|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

貝萊德透過以太坊網路上的機構數位流動性基金大膽擁抱代幣化,為潛在的資產革命鋪平了道路。此舉標誌著貝萊德致力於為機構投資者利用區塊鏈技術,為參與代幣化資產提供每日收益支付的獨特機會。

BlackRock Embraces Tokenization with Institutional Digital Liquidity Fund

貝萊德透過機構數位流動性基金擁抱代幣化

Is BlackRock Paving the Way for Tokenized Asset Revolution?

貝萊德是否正在為代幣化資產革命鋪路?

BlackRock's latest venture into the world of tokenization has garnered significant attention. The launch of the BlackRock USD Institutional Digital Liquidity Fund on the Ethereum network marks a bold move by the asset management giant to embrace the transformative power of blockchain technology. The fund, represented by the blockchain-based BUIDL token, offers investors a unique opportunity to participate in the tokenized asset market, providing daily yield payouts through blockchain rails.

貝萊德進軍代幣化領域的最新舉措引起了廣泛關注。在以太坊網路上推出貝萊德美元機構數位流動性基金,標誌著這家資產管理巨頭擁抱區塊鏈技術變革力量的大膽舉措。該基金以基於區塊鏈的 BUIDL 代幣為代表,為投資者提供了參與代幣化資產市場的獨特機會,透過區塊鏈軌道提供每日收益支付。

Strategic Partnerships for Operational Excellence

卓越營運的策略夥伴關係

To ensure the smooth operation of the fund, BlackRock has partnered with industry leaders Securitize, BNY Mellon, Anchorage Digital Bank NA, BitGo, Coinbase, and Fireblocks. This collaboration brings together a wealth of expertise in asset tokenization, custody, and security, ensuring the fund's stability and efficiency.

為了確保基金的順利運營,貝萊德與行業領導者 Securitize、紐約梅隆銀行、Anchorage Digital Bank NA、BitGo、Coinbase 和 Fireblocks 合作。此次合作匯集了資產代幣化、託管和安全方面豐富的專業知識,確保了基金的穩定性和效率。

BlackRock's Investment in Securitize: A Strategic Gambit

貝萊德對證券化的投資:策略策略

In a strategic move, BlackRock has invested in Securitize, a leading asset tokenization platform. This investment underscores BlackRock's commitment to exploring the vast potential of tokenization. Robert Mitchnick, BlackRock's Head of Digital Assets, has expressed enthusiasm about the collaboration, highlighting the company's dedication to developing solutions that address real-world challenges faced by its clients.

作為一項策略性舉措,貝萊德投資了領先的資產代幣化平台 Securitize。這項投資凸顯了貝萊德致力於探索代幣化巨大潛力的承諾。貝萊德數位資產主管 Robert Mitchnick 對這項合作表示了熱情,強調該公司致力於開發解決方案來解決客戶面臨的現實挑戰。

BlackRock's Leadership in Tokenization

貝萊德在代幣化領域的領導地位

BlackRock's foray into tokenization aligns with a growing trend among traditional financial institutions. Citi, Franklin Templeton, and JPMorgan have all recognized the transformative potential of blockchain technology in tokenizing real-world assets (RWA). This convergence of digital assets and traditional finance is opening up new investment opportunities and bridging the gap between the two realms.

貝萊德進軍代幣化領域與傳統金融機構日益增長的趨勢一致。花旗、富蘭克林鄧普頓和摩根大通都認識到區塊鏈技術在現實世界資產(RWA)代幣化方面的變革潛力。數位資產和傳統金融的整合正在開啟新的投資機會,並彌合兩個領域之間的差距。

Tokenized U.S. Treasuries: A Growing Market

代幣化的美國國債:一個不斷成長的市場

Tokenized U.S. Treasuries have emerged as a compelling use case for blockchain technology. The market for these tokenized assets has experienced exponential growth, with its value soaring from $100 million in early 2023 to an impressive $730 million today. Cryptocurrency firms are particularly attracted to the potential of tokenized U.S. Treasuries, seeking to generate yield from their on-chain funds.

代幣化的美國國債已成為區塊鏈技術引人注目的用例。這些代幣化資產的市場經歷了指數級增長,其價值從 2023 年初的 1 億美元飆升至如今的 7.3 億美元。加密貨幣公司特別被代幣化美國國債的潛力所吸引,尋求從其鏈上基金中產生收益。

BlackRock's Vision for Tokenization

貝萊德的代幣化願景

BlackRock's CEO, Larry Fink, has previously hinted at the company's interest in tokenization. In an interview with CNBC, Fink described the company's spot BTC ETF as "stepping stones towards tokenization." This statement reflects BlackRock's forward-thinking approach and its recognition of the immense potential that tokenization holds for the future of finance.

貝萊德執行長拉里·芬克先前曾暗示該公司對代幣化的興趣。在接受 CNBC 採訪時,芬克將該公司的現貨 BTC ETF 描述為「邁向代幣化的墊腳石」。這項聲明反映了貝萊德的前瞻性思維方法及其對代幣化對金融未來的巨大潛力的認識。

Conclusion: BlackRock's Role in Shaping the Tokenized Future

結論:貝萊德在塑造代幣化未來的作用

BlackRock's launch of the tokenized asset fund on the Ethereum network is a significant step in the integration of digital assets into the traditional financial landscape. With its innovative approach, strategic partnerships, and commitment to addressing client needs, BlackRock is positioning itself as a leading player in the exploration of tokenization's possibilities. As the tokenization market continues to evolve, it will be fascinating to witness BlackRock's role in shaping its future trajectory.

貝萊德在以太坊網路上推出代幣化資產基金,是數位資產融入傳統金融格局的重要一步。憑藉其創新方法、策略合作夥伴關係以及對滿足客戶需求的承諾,貝萊德將自己定位為探索代幣化可能性的領先參與者。隨著代幣化市場的不斷發展,見證貝萊德在塑造其未來發展軌跡中所扮演的角色將是一件令人著迷的事情。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

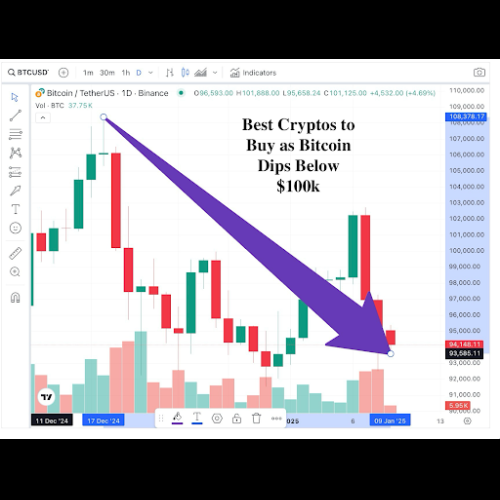

- 10 萬美元以下最適合用比特幣購買的 5 種加密貨幣

- 2025-01-09 17:25:24

- 比特幣跌破 10 萬美元大關令大多數人感到意外,因為就在加密貨幣重新奪回黃金價值幾天后

-

-

-