|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

在市場放緩的情況下,由於比特幣下跌以及比特幣交易所交易基金(ETF)從流入轉向流出,山寨幣的主導地位下降。值得注意的是,Solana (SOL) 面臨鏈上指標下降,包括活躍地址、新地址創建和交易費用,引起了長期投資者的擔憂。

Altcoins Lose Ground as Bitcoin Corrects, Solana Faces Bearish Pressures

隨著比特幣回調,山寨幣下跌,Solana 面臨看跌壓力

In the wake of Bitcoin's recent dip towards the $60,000 threshold, the cryptocurrency market has experienced a downturn, leading to a decline in the dominance of various altcoins. Last week, the market underwent a correction due to a shift from robust inflows into Bitcoin exchange-traded funds (ETFs) towards outflows. This reversal contributed to Bitcoin's decline, dragging altcoins down to their support levels in the process. Notably, after SOL's price fell below the $200 mark, a significant drop in crucial on-chain metrics has raised concerns among long-term investors.

隨著比特幣近期跌至6萬美元大關,加密貨幣市場經歷了低迷,導致各種山寨幣的主導地位下降。上週,由於比特幣交易所交易基金(ETF)的強勁資金流入轉向資金流出,市場經歷了調整。這種逆轉導致了比特幣的下跌,在此過程中將山寨幣拖至支撐位。值得注意的是,在 SOL 價格跌破 200 美元大關後,關鍵鏈上指標的大幅下跌引起了長期投資者的擔憂。

Market Recovery and Liquidations

市場復甦和清算

In recent hours, the cryptocurrency market has entered a phase of recovery, with Bitcoin's price climbing past $68,000, which has helped to revive numerous altcoins. Over the last day, the market witnessed total liquidations surpassing $180 million, with sellers liquidating more than $114 million in positions. Notably, Solana saw a substantial short squeeze, resulting in almost $9 million in short positions being liquidated.

最近幾個小時,加密貨幣市場進入復甦階段,比特幣價格攀升至 68,000 美元以上,有助於許多山寨幣復甦。最後一天,市場清算總額超過 1.8 億美元,其中賣家清算部位超過 1.14 億美元。值得注意的是,Solana 出現了大幅軋空,導致近 900 萬美元的空頭部位被清算。

Solana's Bearish Indicators

Solana 的看跌指標

Despite its recent positive momentum, Solana faces potential challenges that could halt its progress, with bearish trends becoming apparent through on-chain data. Recent data indicates a significant decrease in demand for Solana as active addresses declined from 1.61 million to 1.33 million, pointing to a decline in user interaction. Furthermore, there has been a drop in the creation of new addresses on the Solana network, decreasing from 1.25 million to 1.01 million.

儘管最近勢頭良好,但 Solana 仍面臨著可能阻礙其進步的潛在挑戰,鏈上數據顯示看跌趨勢變得越來越明顯。最近的數據表明,隨著活躍地址從 161 萬個下降到 133 萬個,對 Solana 的需求顯著下降,這表明用戶互動量下降。此外,Solana 網路上的新位址創建量也有所下降,從 125 萬減少到 101 萬。

Additionally, a significant decrease in transaction fees for Solana has been observed, dropping from $4.83 million to just $2.07 million. This decline in fees might plunge investor interest, potentially increasing sellers' dominance on the SOL price chart.

此外,Solana 的交易費用也大幅下降,從 483 萬美元降至 207 萬美元。費用的下降可能會降低投資者的興趣,從而可能增加賣方在 SOL 價格圖表上的主導地位。

SOL's Meteoric Rise and Future Prospects

SOL的崛起與未來展望

Since September 2023, Solana's value has experienced a meteoric rise of over 1000%. This remarkable growth is mainly due to two key elements: the bullish trend of Bitcoin, with its price reaching $75,000, and the substantial buying of SOL after FTX's collapse. Just last month, Solana saw an impressive surge of 90%, recording the biggest increase of 2024.

自 2023 年 9 月以來,Solana 的價值經歷了超過 1000% 的快速上漲。這種顯著的成長主要歸功於兩個關鍵因素:比特幣的看漲趨勢,其價格達到 75,000 美元,以及 FTX 崩盤後對 SOL 的大量購買。就在上個月,Solana 的漲幅高達 90%,創下 2024 年最大增幅。

Currently, the market trends are favoring buyers, with investors aiming to surge above the $200 mark in the next few hours. However, sellers are vigorously defending against an upward price movement beyond the key Fibonacci retracement levels, leading to a notable increase in the volatility of the SOL price.

目前,市場趨勢有利於買家,投資者的目標是在未來幾個小時內飆升至 200 美元大關。然而,賣家正在積極防禦價格上漲超過關鍵斐波那契回撤水平,導致 SOL 價格波動性顯著增加。

Should attempts to break above the $200 resistance level falter, the main line of support is expected to be the ascending trend line at $170. Breaching this support could lead SOL's price to fall to a crucial level of support at $155 as seen on the 4-hour chart. A strong bounce back from the trend line might send the price towards the 20-day Exponential Moving Average (EMA). Clearing this barrier could establish a trading range of $190 to $210.

如果突破 200 美元阻力位的嘗試失敗,則主要支撐線預計將是 170 美元的上升趨勢線。突破該支撐位可能會導致 SOL 的價格跌至 155 美元的關鍵支撐位(如 4 小時圖表所示)。從趨勢線的強勁反彈可能會將價格推向 20 日指數移動平均線 (EMA)。清除這一障礙可能會建立 190 美元至 210 美元的交易區間。

For the bulls to retain control over the market, it is essential to not only reach but also to maintain the price above the $200 mark.

對於多頭來說,要保持對市場的控制,價格不僅要達到 200 美元大關,還要維持在 200 美元大關之上。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

-

-

-

-

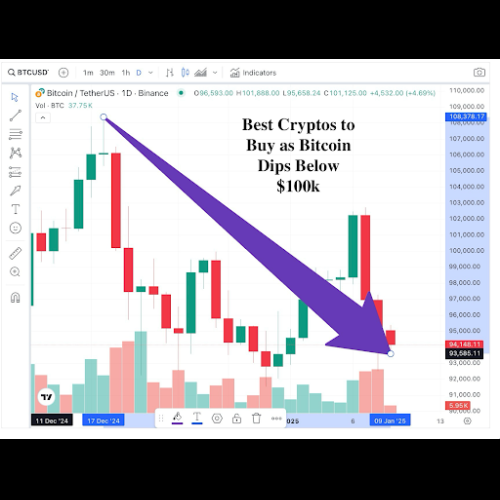

- 10 萬美元以下最適合用比特幣購買的 5 種加密貨幣

- 2025-01-09 17:25:24

- 比特幣跌破 10 萬美元大關令大多數人感到意外,因為就在加密貨幣重新奪回黃金價值幾天后

-

-

-