|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

隨著比特幣 (BTC) 的價格逐漸接近 10 萬美元的心理里程碑,其對衍生性商品市場的影響正成為焦點。

As Bitcoin’s (BTC) price edges closer to the psychological milestone of $100,000, its impact on derivatives markets is becoming a key focus. While retail investors celebrate such milestones, the real significance lies in the institutional adoption and evolution of Bitcoin’s derivatives infrastructure.

隨著比特幣 (BTC) 的價格逼近 10 萬美元的心理里程碑,其對衍生性商品市場的影響正成為焦點。儘管散戶慶祝這些里程碑,但真正的意義在於比特幣衍生性商品基礎設施的機構採用和演變。

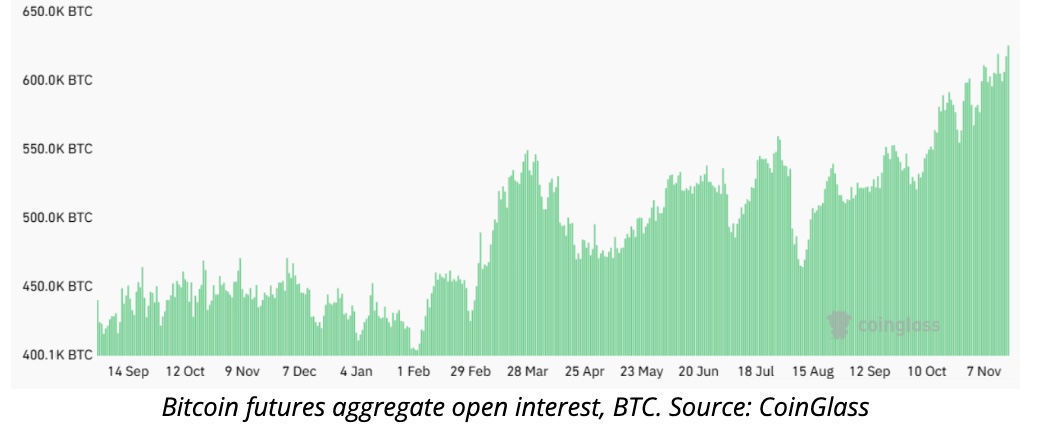

Currently, Bitcoin (BTC) futures open interest stands at 626,520 BTC ($58 billion), a 15% increase over the past two months, according to CoinGlass. If Bitcoin (BTC) hits $100,000, this open interest could climb to $62.5 billion, representing 3.1% of Bitcoin’s projected $2 trillion market cap. Comparatively, the S&P 500 futures open interest of $817 billion constitutes only 1.9% of its $43 trillion market cap, highlighting Bitcoin’s (BTC) disproportionate derivatives activity relative to traditional assets.

根據 CoinGlass 的數據,目前比特幣 (BTC) 期貨未平倉合約為 626,520 BTC(580 億美元),比過去兩個月增加了 15%。如果比特幣 (BTC) 達到 10 萬美元,未平倉合約可能會攀升至 625 億美元,佔比特幣預計 2 兆美元市值的 3.1%。相比之下,標準普爾 500 指數期貨未平倉合約為 8,170 億美元,僅佔其 43 兆美元市值的 1.9%,突顯比特幣 (BTC) 的衍生性活動相對於傳統資產不成比例。

This dynamic underscores the growing institutional interest in Bitcoin futures, especially as spot Bitcoin ETFs and ETF options prepare to enter the market. These products are expected to create new pathways for institutional players, enabling advanced strategies like covered calls and liquidity risk hedging.

這種動態凸顯了機構對比特幣期貨日益增長的興趣,特別是在現貨比特幣 ETF 和 ETF 選擇權準備進入市場之際。這些產品預計將為機構參與者創造新的途徑,以實現備兌買權和流動性風險對沖等先進策略。

Institutional interest is pivotal in transforming Bitcoin’s (BTC) $100,000 milestone into a meaningful derivatives market expansion. Recent regulatory developments, including approvals for spot Bitcoin ETF options, mark progress but remain insufficient deeper integration into traditional financial markets.

機構利益對於將比特幣 (BTC) 的 10 萬美元里程碑轉變為有意義的衍生性商品市場擴張至關重要。最近的監管進展,包括批准現貨比特幣 ETF 選擇權,標誌著進展,但仍不足以更深入地融入傳統金融市場。

Historical examples illustrate the challenge of adoption. The CBOE discontinued its Bitcoin futures offering in 2019 due to low demand, emphasizing the need for sustained institutional engagement. Spot ETFs, particularly those offering in-kind creation, could bridge this gap, attracting institutional investors who view Bitcoin as a reserve asset.

歷史例子說明了採用的挑戰。由於需求低迷,芝加哥選擇權交易所於 2019 年停止了比特幣期貨發行,強調需要機構持續參與。現貨ETF,特別是那些提供實體ETF的ETF,可以彌補這一差距,吸引將比特幣視為儲備資產的機構投資者。

Several developments could catalyze Bitcoin’s rise and derivatives market expansion:

一些發展可能會促進比特幣的崛起和衍生性商品市場的擴張:

Corporate Bitcoin Allocation: Microsoft shareholders recently voted on allocating funds to Bitcoin (BTC), signaling growing acceptance among influential corporate players. Such moves could pressure other corporations to consider similar strategies.

企業比特幣配置:微軟股東最近投票決定將資金分配給比特幣(BTC),這表明有影響力的企業參與者的接受度越來越高。此類舉措可能會迫使其他公司考慮類似的策略。

Strategic Bitcoin Reserve: U.S. Senator Cynthia Lummis has proposed converting Treasury gold certificates into Bitcoin, aiming to acquire 1 million BTC—5% of the total supply—as a 20-year reserve. This initiative could solidify Bitcoin’s role as a reserve asset and spur broader institutional interest.

比特幣戰略儲備:美國參議員 Cynthia Lummis 提議將財政部黃金憑證轉換為比特幣,目標是購買 100 萬枚 BTC(佔總供應量的 5%)作為 20 年儲備。這項措施可以鞏固比特幣作為儲備資產的作用,並激發更廣泛的機構利益。

Bitcoin’s derivatives markets are likely to expand as a result of broader adoption rather than drive it directly. Institutional and retail fears of fiat debasement remain the primary drivers pushing Bitcoin higher. Research by Lyn Alden correlates Bitcoin’s price with the global M2 money supply, reinforcing its appeal as a hedge against monetary debasement.

比特幣的衍生性商品市場可能會因更廣泛的採用而擴大,而不是直接推動它。機構和散戶對法定貨幣貶值的擔憂仍然是推動比特幣走高的主要動力。 Lyn Alden 的研究將比特幣的價格與全球 M2 貨幣供應量聯繫起來,增強了其作為對沖貨幣貶值的吸引力。

As Bitcoin solidifies its role in institutional portfolios, a mature and liquid derivatives market will emerge organically, serving as a reflection of its broader adoption and acceptance in traditional finance.

隨著比特幣在機構投資組合中的作用得到鞏固,一個成熟且流動性強的衍生性商品市場將有機出現,這反映了比特幣在傳統金融中更廣泛的採用和接受度。

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- LivePeer將於4月7日舉行社區電話,重點介紹其鏈財政部的治理,資金和戰略方向。

- 2025-04-03 10:35:13

- LivePeer是一項分散的協議,利用以太坊區塊鏈使視頻處理領域民主化。

-

-

- PI網絡未能列入二手列表

- 2025-04-03 10:30:12

- 當Binance列出倡議的投票開始時,該交易所已第二次轉移了PI網絡。

-

-

-

-

-

- 隨著鯨魚的積累,比特幣(BTC)所有權動態變化,較小的持有人卸載

- 2025-04-03 10:20:12

- 來自加密分析公司玻璃節的數據揭示了比特幣(BTC)所有權動態的重大變化。

-