|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

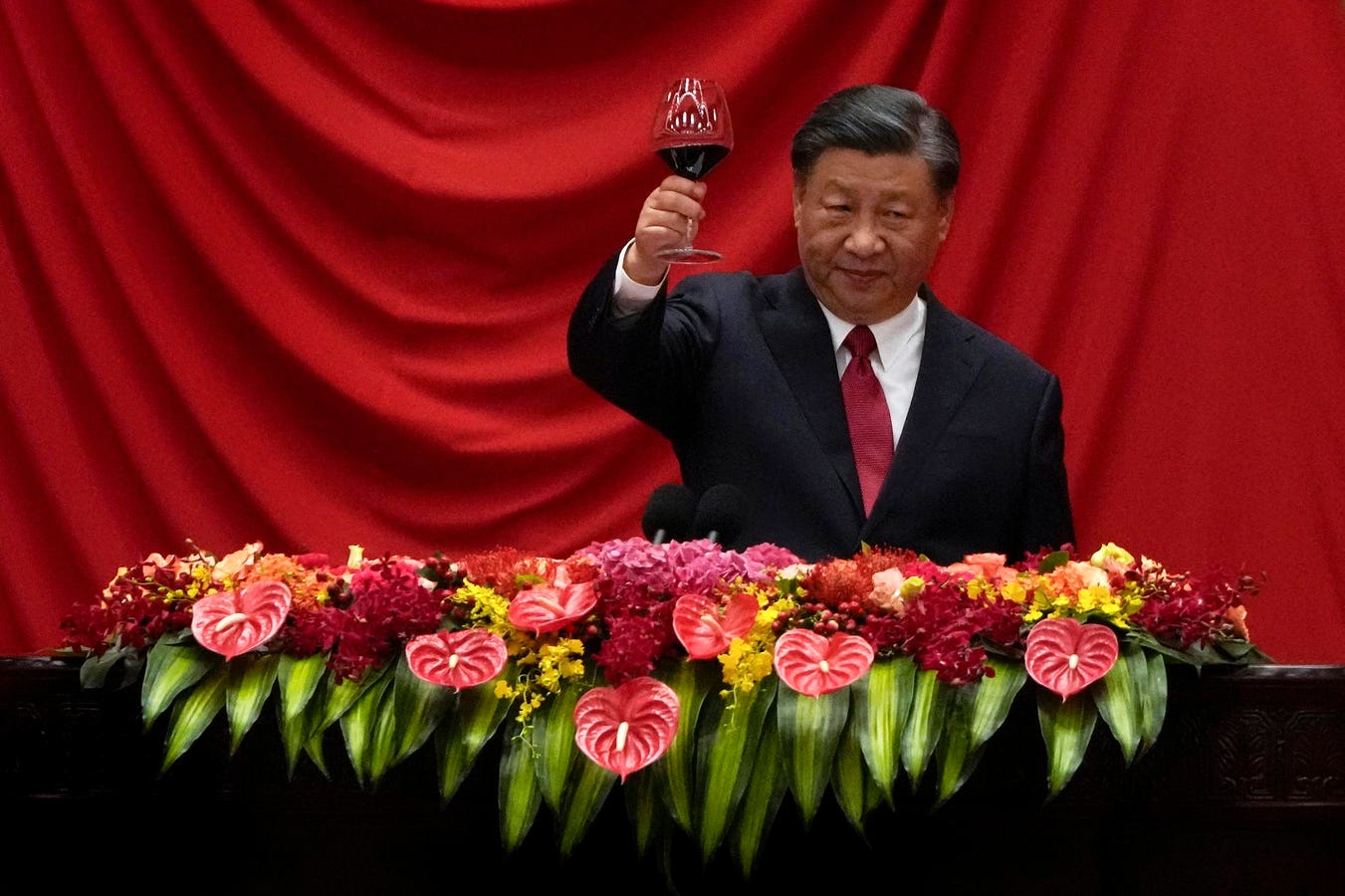

中國國家主席習近平監督了中國對比特幣和加密貨幣的打擊,這對比特幣、以太坊、瑞波幣和其他主要加密貨幣的價格造成了壓力。

This week, G7 leaders are set to warn small banks in China over their Russia ties after sanctions have "stoked the use of underground financing channels or banned cryptocurrency," according to Reuters.

根據路透社報道,本週,七國集團領導人將就與俄羅斯的關係對中國的小銀行發出警告,此前製裁「助長了地下融資管道的使用或禁止加密貨幣」。

During this week's G7 meeting of wealthy democracies in Italy, leaders will reportedly send a tough new warning to China's small banks to stop helping Russia evade Western sanctions, with meetings set to focus on the threat posed by burgeoning Chinese-Russian trade to the war in Ukraine.

據報道,本週在義大利舉行的七國集團(G7)富裕民主國家會議期間,領導人將向中國的小型銀行發出新的嚴厲警告,要求其停止幫助俄羅斯逃避西方制裁,會議重點討論中俄貿易蓬勃發展對戰爭的威脅。

In April, it was reported that after China's big banks pulled back from financing Russia-related transactions, some China companies have turned to small banks on the border and cryptocurrency.

今年4月,有報告指出,在中國大銀行退出對俄羅斯相關交易的融資後,一些中國企業轉向邊境小型銀行和加密貨幣。

"Our concern is that China is increasingly the factory of the U.S. war machine. You can call it the arsenal of autocracy when you consider Russia's military ambitions, which obviously threaten the existence of Ukraine, but increasingly European security, NATO and transatlantic security," Daleep Singh, deputy national security adviser for international economics, was quoted as saying by Reuters.

「我們擔心的是,中國日益成為美國戰爭機器的工廠。當你考慮到俄羅斯的軍事野心時,你可以稱其為獨裁政權的軍火庫,這顯然威脅到烏克蘭的存在,但也日益威脅到歐洲安全、北約和跨大西洋安全,」路透社引述負責國際經濟的副國家安全顧問達利普·辛格的話說。

Following the implementation of U.S.-led Western sanctions on Russia in the aftermath of its invasion of Ukraine, bitcoin and crypto were touted by some as a potential way to evade the strict financial rules.

在俄羅斯入侵烏克蘭後,以美國為首的西方國家對其實施制裁,比特幣和加密貨幣被一些人吹捧為逃避嚴格金融規則的潛在方式。

Last month, attendees of a Hong Kong bitcoin conference sparked speculation the much-hyped Hong Kong spot bitcoin ETFs could eventually be opened up to mainland China investors.

上個月,香港比特幣會議的與會者引發了人們的猜測,大肆宣傳的香港現貨比特幣 ETF 最終可能會向中國大陸投資者開放。

"I think Hong Kong is leading the way in many respects," Pierce said. "I think the main opportunity in Hong Kong is in [traditional finance], and that's where a Hong Kong digital dollar stablecoin has great potential."

「我認為香港在很多方面都處於領先地位,」皮爾斯說。 “我認為香港的主要機會在於[傳統金融],而這正是香港數位美元穩定幣具有巨大潛力的領域。”

Pierce added that China's supply chain advantage means "there's clearly a very big opportunity that exists [in Hong Kong]."

皮爾斯補充說,中國的供應鏈優勢意味著“[香港]顯然存在一個非常大的機會。”

This week, there were further signs Hong Kong and China are gradually warming back up to bitcoin and crypto, with Dubai-based crypto exchange Bybit announcing it will allow Chinese nationals living overseas to open accounts and trade crypto.

本週,有更多跡象顯示香港和中國大陸正在逐漸回暖比特幣和加密貨幣,總部位於杜拜的加密貨幣交易所 Bybit 宣布將允許居住在海外的中國公民開設帳戶和交易加密貨幣。

"Bybit, one of the world's top three crypto exchanges by volume, is pleased to announce the expansion of our service offerings to the overseas Chinese community," the company said in a statement. "This move is in response to the growing demand for secure, reliable, and user-friendly cryptocurrency trading platforms among Chinese expatriates and international Chinese communities."

該公司在一份聲明中表示:“按交易量計算,全球三大加密貨幣交易所之一的Bybit很高興宣布擴大我們向海外華人社區提供的服務。” “此舉是為了滿足中國僑民和國際華人社區對安全、可靠和用戶友好的加密貨幣交易平台日益增長的需求。”

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

-

-

- 本週最值得購買的 7 種加密貨幣:Qubetics 作為資產代幣化的後起之秀引領潮流

- 2024-11-25 04:25:02

- 在數位經濟以閃電般的速度成長的世界中,本週尋找最佳加密貨幣的競賽正在升溫。

-

-

-

-

-

- 意外的全球事件引發辯論:揭露隱藏的真相及其對我們世界的影響

- 2024-11-25 04:20:01

- 在一場席捲全球的重大事件發生後,關於其未見的後果和它所揭示的更深層次的真相,許多問題仍然存在。

-