|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

儘管近期價格飆升,但由於通膨高於預期和獲利回吐,山寨幣本週仍出現下跌。 Fantom、Theta Network 和 Bittensor 分別下跌近 6%、超過 8% 和 8%。通膨上升高於預期,削弱了投資者對加密貨幣等風險資產的熱情,導致山寨幣和比特幣也遭到拋售。

Crypto Market Plunge: Altcoins Witness Steep Declines Amid Inflation Woes and Profit-Taking

加密貨幣市場暴跌:在通膨困境和獲利回吐中,山寨幣大幅下跌

The cryptocurrency market has experienced a significant downturn this week, with several popular altcoins recording notable declines. This نزول حاد can be attributed to a combination of factors, primarily the higher-than-expected inflation data and profit-taking by traders.

本週,加密貨幣市場經歷了嚴重的低迷,幾種流行的山寨幣都錄得顯著下跌。這種上漲可以歸因於多種因素,主要是高於預期的通膨數據和交易員的獲利了結。

According to data compiled by S&P Global Market Intelligence, Fantom (FTM) and Theta Network (THETA) have both lost approximately 6% of their value since the start of the week. Bittensor (TAO) has fared even worse, plummeting by over 8% during the same period.

根據標準普爾全球市場情報彙編的數據,自本周初以來,Fantom (FTM) 和 Theta Network (THETA) 的價值均下跌了約 6%。 Bittensor (TAO) 的表現更糟,同期暴跌超過 8%。

Inflation: A Looming Threat

通貨膨脹:迫在眉睫的威脅

One of the major factors contributing to the crypto market's decline is the recent inflation data released by the Bureau of Labor Statistics. The report indicated that inflation in March rose by 3.5% year-over-year, exceeding the预期 by 0.3 percentage points. This reading has raised concerns about the persistence of elevated inflation, potentially leading to a more conservative monetary policy stance by the Federal Reserve.

導致加密貨幣市場下跌的主要因素之一是美國勞工統計局最近發布的通膨數據。報告顯示,3月通貨膨脹率年增3.5%,超出預期0.3個百分點。這項數據引發了人們對通膨持續上升的擔憂,可能導緻聯準會採取更保守的貨幣政策立場。

Interest Rate Impact

利率影響

The prospect of higher interest rates for an extended period has a sobering effect on crypto investors. When interest rates are low, investors are less inclined to seek out higher-yielding assets such as cryptocurrencies. This is because traditional investments like bonds offer more attractive returns in a low-interest-rate environment. Despite the growing popularity of cryptocurrencies as potential stores of value, they remain perceived as high-risk assets.

長期升息的前景對加密貨幣投資者俱有警醒作用。當利率較低時,投資人不太願意尋找加密貨幣等高收益資產。這是因為債券等傳統投資在低利率環境下提供更具吸引力的回報。儘管加密貨幣作為潛在的價值儲存手段越來越受歡迎,但它們仍然被視為高風險資產。

Market Sell-Off

市集拋售

The release of the inflation data triggered a sell-off in the crypto market on Friday. Bitcoin (BTC), the bellwether of the industry, led the decline, losing nearly 5% of its value in a single trading day. This sell-off extended to altcoins as well, as investors sought to reduce their exposure to riskier assets.

通膨數據的發布引發了周五加密貨幣市場的拋售。業界領頭羊比特幣(BTC)領跌,單交易日跌幅近5%。由於投資者尋求減少風險資產的曝險,這種拋售也延伸到了山寨幣。

Potential Bargains?

潛在的便宜貨?

Some economists predict further inflation surprises in the coming months. The ongoing surge in housing prices is also contributing to concerns about sustained inflation. This could lead to a period of correction in the crypto market as investors adjust to the evolving economic landscape. However, this correction may also present opportunities for savvy investors, particularly with altcoins, which have the potential for significant price swings.

一些經濟學家預測未來幾個月通膨將進一步出人意料。房價持續飆升也加劇了人們對持續通膨的擔憂。隨著投資者適應不斷變化的經濟形勢,這可能會導致加密貨幣市場出現一段調整期。然而,這種調整也可能為精明的投資者帶來機會,尤其是山寨幣,因為山寨幣的價格可能會大幅波動。

Conclusion

結論

The recent downturn in the crypto market highlights the challenges facing the industry in the face of macroeconomic headwinds. While inflation remains a major concern, profit-taking and the prospect of higher interest rates have also weighed on prices. Investors should remain vigilant and be prepared for further volatility in the coming weeks and months.

最近加密貨幣市場的低迷凸顯了該行業在宏觀經濟逆風下面臨的挑戰。儘管通貨膨脹仍然是一個主要問題,但獲利回吐和利率上升的前景也對價格造成壓力。投資者應保持警惕,為未來幾週和幾個月的進一步波動做好準備。

免責聲明:info@kdj.com

The information provided is not trading advice. kdj.com does not assume any responsibility for any investments made based on the information provided in this article. Cryptocurrencies are highly volatile and it is highly recommended that you invest with caution after thorough research!

If you believe that the content used on this website infringes your copyright, please contact us immediately (info@kdj.com) and we will delete it promptly.

-

-

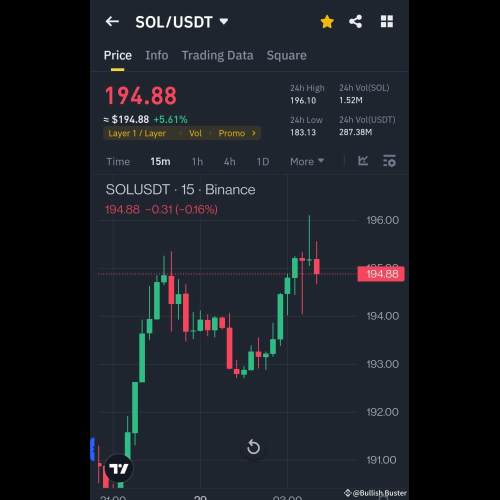

- SOL/USD 市場分析:目前價格為 194.88 美元

- 2024-12-29 18:30:02

- Solana (SOL) 穩定在 194.88 美元,交易員正在關注關鍵物價水準以採取潛在行動。

-

-

- Illuminex 與 Dash 結盟,重新定義數位貨幣格局

- 2024-12-29 18:25:01

- Illuminex 是一個以對隱私的承諾而聞名的著名平台,這是一項開創性的舉措,將重新定義數位貨幣的格局

-

- DAWGZ AI-席捲加密貨幣市場的 Memecoin

- 2024-12-29 18:25:01

- 所謂的「Memecoins 之父」自 2013 年以來就已存在,遠早於我們擁有以太坊 (ETH) 等頂級加密貨幣。

-

-

- 裡亞爾貶值、通膨飆升,伊朗經濟危機加劇

- 2024-12-29 18:25:01

- 12月28日星期六,伊朗自由市場美元匯率飆升800托曼,達到81,700托曼。

-

- BTFD 硬幣:您通往下一個大 Meme 硬幣的節日門票

- 2024-12-29 18:25:01

- 於是,你眨了眨眼睛,突然間,矮胖企鵝就飛向月球了。每個人都在熱議預售,如果你沒能跳上矮胖企鵝火車

-

- Meme 幣和利基代幣引領加密貨幣市場反彈,預示著一波投機興趣

- 2024-12-29 18:25:01

- 加密貨幣市場見證了迷因幣和利基代幣的驚人反彈,其中一些在過去 24 小時內實現了大幅上漲。