|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

隨著加密貨幣市場在關鍵支持區附近穩定下來,貿易商和投資者密切關注即將舉行的“解放日”活動,定於4月2日

As the cryptocurrency market navigates a period of stability close to crucial support zones, traders and investors are closely following the upcoming “Liberation Day” event on April 2.

隨著加密貨幣市場在接近關鍵的支持區域的穩定時期導航時,交易者和投資者在4月2日即將舉行的“解放日”活動之後緊隨其後。

This event, spearheaded by former U.S. President Donald Trump, is expected to feature the introduction of new policy directives and tariff measures, which could have a broad impact on market volatility across risk assets, including Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP).

這項事件由前美國總統唐納德·特朗普(Donald Trump)率領,預計將引入新的政策指令和關稅措施,這可能會對跨風險資產的市場波動產生廣泛的影響,包括比特幣(BTC),以太坊(ETH)和Ripple(XRP)。

Bitcoin Could See $90,000 If 200-Day EMA Holds

如果200天EMA持有,比特幣可能會看到90,000美元

Bitcoin, the world’s leading cryptocurrency, is currently trading at around $86,766 after successfully reclaiming its 200-day Exponential Moving Average (EMA) at $85,556 earlier this week.

世界領先的加密貨幣比特幣在本週早些時候成功地收回了200天的指數移動平均值(EMA),目前的交易價格約為86,766美元。

The digital asset has seen a 4.4% increase over the last three sessions, although bullish momentum remains moderate ahead of key macroeconomic catalysts.

儘管看漲的動量在關鍵的宏觀經濟催化劑之前,數字資產比過去三個會議增長了4.4%。

From a technical standpoint, Bitcoin’s daily chart shows a slight buildup of buying pressure. The Relative Strength Index (RSI) stands at 51, placing it slightly above the neutral midpoint and indicating moderate bullish momentum.

從技術角度來看,比特幣的每日圖表顯示出略有購買壓力。相對強度指數(RSI)為51,將其略高於中性中點,表明中度的看漲勢頭。

Moreover, the Moving Average Convergence Divergence (MACD) indicator has recently shown a bullish crossover, with green histogram bars forming above the zero line, suggesting a potential continuation of upward movement.

此外,移動平均收斂差異(MACD)指標最近顯示了看漲的交叉,綠色直方圖桿在零線以上形成,這表明向上運動的潛在延續。

If BTC manages to hold above its 200-day EMA, it could continue its recovery and test the psychological resistance at $90,000. A successful daily close above this level would pave the way for a further rally toward the March 2 swing high at $95,000.

如果BTC設法超過200天EMA,則可以繼續恢復並測試心理阻力為90,000美元。超過此水平的每日成功接近,將為3月2日鞦韆的進一步集會鋪平道路,為95,000美元。

However, failure to maintain support at the 200-day EMA could result in a bearish reversal, exposing Bitcoin to increased downside risks, with the next significant support level located at $78,258.

但是,未能在200天EMA上維持支持可能會導致看跌,從而使比特幣面臨增加的下行風險,下一個重大支持水平為78,258美元。

Ethereum Attempts Recovery As $1,861 Support Holds

以太坊嘗試恢復為1,861美元的支持持有

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has shown signs of recovery after finding strong support at $1,861 over the past two weeks.

以太坊(ETH)是市場資本化的第二大加密貨幣,在過去兩周中找到了強勁的支撐,在1,861美元的情況下顯示出恢復的跡象。

Currently trading at approximately $2,056, ETH has rebounded by nearly 7% from its recent support zone, briefly touching the $2,081 mark before encountering mild profit-taking.

ETH目前的交易價格約為2,056美元,與最近的支持區相比,ETH的反彈率近7%,在遇到輕度獲利之前,短暫觸及了2,081美元的大關。

The daily RSI for Ethereum is at 44.3, below the neutral 50, indicating that traders are still exhibiting caution. A decisive move above 50 would signal a stronger resurgence of bullish momentum.

以太坊的每日RSI為44.3,低於中性50,表明交易者仍在謹慎。超過50歲以上的決定性舉動將表明看漲的動力更強。

Additionally, the MACD indicator remains in a bullish crossover, with green histogram bars becoming more prominent above the neutral line, suggesting a potential continuation of upward movement.

此外,MACD指示器仍保留在看漲的交叉中,綠色直方圖桿在中性線上越來越突出,這表明向上運動的潛在延續。

If Ethereum sustains its position above $1,861, it could attempt to retest the March 7 high of $2,258. A confirmed breakout above this resistance level would open the door for further gains toward $2,315.

如果以太坊的頭寸高於1,861美元,則可以試圖重新測試3月7日的高點2,258美元。在此阻力水平上方的確認突破將為2,315美元的進一步增長打開大門。

Conversely, a daily close below $1,861 would invalidate the short-term bullish setup, potentially leading ETH to retest lower support at $1,756.

相反,每天關閉$ 1,861的每日關閉將使短期看漲的設置無效,這可能導致ETH以1,756美元的價格重新獲得較低的支持。

XRP Aims For $2.72 If $2.32 Support Holds

XRP的目標是$ 2.72,如果$ 2.32支持

Ripple’s native token, XRP, is currently consolidating gains above $2.44 after bouncing off its 100-day EMA support at $2.32 last week. The cryptocurrency has seen a 7% rebound before stabilizing, and its near-term trajectory will depend on whether the $2.32 support level holds.

Ripple的本地令牌XRP目前在上週以2.32美元的價格彈跳其100天的EMA支持後,將收益超過2.44美元。加密貨幣在穩定之前已經有7%的反彈,其近期軌跡將取決於2.32美元的支持水平是否持有。

Technical indicators present a mixed outlook for XRP. The RSI stands at 50.16, suggesting a balance between buyers and sellers. A move above 55 would indicate a stronger bullish bias, potentially sparking more significant gains.

技術指標呈現出XRP的混合前景。 RSI為50.16,表明買賣雙方之間有平衡。超過55的舉動將表明更強烈的看漲偏見,可能會引發更大的收益。

Additionally, the MACD indicator remains in a bullish crossover, with histogram bars above the baseline, implying that upward momentum could continue if buying volume increases.

此外,MACD指示器仍保留在看漲的交叉中,直方圖桿高於基線,這意味著如果購買量增加,則可以繼續前進。

Should XRP maintain support above $2.32, it could attempt a breakout toward the $2.72 resistance zone. A successful move above this level would confirm a bullish continuation toward $2.98.

如果XRP將支撐保持在2.32美元以上,則可能會嘗試向2.72美元的電阻區域進行突破。超過此級別的成功舉動將證實看漲延續至2.98美元。

However, failure to hold above $2.32 could trigger a fresh wave of selling pressure, leading to a potential drop toward the next major support at $1.96.

但是,如果不超過2.32美元,可能會引發新鮮的銷售壓力,從而導致下一個主要支持下降,為1.96美元。

Broader Market Sentiment And Implications

更廣泛的市場情緒和含義

The broader cryptocurrency market remains sensitive to upcoming macroeconomic events, with traders closely monitoring Trump’s “Liberation Day” and potential policy announcements.

更廣泛的加密貨幣市場仍然對即將發生的宏觀經濟事件敏感,交易者密切監視特朗普的“解放日”和潛在的政策公告。

Historically, political uncertainty and economic shifts have a significant impact on digital asset prices, making April 2 a crucial date for market participants.

從歷史上看,政治不確定性和經濟轉變對數字資產價格產生了重大影響,使4月2日成為市場參與者的關鍵日期。

Overall, Bitcoin, Ethereum, and XRP are at pivotal support zones, and their near-term direction will depend on key technical and fundamental factors. If bullish momentum strengthens, these assets could see significant upside, but downside risks remain if crucial support

總體而言,比特幣,以太坊和XRP處於關鍵支持區,其近期方向將取決於關鍵的技術和基本因素。如果看漲勢頭增強,這些資產可能會看到很大的上升空間,但是如果至關重要的支持,下行風險仍然存在

免責聲明:info@kdj.com

所提供的資訊並非交易建議。 kDJ.com對任何基於本文提供的資訊進行的投資不承擔任何責任。加密貨幣波動性較大,建議您充分研究後謹慎投資!

如果您認為本網站使用的內容侵犯了您的版權,請立即聯絡我們(info@kdj.com),我們將及時刪除。

-

- SUI(SUI)定於重大供應活動,計劃於4月1日釋放6419萬SUI令牌。

- 2025-03-31 15:25:13

- SUI將舉行重大供應活動,計劃於4月1日發布6419萬SUI令牌,價值約1.482億美元

-

-

- 隨著交易量的增加,XRP顯示出有趣的價格變動

- 2025-03-31 15:20:12

- XLM在過去24小時內顯示了一些有趣的價格變動,而交易活動的增加引起了交易者的注意。

-

-

- 3個廉價的數字硬幣,具有巨大的潛力

- 2025-03-31 15:15:12

- 如今,三個數字硬幣引起了人們的關注,這是一個很大的原因:它們現在便宜,但具有巨大的潛力。

-

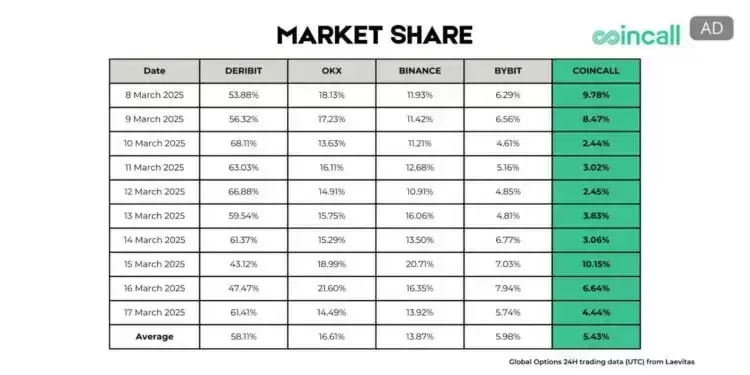

- CONCALL正式進入全球5號加密貨幣選項交流

- 2025-03-31 15:15:12

- 加密貨幣交易所Concincall已正式進入世界上五大加密貨幣期權交易所的行列,在建立後僅18個月就達到了這一里程碑。

-

- 比特幣(BTC)在亞洲早晨的交易額超過80,00美元

- 2025-03-31 15:10:12

- 星期一,在亞洲早上的時間裡,比特幣(BTC)的交易剛剛超過80,00美元

-

- 上週加密貨幣市場大幅縮小

- 2025-03-31 15:10:12

- 由於宏觀經濟環境不確定,上週的加密貨幣市場縮小了大量,儘管一些鮮為人知的硬幣贏得了大量回報。

-