|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Solana、XRP 和 Dogecoin 等主要山寨幣在 24 小時內大幅下跌,跌幅高達 16%,而 Dogwifhat、Bonk 和 Arbitrum 等不太知名的資產損失更大。山寨幣未平倉合約的下降以及 7.7 億美元槓桿加密貨幣期貨多頭頭寸的清算進一步加劇了市場低迷。許多山寨幣已從近期高點下跌至少 25%,有些跌幅超過 50%。

Cryptocurrency Market Turmoil: Altcoins Plummet, Open Interest and Leveraged Positions Evaporate

加密貨幣市場動盪:山寨幣暴跌,未平倉合約和槓桿部位蒸發

The cryptocurrency market has been rocked by a wave of heavy sell-offs, with a slew of major altcoins experiencing staggering declines of up to 16% within a mere 24-hour period, according to the latest data from CoinMarketCap. Solana, XRP, Dogecoin, Toncoin, Cardano, and Avalanche were among the casualties, with lesser-known names like Dogwifhat, Bonk, and Arbitrum also suffering significant losses.

根據 CoinMarketCap 的最新數據,加密貨幣市場受到一波大幅拋售的衝擊,多種主要山寨幣在短短 24 小時內跌幅高達 16%。 Solana、XRP、Dogecoin、Toncoin、Cardano 和 Avalanche 都受到影響,而較不知名的公司如 Dogwifhat、Bonk 和 Arbitrum 也遭受了重大損失。

The carnage extended beyond the top performers, as open interest in altcoin cryptocurrencies plummeted by a staggering 30%, according to CoinMarketCap. This was compounded by the liquidation of $770 million in leveraged long crypto futures positions, as reported by coinglass.com, sending shockwaves through the already jittery market.

根據 CoinMarketCap 的數據,這場大屠殺不僅限於表現最好的加密貨幣,山寨幣加密貨幣的未平倉部位大幅下降了 30%。根據 coinglass.com 報道,7.7 億美元的槓桿加密貨幣期貨多頭頭寸被清算,這給本已緊張的市場帶來了衝擊,這讓情況變得更加複雜。

The pain was particularly acute for some altcoins, with many losing at least 25% from recent highs. For tokens like Arbitrum and Bonk, the descent was even more precipitous, surpassing 50% losses from their yearly peaks.

對某些山寨幣來說,這種痛苦尤其嚴重,許多山寨幣較近期高點下跌了至少 25%。對於像 Arbitrum 和 Bonk 這樣的代幣來說,下跌幅度更大,較年度高峰跌幅超過 50%。

This tumultuous downturn unfolded on Friday, as open interest in altcoin cryptocurrencies took a nosedive by a whopping 30%. The fallout was further exacerbated by the liquidation of $770 million in leveraged long crypto futures positions, as reported by Coinglass.com.

隨著山寨幣加密貨幣的未平倉合約急劇下降 30%,這場動盪的低迷局面於週五展開。根據 Coinglass.com 報導,7.7 億美元的槓桿加密貨幣期貨多頭部位被清算,進一步加劇了影響。

What's most alarming is the steep decline many of these altcoins have experienced from their recent highs. For some, such as Arbitrum and Bonk, the plunge has been relentless, with losses exceeding 50% from their yearly peaks. Even the more resilient contenders find themselves at least 25% down, signaling a sharp reversal from the euphoria that characterized the beginning of the year.

最令人擔憂的是,許多山寨幣從近期高點經歷了急劇下跌。對於 Arbitrum 和 Bonk 等一些公司來說,暴跌是無情的,與年度高峰相比損失超過 50%。即使是更有韌性的競爭者也發現自己的股價至少下跌了 25%,這表明與年初的樂觀情緒發生了急劇逆轉。

This downward spiral comes on the heels of a period of unprecedented highs and dizzying gains for cryptocurrencies. In the early months of 2024, major altcoins skyrocketed, often doubling or tripling in value, while Bitcoin soared to dizzying new heights. However, as momentum waned and profit-taking took center stage, the once-promising trajectory faltered, leaving investors grappling with uncertainty.

這種螺旋式下降是在加密貨幣經歷了前所未有的高點和令人眼花繚亂的收益之後出現的。 2024 年初,主要山寨幣價格飆升,價值通常翻倍或三倍,而比特幣則飆升至令人眼花撩亂的新高度。然而,隨著勢頭減弱和獲利回吐佔據中心地位,曾經充滿希望的軌跡動搖了,讓投資者面臨不確定性。

The root causes of this market upheaval are complex. Leveraged trading, a double-edged sword that amplifies gains but also magnifies losses, has been a key player in exacerbating volatility. The liquidation of leveraged long crypto futures positions serves as a stark reminder of the risks inherent in such high-stakes maneuvers, with fortunes made and lost in the blink of an eye.

這次市場動盪的根本原因很複雜。槓桿交易是一把雙面刃,既放大收益,也放大損失,一直是加劇波動性的關鍵因素。槓桿加密貨幣期貨多頭頭寸的清算清楚地提醒人們,這種高風險的操作所固有的風險,財富的產生和損失都在眨眼之間。

The sudden downturn was catalyzed by a confluence of factors, with the market grappling with its own volatility. Despite a promising start to 2024, which witnessed a resurgence in Bitcoin and hefty gains for numerous altcoins, the momentum has undeniably waned, giving way to a wave of profit-taking among investors.

突然的低迷是由多種因素共同促成的,市場正努力應對自身的波動性。儘管 2024 年開局良好,見證了比特幣的復甦和眾多山寨幣的大幅上漲,但不可否認的是,這種勢頭已經減弱,引發了投資者的一波獲利了結浪潮。

However, it's not merely a case of investors cashing out and calling it a day. The rise of leverage trading, particularly in futures markets, has introduced a new layer of complexity to an already intricate landscape. As leveraged long positions faced liquidation en masse, the market felt the tremors of cascading sell-offs, amplifying the downward pressure on prices.

然而,這不僅僅是投資者套現並收工的情況。槓桿交易的興起,特別是在期貨市場,為本已錯綜複雜的局面帶來了新的複雜性。隨著槓桿多頭面臨大規模爆倉,市場感受到連續拋售的震懾,加劇了價格下行壓力。

For seasoned traders and newcomers alike, the recent events serve as a stark reminder of the inherent risks associated with cryptocurrencies, often touted as high-beta assets. While the allure of quick gains may be tantalizing, the flip side can be equally unforgiving, as evidenced by Friday's bloodbath.

對於經驗豐富的交易者和新手來說,最近發生的事件清楚地提醒人們,加密貨幣(通常被吹捧為高貝塔資產)存在固有風險。雖然快速收益的誘惑可能很誘人,但另一方面也可能同樣無情,週五的大屠殺證明了這一點。

As investors lick their wounds and reassess their strategies, the broader implications of this sell-off loom large. Will it mark a temporary setback in the relentless march of cryptocurrencies towards mainstream acceptance? Or is it a harbinger of deeper systemic issues yet to be addressed?

當投資者舔舐傷口並重新評估自己的策略時,這次拋售的更廣泛影響日益凸顯。這是否標誌著加密貨幣向主流接受的不懈進軍過程中的暫時挫折?還是這是尚未解決的更深層系統性問題的預兆?

Only time will tell. In the meantime, market participants would do well to tread cautiously, recognizing that fortunes can be made and lost in the blink of an eye in the ever-evolving landscape of digital assets.

只有時間會給出答案。同時,市場參與者最好謹慎行事,因為他們認識到,在不斷變化的數位資產格局中,財富的產生和損失可能在眨眼之間。

As the dust settles and the cryptocurrency market catches its breath, one thing remains abundantly clear: volatility is the name of the game, and only those with nerves of steel and a keen understanding of the market dynamics will emerge victorious in this high-stakes arena.

隨著塵埃落定,加密貨幣市場喘口氣,有一點仍然非常清楚:波動性是遊戲的名稱,只有那些擁有鋼鐵般的意志和對市場動態有敏銳了解的人才能在這個高風險的舞台上取得勝利。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- 俄羅斯將從 2025 年 1 月 1 日起禁止多個地區的比特幣挖礦

- 2024-12-25 14:40:01

- 俄羅斯政府最近宣布,該國多個地區將禁止比特幣開採。該措施將於2025年1月1日開始實施,有效期為6年。

-

- 儘管存在可疑交易和大量 USDC 外流,Hyperliquid (HYPE) 對攻擊索賠不屑一顧

- 2024-12-25 14:40:01

- 12 月 23 日,USDC 大量外流,引發了對網路潛在安全攻擊的擔憂。

-

-

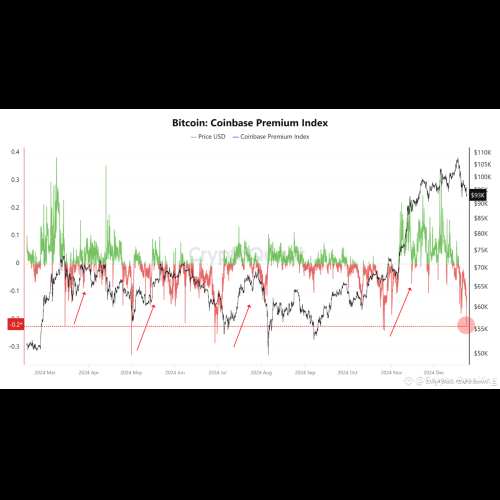

- Quant 表示,比特幣 Coinbase 溢價給出了潛在的買入訊號

- 2024-12-25 14:35:02

- 一位量化分析師解釋了比特幣 Coinbase 溢價指數的最新趨勢如何意味著該資產的買入機會。

-

- 2024年加密產業回顧

- 2024-12-25 14:30:59

- 2024 年對加密產業來說是動盪的一年。比特幣現貨ETF推出,機構加速採用,帶來產業繁榮

-

-

-

- 莫迪總理將在阿塔爾·比哈里·瓦杰帕伊誕辰紀念日為肯貝特瓦河連接工程奠基

- 2024-12-25 14:30:59

- 總理莫迪將在前總理阿塔爾·比哈里·瓦杰帕伊誕辰之際為該國首個肯-貝特瓦河流連接項目在克久拉霍奠基

-

- 萊特幣(LTC)今年平均每日活躍地址顯著增加

- 2024-12-25 14:30:59

- 鏈上數據顯示,今年萊特幣每日活躍地址指標較去年大幅增加。