|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

比特幣艱難復甦,面臨 63,000 美元的阻力。跌破 6 萬美元支撐位可能會引發大幅下跌。技術指標顯示看跌勢頭,MACD 位於看跌區域,RSI 低於 50。明確突破 64,200 美元或收盤低於 60,000 美元將決定下一個方向偏差。

Bitcoin's Struggle for Recovery: Market Volatility Persists

比特幣復甦之路:市場波動持續

October 10, 2021 - Bitcoin, the world's most prominent cryptocurrency, continues to face headwinds in its attempt to regain lost ground, hovering below a key resistance zone that has proven difficult to breach.

2021 年 10 月 10 日 - 世界上最著名的加密貨幣比特幣在試圖收復失地的過程中繼續面臨阻力,徘徊在已被證明難以突破的關鍵阻力區下方。

Failed Recovery Attempt

恢復嘗試失敗

After a brief surge that briefly pushed it above $64,000, Bitcoin has encountered significant resistance at $63,000, failing to sustain its momentum. This rejection has triggered a sharp decline that has dragged the price below the $62,800 mark and the 100 hourly Simple Moving Average.

在短暫上漲並短暫突破 64,000 美元之後,比特幣在 63,000 美元處遇到了重大阻力,未能維持其勢頭。這一拒絕引發了大幅下跌,導致價格跌破 62,800 美元大關和 100 小時簡單移動平均線。

Technical Analysis

技術分析

On the hourly chart, the price action has breached a connecting bullish trend line with support at $62,400. This technical indicator suggests that further downward pressure may be imminent. Immediate resistance lies at $62,000, while the 50% Fibonacci retracement level of the recent decline from $64,142 to $59,666 serves as a potential barrier to recovery.

在小時圖上,價格走勢已突破連接看漲趨勢線,支撐位為 62,400 美元。此技術指標顯示進一步的下行壓力可能迫在眉睫。直接阻力位於 62,000 美元,而近期從 64,142 美元跌至 59,666 美元的 50% 斐波那契回檔位是復甦的潛在障礙。

Immediate Support

即時支援

If the price fails to regain traction above $62,000, immediate support is anticipated at $60,800. A break below this level could open the door to a decline towards $60,000, a psychologically significant level that has served as a support base in the past.

如果價格未能重新回到 62,000 美元上方,預計立即支撐位為 60,800 美元。跌破該水平可能會打開跌向 60,000 美元的大門,這是一個重要的心理水平,過去一直是支撐基礎。

Longer-Term Outlook

長期展望

Beyond these immediate price levels, Bitcoin faces further resistance at $63,000, $64,200, and $66,500. A decisive move above these zones would signal a renewed bullish momentum that could potentially propel the price towards $67,500.

除了這些直接價格水平之外,比特幣還面臨 63,000 美元、64,200 美元和 66,500 美元的進一步阻力。突破這些區域的決定性走勢將標誌著新的看漲勢頭,可能將價格推向 67,500 美元。

Technical Indicators

技術指標

The Hourly Moving Average Convergence Divergence (MACD) indicator suggests that bearish momentum is gaining traction, while the Hourly Relative Strength Index (RSI) has fallen below the 50 level, indicating that selling pressure is intensifying.

每小時移動平均線收斂分歧(MACD)指標顯示看跌勢頭正在增強,而每小時相對強弱指數(RSI)已跌破50水平,顯示賣壓正在加劇。

Investment Disclaimer

投資免責聲明

It is crucial to note that cryptocurrency markets are highly volatile and unpredictable. The information provided in this article should not be construed as investment advice. Investors should conduct their own research and consult with qualified professionals before making any investment decisions involving cryptocurrencies.

值得注意的是,加密貨幣市場高度波動且不可預測。本文提供的資訊不應被視為投資建議。在做出任何涉及加密貨幣的投資決策之前,投資者應進行自己的研究並諮詢合格的專業人士。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

- 俄羅斯將從 2025 年 1 月 1 日起禁止多個地區的比特幣挖礦

- 2024-12-25 14:40:01

- 俄羅斯政府最近宣布,該國多個地區將禁止比特幣開採。該措施將於2025年1月1日開始實施,有效期為6年。

-

- 儘管存在可疑交易和大量 USDC 外流,Hyperliquid (HYPE) 對攻擊索賠不屑一顧

- 2024-12-25 14:40:01

- 12 月 23 日,USDC 大量外流,引發了對網路潛在安全攻擊的擔憂。

-

-

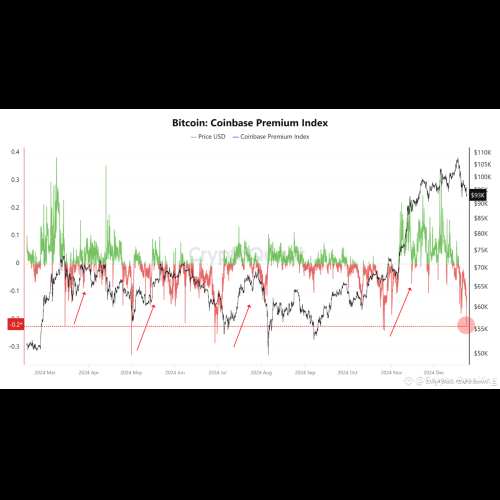

- Quant 表示,比特幣 Coinbase 溢價給出了潛在的買入訊號

- 2024-12-25 14:35:02

- 一位量化分析師解釋了比特幣 Coinbase 溢價指數的最新趨勢如何意味著該資產的買入機會。

-

- 2024年加密產業回顧

- 2024-12-25 14:30:59

- 2024 年對加密產業來說是動盪的一年。比特幣現貨ETF推出,機構加速採用,帶來產業繁榮

-

-

-

- 莫迪總理將在阿塔爾·比哈里·瓦杰帕伊誕辰紀念日為肯貝特瓦河連接工程奠基

- 2024-12-25 14:30:59

- 總理莫迪將在前總理阿塔爾·比哈里·瓦杰帕伊誕辰之際為該國首個肯-貝特瓦河流連接項目在克久拉霍奠基

-

- 萊特幣(LTC)今年平均每日活躍地址顯著增加

- 2024-12-25 14:30:59

- 鏈上數據顯示,今年萊特幣每日活躍地址指標較去年大幅增加。