|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

美國股市和比特幣(BTC)之間的傳染效應可能會繼續影響加密貨幣市場。最近標準普爾 500 指數跌破 50 日移動平均線,引起了投資者的緊張情緒,這可能會蔓延到加密貨幣市場,導致波動性加劇和比特幣價格下跌。

The Contagion Effect: How the S&P 500's Performance Impacts Bitcoin

傳染效應:標準普爾 500 指數的表現如何影響比特幣

The intertwined destinies of US stocks and Bitcoin (BTC) continue to create ripples in the financial market. The recent dip of the S&P 500 below its 50-day moving average has sent shivers down the spines of investors, casting a shadow over the crypto market. How will this development influence the trajectory of Bitcoin?

美股和比特幣(BTC)交織在一起的命運繼續在金融市場上掀起漣漪。最近,標準普爾 500 指數跌破 50 日移動平均線,令投資者感到不寒而栗,給加密貨幣市場蒙上了陰影。這項發展將如何影響比特幣的軌跡?

The S&P 500's Influence on Bitcoin

標準普爾 500 指數對比特幣的影響

The S&P 500's recent breach of its 50-day moving average marks a significant event not witnessed in over five months. This decline, coupled with the mixed performance of US stock indices, has raised red flags for the cryptocurrency market, particularly for Bitcoin.

標準普爾 500 指數最近突破 50 日移動平均線,標誌著五個多月以來未曾發生的重大事件。這種下跌,加上美國股指的好壞參半的表現,給加密貨幣市場(尤其是比特幣)發出了危險信號。

In times of stock market volatility, investors often adopt a cautious approach to their assets. This uncertainty spills over into the crypto realm, affecting digital assets like Bitcoin. As the S&P 500 falters, Bitcoin holders can expect increased volatility. The contagion effect can trigger sell-offs as investors seek to minimize their risk exposure.

在股市波動時期,投資人往往對其資產採取謹慎態度。這種不確定性蔓延到了加密領域,影響了比特幣等數位資產。隨著標普 500 指數下跌,比特幣持有者預計波動性將會加大。由於投資者尋求將風險敞口降至最低,傳染效應可能會引發拋售。

Navigating the Critical Zone for Bitcoin

穿越比特幣的關鍵區域

Bitcoin currently finds itself in a pivotal position. Trading at around $61,950, it has experienced a 3.78% decline in the past 24 hours. This negative trend mirrors the performance of the past seven days, during which the crypto king has shed 10.20% of its value.

比特幣目前處於關鍵地位。交易價格約為 61,950 美元,過去 24 小時內下跌 3.78%。這種負面趨勢反映了過去 7 天的表現,在此期間,加密貨幣之王的價值已縮水 10.20%。

If Bitcoin can maintain its foothold above $60,000, the next crucial threshold lies around $67,000. Historically, this level has proven to be a hurdle for the leading crypto. Breaking through this resistance could signal a renewed confidence in Bitcoin and a potential bullish trajectory.

如果比特幣能夠維持在 6 萬美元以上,那麼下一個關鍵門檻就在 6.7 萬美元左右。從歷史上看,這一水平已被證明是領先加密貨幣的一個障礙。突破這一阻力可能預示著人們對比特幣的新信心和潛在的看漲軌跡。

However, should Bitcoin fall below $60,000, the next support level comes in at approximately $50,000. In such a scenario, Bitcoin's value could experience a rapid decline.

然而,如果比特幣跌破 6 萬美元,下一個支撐位約為 5 萬美元。在這種情況下,比特幣的價值可能會迅速下跌。

The Interplay of Stock Markets and Bitcoin

股票市場和比特幣的相互作用

The relationship between the S&P 500 and Bitcoin is undeniable. As the stock market continues to fluctuate, Bitcoin will inevitably face additional challenges. A prolonged decline in the S&P 500 could further pressure Bitcoin and lead to a potential price drop.

標準普爾 500 指數與比特幣之間的關係是不可否認的。隨著股市的持續波動,比特幣將不可避免地面臨額外的挑戰。標準普爾 500 指數的長期下跌可能會進一步給比特幣帶來壓力,並導致潛在的價格下跌。

Conversely, a rebound in stock markets could provide a much-needed boost to the leading crypto. Bitcoin may have the opportunity to regain its losses and potentially reach new highs.

相反,股市的反彈可能為領先的加密貨幣提供急需的提振。比特幣可能有機會收復失地並可能創下新高。

Conclusion: Navigating Market Volatility

結論:應對市場波動

The interplay between the S&P 500 and Bitcoin underscores the interconnectedness of financial markets. Investors must remain aware of the potential contagion effect and adjust their strategies accordingly. While Bitcoin's price may experience fluctuations in the short term, its long-term potential remains intact. By understanding the market dynamics and adopting a balanced approach, investors can navigate the complexities of the cryptocurrency landscape and potentially reap the rewards of Bitcoin's growth.

標準普爾 500 指數與比特幣之間的相互作用凸顯了金融市場的相互關聯性。投資人必須時時意識到潛在的傳染效應,並隨之調整策略。儘管比特幣的價格短期內可能會出現波動,但其長期潛力仍然完好無損。透過了解市場動態並採取平衡的方法,投資者可以應對加密貨幣領域的複雜性,並有可能獲得比特幣成長的回報。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

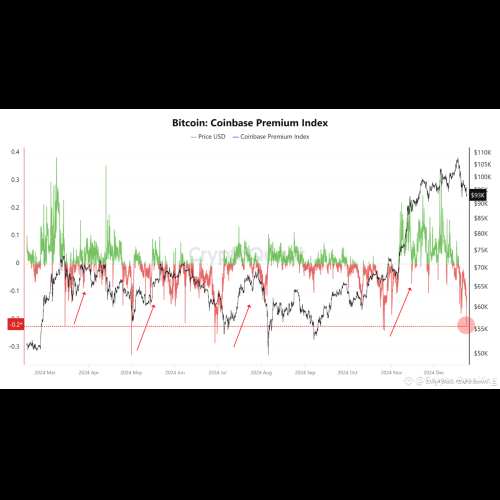

- Quant 表示,比特幣 Coinbase 溢價給出了潛在的買入訊號

- 2024-12-25 14:35:02

- 一位量化分析師解釋了比特幣 Coinbase 溢價指數的最新趨勢如何意味著該資產的買入機會。

-

- 2024年加密產業回顧

- 2024-12-25 14:30:59

- 2024 年對加密產業來說是動盪的一年。比特幣現貨ETF推出,機構加速採用,帶來產業繁榮

-

-

-

- 莫迪總理將在阿塔爾·比哈里·瓦杰帕伊誕辰紀念日為肯貝特瓦河連接工程奠基

- 2024-12-25 14:30:59

- 總理莫迪將在前總理阿塔爾·比哈里·瓦杰帕伊誕辰之際為該國首個肯-貝特瓦河流連接項目在克久拉霍奠基

-

- 萊特幣(LTC)今年平均每日活躍地址顯著增加

- 2024-12-25 14:30:59

- 鏈上數據顯示,今年萊特幣每日活躍地址指標較去年大幅增加。

-

-

- 由於停產和競爭壓力,豐田 11 月全球銷量停滯不前

- 2024-12-25 14:30:59

- (彭博)—由於需求低迷加上兩家工廠暫停生產,豐田汽車公司 11 月的全球銷售趨於穩定。

-