|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CryptoBlackRock 的代幣化基金建立在以太坊區塊鏈上,自成立以來已籌集 2.4 億美元。這些基金代幣稱為 BUIDL,每個價值 1 美元,可以在批准的數位錢包之間轉移。該基金投資於現金、美國國庫券和回購協議,代幣持有者在區塊鏈上獲得其股份的所有權。

Will BlackRock's Tokenized Fund Reach Its Potential?

貝萊德的代幣化基金會發揮其潛力嗎?

BlackRock's venture into the tokenized fund space has generated buzz, reportedly amassing a sizeable $240 million since its inception. This fund, built upon the Ethereum blockchain, operates by assigning share ownership through a digital token called BUIDL, valued at $1 apiece.

貝萊德進軍代幣化基金領域引起了轟動,據報道自成立以來已籌集了 2.4 億美元的資金。該基金建立在以太坊區塊鏈上,透過一種名為 BUIDL 的數位代幣分配股權來運作,每個代幣價值 1 美元。

What's the Catch with Tokenization?

代幣化有什麼問題?

The ability to transfer these fund tokens between approved digital wallets raises questions about accessibility and the potential for volatility. Securitize, BlackRock's partner in this endeavor, ensures that only verified wallets can participate in these transactions.

在批准的數位錢包之間轉移這些基金代幣的能力引發了有關可訪問性和潛在波動性的問題。貝萊德在這項努力中的合作夥伴 Securitize 確保只有經過驗證的錢包才能參與這些交易。

Is the Future Tokenized?

未來是通證化的嗎?

BlackRock's foray into tokenization is a step toward modernizing the financial landscape. The liquidity of the fund, which invests in cash, U.S. Treasury bills, and repurchase agreements, could appeal to investors looking for an alternative to traditional money-market funds.

貝萊德進軍代幣化是邁向金融格局現代化的一步。該基金投資於現金、美國國債和回購協議,其流動性可能會吸引尋求傳統貨幣市場基金替代品的投資者。

Diversification or Niche Investment?

多元化還是利基投資?

The fund's focus on traditional assets raises questions about its role in diversifying portfolios. While it may offer an additional layer of exposure to digital assets, it remains tied to the performance of more conventional investments.

該基金對傳統資產的關注引發了對其在投資組合多元化方面的作用的質疑。雖然它可能會提供額外的數位資產風險敞口,但它仍然與更傳統投資的表現掛鉤。

Limited Accessibility or a Step Forward?

有限的可訪問性還是向前邁出了一步?

The restriction of token trading to approved wallets limits the fund's accessibility. This raises questions about whether such exclusivity will hinder its growth potential and appeal to a wider investor base.

代幣交易僅限於經批准的錢包,這限制了基金的可訪問性。這引發了這樣的疑問:這種排他性是否會阻礙其成長潛力並吸引更廣泛的投資者基礎。

The Bottom Line:

底線:

BlackRock's tokenized fund presents a novel approach to money-market investing, offering the potential for increased liquidity and digital asset exposure. However, the fund's accessibility, volatility concerns, and diversification benefits remain key factors to consider before making an investment decision.

貝萊德的代幣化基金提出了一種新穎的貨幣市場投資方法,提供了增加流動性和數位資產曝險的潛力。然而,基金的可獲取性、波動性問題和多元化收益仍然是做出投資決策之前需要考慮的關鍵因素。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

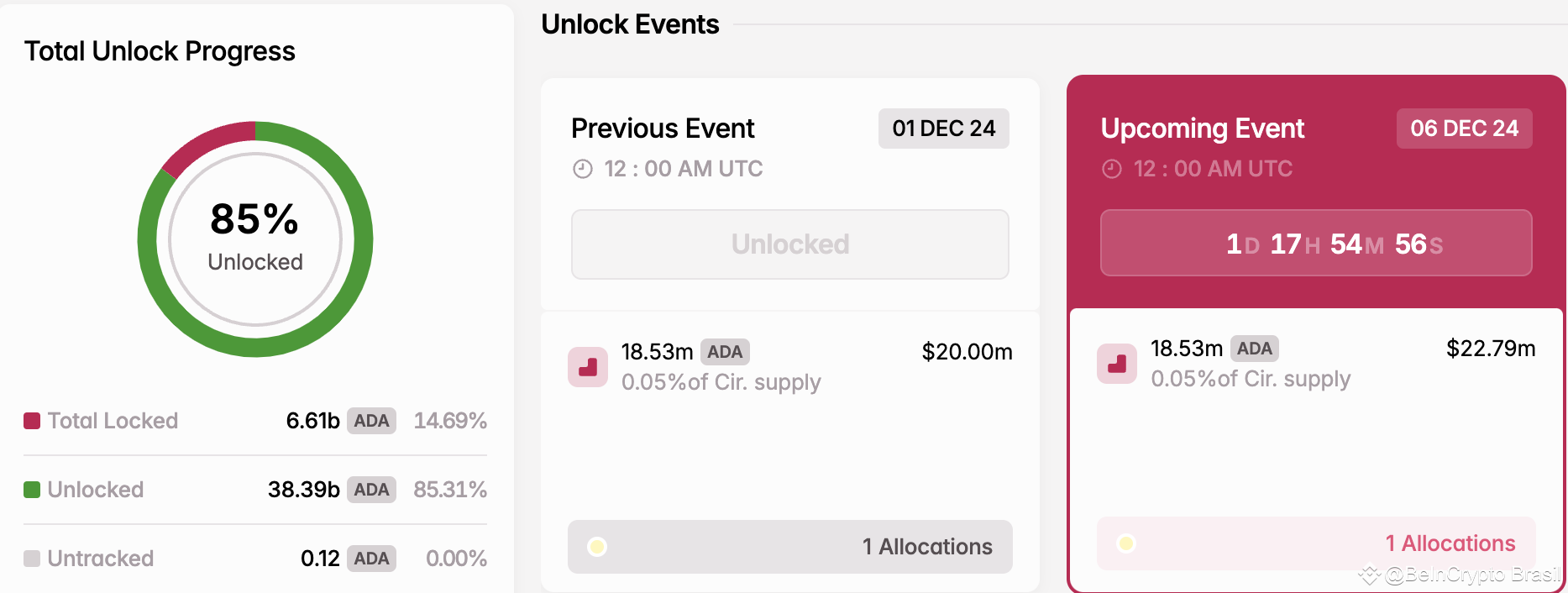

- 鯨魚在代幣解鎖前出售卡爾達諾(ADA)—分析

- 2024-12-05 02:30:02

- 卡爾達諾 (ADA) 鯨魚在過去 30 天內推動加密貨幣價格上漲 270%,現在在 ADA 解鎖之前拋售

-

-

-

- BRP 在魁北克省的三個工廠解雇了 120 名工人和管理人員

- 2024-12-05 02:25:02

- BRP Inc. 表示,其魁北克三處工廠已解僱 120 多名工人和管理人員。

-

- 俄羅斯總統弗拉基米爾·普丁表示“沒有人可以禁止比特幣”

- 2024-12-05 02:25:02

- 在“俄羅斯的召喚!”在莫斯科投資論壇上,普丁總統談到了比特幣作為支付手段的作用。

-

-

-

-