉量第一次飆升至歷史新高。但有趣的是,與之前的多頭市場相比,ETH 在 2024 年的未平倉合約量一直在增加。

For example, its previous peak was $17.09 billion at the end of May 2024. This was higher than its $13.08 billion peak in November 2021.

例如,其先前的峰值為 2024 年 5 月底的 170.9 億美元。

But how will this ETH open interest surge affect the cryptocurrency? Well, open interest is a double-edged sword because it could not only indicate demand but also sell pressure in the form of shorts.

但 ETH 持倉量激增將如何影響加密貨幣?嗯,未平倉合約是一把雙面刃,因為它不僅可以表明需求,還可以表明空頭形式的拋售壓力。

According to Coinglass, ETH shorts were notably higher than longs in the last 3 days. This indicates rising expectations of sell pressure after the cryptocurrency’s bullish momentum ground to a halt during the weekend.

根據 Coinglass 的數據,過去 3 天,ETH 空頭數量明顯高於多頭數。這顯示在加密貨幣的看漲勢頭在周末陷入停滯後,拋售壓力的預期不斷上升。

Will ETH Price Be Subject to a Pullback or Another Rally?

ETH 價格會回檔還是再次上漲?

It is clear why some would expect a bearish outcome judging by ETH’s recent price action. Zooming out reveals that the cryptocurrency has been trading in a wedge pattern. It recently retested this pattern’s descending resistance line.

從 ETH 最近的價格走勢來看,很明顯為什麼有些人會預期會出現看跌結果。縮小顯示加密貨幣一直在以楔形模式進行交易。它最近重新測試了該模式的下降阻力線。

Bullish momentum went on recess after previously achieving a significant upside this month. ETH’s recent resistance retest indicates that the cryptocurrency could be headed for some downside.

在本月實現大幅上漲後,看漲勢頭陷入衰退。 ETH 最近的阻力重新測試顯示該加密貨幣可能會出現一些下行趨勢。

A substantial pullback could see Ethereum price dip below $3,000 and possibly to $2,600 in case of a major crash. This could eventually lead to a retest of the support line.

大幅回檔可能導致以太坊價格跌破 3,000 美元,如果發生重大崩盤,可能會跌至 2,600 美元。這最終可能導致重新測試支撐線。

While some profit-taking was observed, there were significant reasons to also expect a potential bullish breakout from the consolidation zone.

雖然觀察到了一些獲利了結,但也有充分的理由預計可能會突破盤整區。

One of the main reasons was that Ethereum ETFs kicked off this week with positive flows. Roughly $43.2 million worth of inflows was recorded during Monday’s trading session.

主要原因之一是以太坊 ETF 本週啟動並帶來積極的資金流入。週一交易時段錄得約 4,320 萬美元的資金流入。

ETFs have had a significant impact on market direction recently, especially for Bitcoin. And ETFs are unlikely to buy unless they anticipate some upside. A breakout from the current resistance level could validate the positive ETF flows.

ETF 最近對市場方向產生了重大影響,尤其是比特幣。除非預期會有上漲,否則 ETF 不太可能買進。突破當前阻力位可能會驗證 ETF 的積極流動。

However, there was another major reason for bullish expectations. Bitcoin dominance dipped during the weekend after topping out at 61.53% last week. It hovered at 59.01% at the time of writing.

然而,看漲預期還有另一個主要原因。比特幣的主導地位在上週達到 61.53% 的峰值後,在周末有所下降。截至撰寫本文時,該比例徘徊在 59.01%。

If Bitcoin dominance continues dipping, it could pave the way for more liquidity flows into ETH. And it is possible that an Ethereum price rally could be on the cards if the Bitcoin dominance continues declining.

如果比特幣的主導地位繼續下降,可能會為更多的流動性流入 ETH 鋪平道路。如果比特幣的主導地位繼續下降,以太坊價格可能會上漲。

Finally, large holder flow data from IntoTheBlock revealed that inflows into large accounts were at 4 week highs.

最後,來自 IntoTheBlock 的大戶流量數據顯示,大戶的資金流入達到 4 週以來的最高點。

ETH large holder inflows peaked at 714,430 coins as of 25 November. A sign that there was strong demand from whales despite the recent resistance retest.

截至 11 月 25 日,ETH 大戶流入量達到高峰 714,430 個代幣。這表明儘管最近出現了阻力,但鯨魚的需求仍然強勁。

Large holder outflows also registered a significant surge on 25 November. However, they peaked at 603,040 ETH which was slightly lower than inflows.

11 月 25 日,大戶資金流出也大幅增加。然而,峰值為 603,040 ETH,略低於流入量。

In other words, whale demand was slightly higher than whale sell pressure. And a strong demand resurgence could potentially push ETH price close to the $4,000 before it encounters its next major resistance level.

換句話說,鯨魚的需求略高於鯨魚的拋售壓力。強勁的需求復甦可能會推動 ETH 價格接近 4,000 美元,然後再遇到下一個主要阻力位。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- 2024 年 12 月最值得購買的加密貨幣:Qubetics、XRP 和 FIL

- 2024-11-28 12:25:02

- 隨著 12 月的到來,加密貨幣市場一片熱鬧。 Ripple的XRP已飆升至三年來的最高點

-

-

- UVA Health 向非營利組織捐贈數千美元以慶祝節日

- 2024-11-28 12:20:02

- 為了慶祝節日,並作為對員工的謝意,UVA Health 向五個非營利組織各捐贈了數千美元。

-

- 比特幣(BTC)近期價格調整後出現反彈,投資人獲利了結行為消退

- 2024-11-28 12:20:02

-

-

-

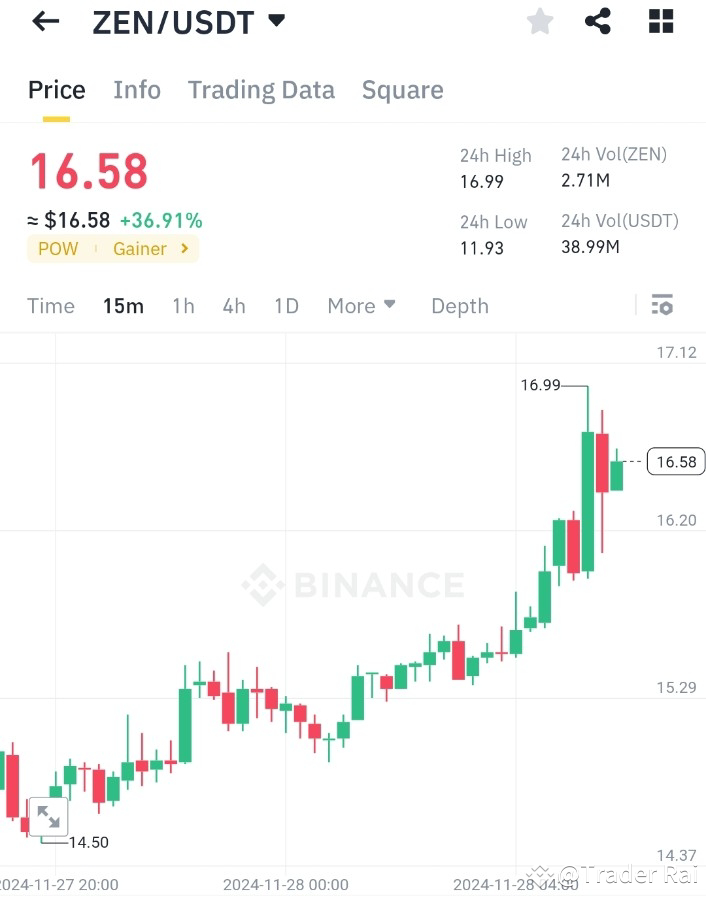

- 🚀 $ZEN /USDT POW 增益 | +36.91% 激增! 💥

- 2024-11-28 12:15:01

-

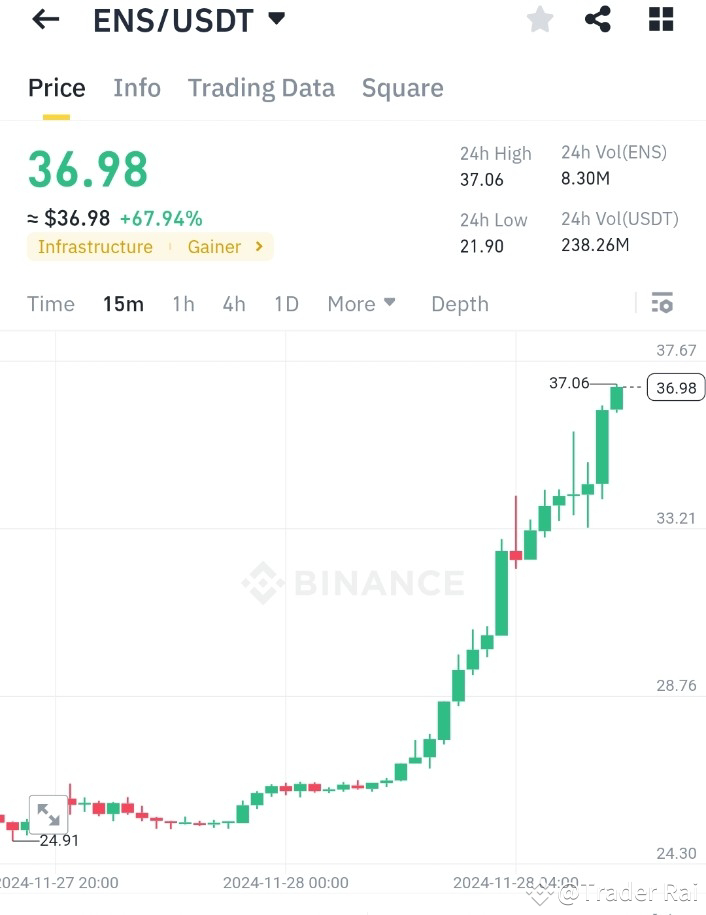

- ENS(以太坊名稱服務)飆升,成為基礎設施的領頭羊 | +67.94% 激增!

- 2024-11-28 12:15:01

- ENS(以太坊名稱服務)以驚人的 67.94% 成長,成為基礎設施成長最快的領域。

-